Real Estate Agent Tax Deductions Worksheet To Maximize Tax Savings

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business. As a real estate agent, it is crucial to maintain detailed information and receipts for all deductible expenses to maximize your tax deductions at the end of the tax year. you might be self employed, a sole proprietor, or operating as a corporation, keeping track of office supplies, commissions paid, and other business expenses can.

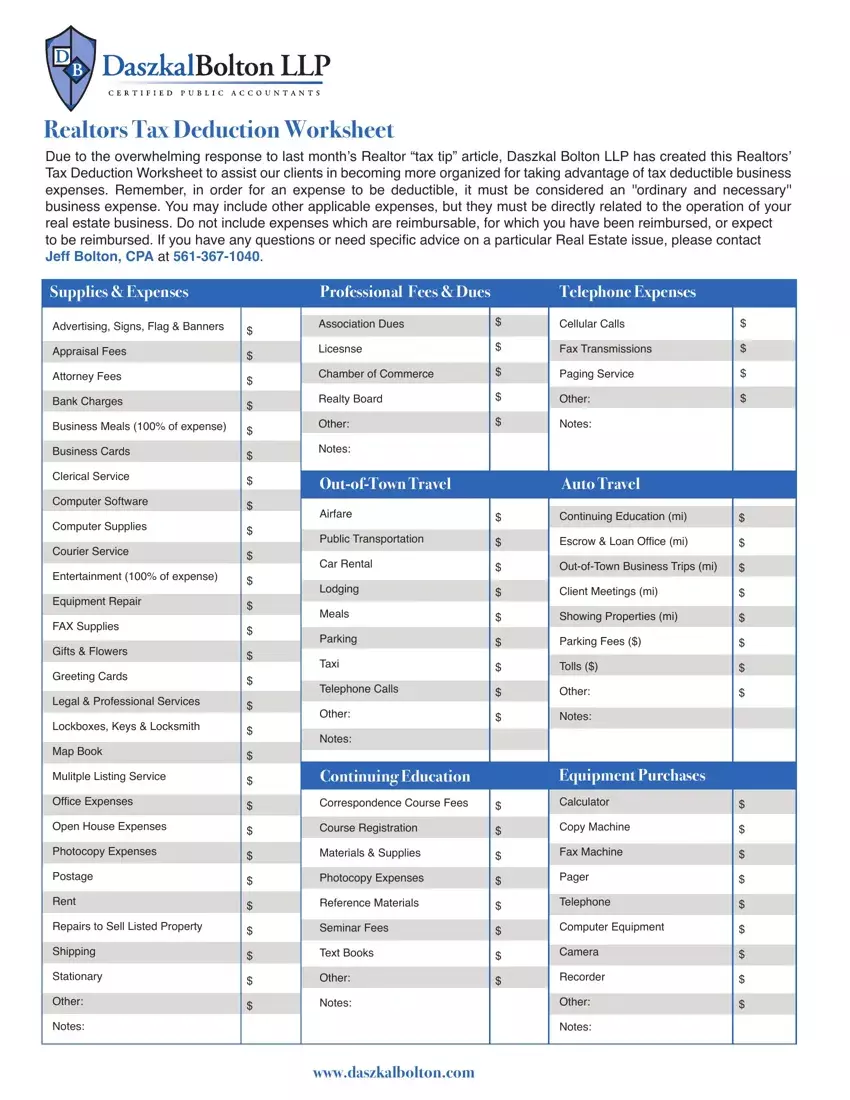

Real Estate Tax Deduction Worksheet тйб Fill Out Printable Pdf Forms Online Real estate agents invest a significant amount of money in their businesses, with average annual expenses ranging from $6,500 to more than $10,000. understanding and maximizing tax deductions available to you is essential for agents to net more income: enter the real estate agent tax deductions worksheet!. The resulting amount is your taxable income, which is used to calculate your tax liability. . for example, if your gross income is $100,000 and you have $20,000 in eligible deductions, your taxable income would be $80,000. your tax liability is then calculated based on this $80,000, not the original $100,000. Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business.

Real Estate Agent Deduction Worksheet Tax deductions can reduce your income, saving thousands of dollars in yearly taxes. some common tax deductions for real estate agents include advertising costs, auto travel expenses, and professional services fees, such as those paid to an accountant or marketing firm. one significant real estate tax deduction is the business gifts deduction. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Assuming you’re a self employed real estate agent, your income will be subject to the standard self employment tax of 15.3%. this accounts for social security and medicare taxes, but it can still be a substantial expense. thankfully, 50% of this cost is tax deductible, meaning you’ll recoup half of it in the end. 2. Method 2: go by the standard mileage rate. with this method, you don’t have to track all your auto related expenses. just your mileage. the irs sets three federal mileage rates for tax deductions each year. to give you a rough idea, it’s approximately $0.60 per business related mile.

Comments are closed.