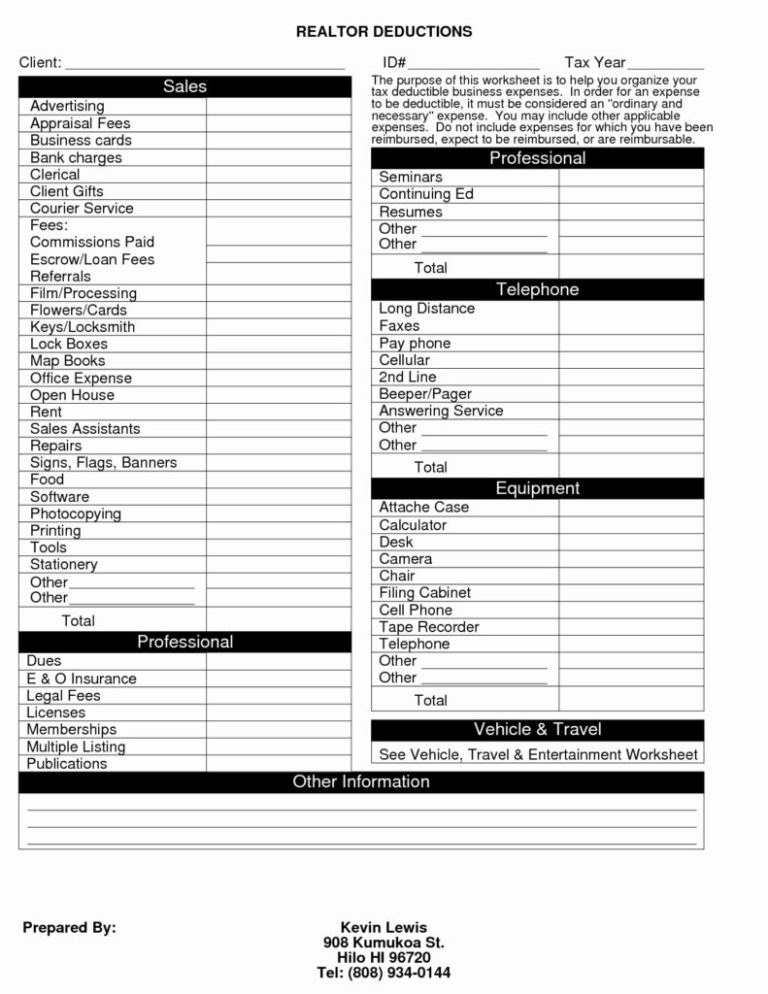

Realtor Tax Deductions Worksheets

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online Realtor real estate agent tax deduction cheat sheet. nizational costs for your entity (pllc, s corp, etc.)the information inc. uded on this cheat sheet is meant as an outline only. please always confirm all deductions with your cpa o. tax professional as the laws may change at any time. this document is not inten. Daszkal bolton llp real estate agent tax deductions worksheet excel 2023. the user friendly interface includes a list of expense accounts, built in data validation, and an easy to follow layout. 👉 direct download link. 3. atm expense worksheet for realtors. atm offers a real estate expense worksheet that focuses on helping real estate.

Real Estate Agent Tax Deductions Worksheet Excel Fill Online You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023. Such a cheat sheet is exactly what’s below, thanks to two folks: 1) fred podris of podris tax service who compiled the list, and realtor® brenda douglas who kindly posted it to facebook for all to benefit from. one problem, though. this cheat sheet, which was originally intended as a print out, isn’t legible in digital format (see below). Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2. The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business.

Real Estate Agent Expenses Spreadsheet 4 Free Templates Worksheets Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2. The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business. This deduction is taken on schedule a, lines 5 6. note that the 'taxes and licenses' deduction on schedule c, line 23, applies to sales tax on business income, real estate and property taxes on business assets, and taxes you pay on behalf of your employees. for example. philip is a successful real estate agent based in san diego, california. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction.

Realtor Tax Deductions Worksheets This deduction is taken on schedule a, lines 5 6. note that the 'taxes and licenses' deduction on schedule c, line 23, applies to sales tax on business income, real estate and property taxes on business assets, and taxes you pay on behalf of your employees. for example. philip is a successful real estate agent based in san diego, california. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction.

Comments are closed.