Realtor Tax Deductions List For 2023

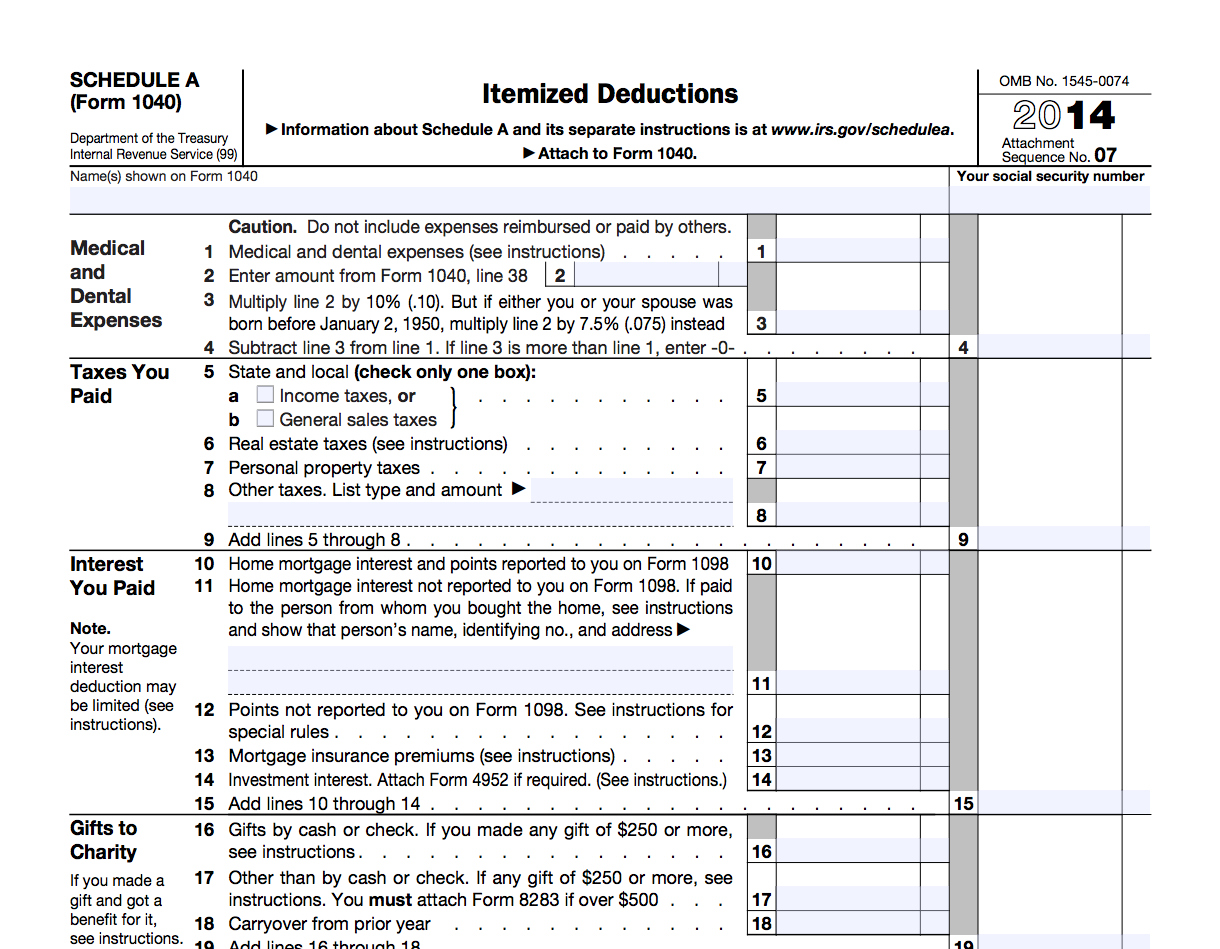

List Of Tax Deductions For Realtors Traveling for work or business purposes, such as out of town conferences or property showings, can result in deductible expenses. these include airfare, lodging, and car rentals. furthermore, you can deduct 50% of meal costs incurred while discussing work with a client or colleague. List this deduction on line 15 on schedule 1 to reduce your taxable income by the respective amount. 2. state and local taxes. state income tax, property taxes, and other local taxes are deductible up to a limit of $10,000. claim your state and local tax payments on lines 5 6 of schedule a. claim taxes paid on business assets (real estate and.

5 Tax Deductions To Look Out For In 2023 Speed Financial Group In 2018 and beyond, the state and local tax deduction is limited to $10,000. this deduction is taken on schedule a, lines 5 6. note that the 'taxes and licenses' deduction on schedule c, line 23, applies to sales tax on business income, real estate and property taxes on business assets, and taxes you pay on behalf of your employees. for example. Write it off using: schedule c, box 17. legal fees paid to set up your business or draw up paperwork are deductible. 🧾. licenses and fees. your state license renewal, mls dues, and professional memberships are deductible. 💸. commissions paid. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2.

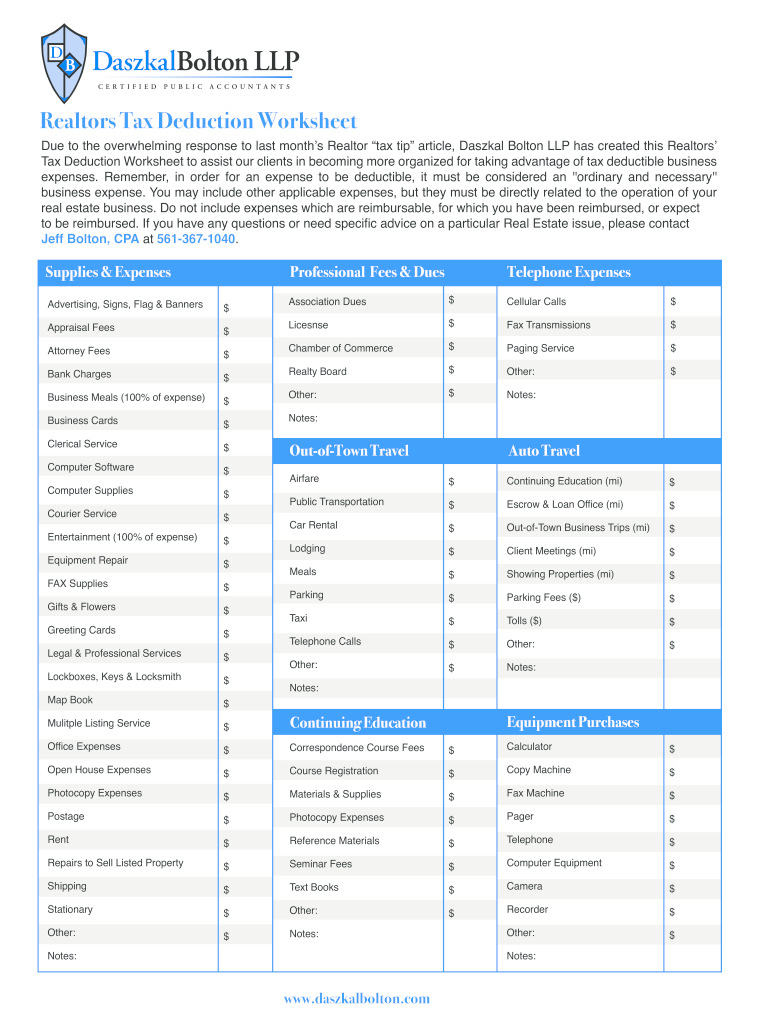

Realtor Tax Deductions List Realtor Expenses Small Etsy 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2. Realtor tax deductions: list for 2023. the average annual business expense for a typical real estate agent is around $6,500. however, expenses for top performing agents can go beyond $10,000. properly tracking and deducting all eligible business expenses is crucial as it helps prevent a reduction in net income and take home pay due to. A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both.

Printable Real Estate Agent Tax Deductions Worksheet Printable Word Realtor tax deductions: list for 2023. the average annual business expense for a typical real estate agent is around $6,500. however, expenses for top performing agents can go beyond $10,000. properly tracking and deducting all eligible business expenses is crucial as it helps prevent a reduction in net income and take home pay due to. A desk fee is a payment agreement between a real estate agent and their broker in which the broker charges a monthly fee for providing office space and a desk to the agent. if you exercise your license for a broker and pay a desk fee, then your desk fee is 100% deductible. you may deduct your desk fee or home office expenses, but not both.

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Realtor Tax Deduction List

Comments are closed.