Real Estate Investing Strategies The Pros And Cons

Real Estate Investing Strategies The Pros And Cons 8. real estate provides a hedge against inflation. inflation is the economic reality that prices increase over time due to the value of money decreasing. the annual inflation rate varies, but 2022 has been a brutal year for markets and the inflation rate. inflation erodes the value of many investments. Pro #3: rental property tax benefits. real estate is a good investment when it comes to tax deductions. there’s a long list of tax benefits that rental property owners can take advantage of and these investment property tax deductions can include: mortgage interest. depreciation.

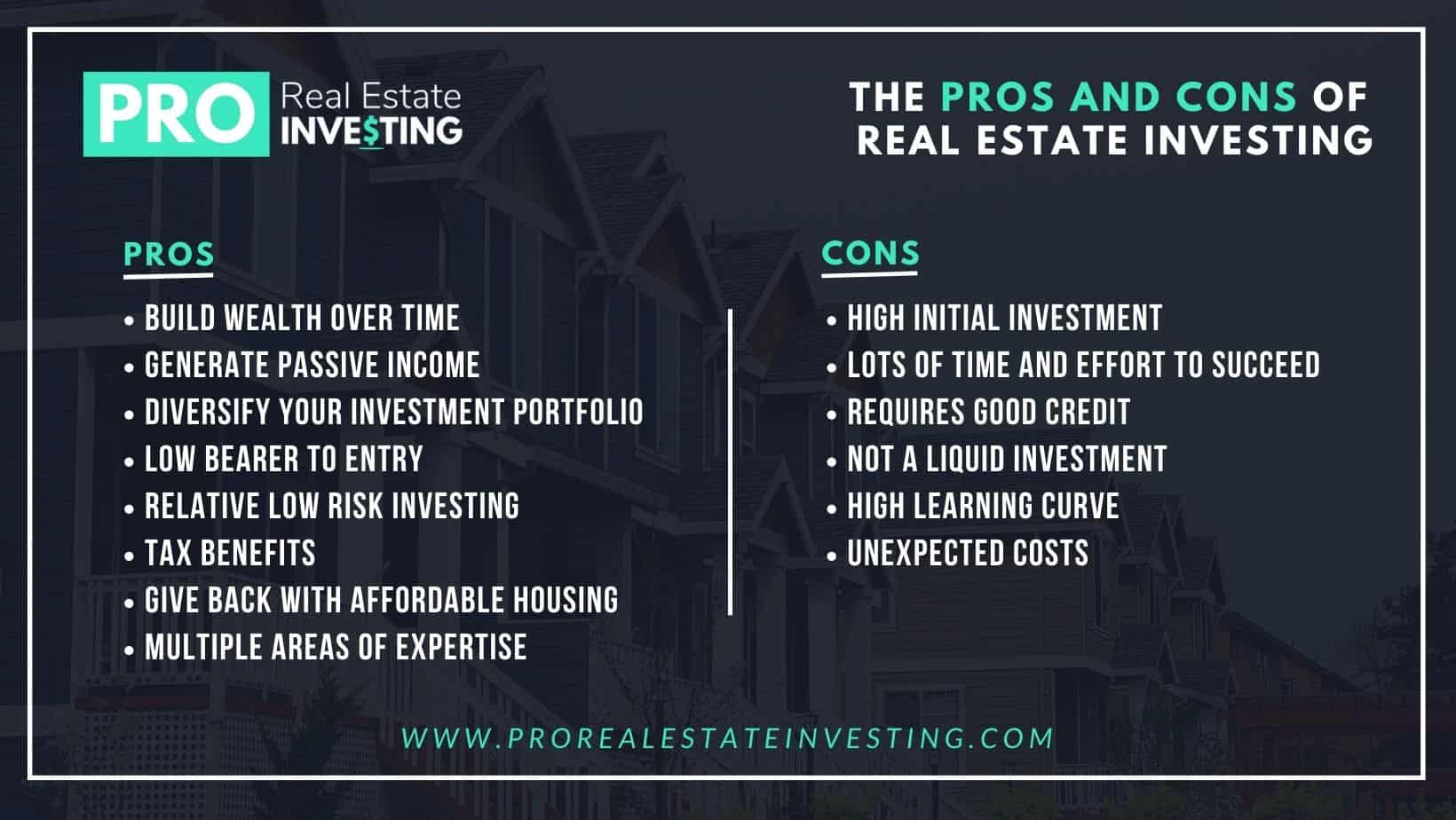

Real Estate Investing The Pros And Cons Investors Should Know Guidance for potential real estate investors 1. educate yourself. before diving into your first investment, take the time to learn about the local real estate market and investment strategies. The two most common ways to flip houses are to buy, repair, and sell, or buy, rehab, rent, refinance, and repeat (brrrr method). in either case, the key is to limit your initial investment with a. The first is that you can use owner occupied home loans to finance your purchase of the investment property. the second is that the irs doesn’t require you to pay taxes on your investment profits up to $250,000 for individuals and $500,00 for joint filers. Investing in real estate is a popular choice for good reasons, but it’s more complicated than owning your typical stocks and bonds. investing strategies pros & cons of real estate investing.

Real Estate Investing The Pros And Cons Investors Should Know The first is that you can use owner occupied home loans to finance your purchase of the investment property. the second is that the irs doesn’t require you to pay taxes on your investment profits up to $250,000 for individuals and $500,00 for joint filers. Investing in real estate is a popular choice for good reasons, but it’s more complicated than owning your typical stocks and bonds. investing strategies pros & cons of real estate investing. Generates steady cash flow. one of the main benefits of investing in real estate is that it can generate a steady cash flow. this cash flow can be passive income or it can be your main source of income from rental properties or investment properties. that specific source of income would be known as rental income and will come once tenants are. Buying real estate you intend to list as a short term rental—for example, on airbnb or vrbo—is similar to investing in long term housing. you generally need to put down 20% or more for a down payment, plus enough to cover closing costs that can range from 2% to 5% of the property's value.

The Pros And Cons Of Real Estate Investing The Definitive Guide Pro Generates steady cash flow. one of the main benefits of investing in real estate is that it can generate a steady cash flow. this cash flow can be passive income or it can be your main source of income from rental properties or investment properties. that specific source of income would be known as rental income and will come once tenants are. Buying real estate you intend to list as a short term rental—for example, on airbnb or vrbo—is similar to investing in long term housing. you generally need to put down 20% or more for a down payment, plus enough to cover closing costs that can range from 2% to 5% of the property's value.

Comments are closed.