Real Estate Agent Tax Deductions Worksheet Excel Fill Online

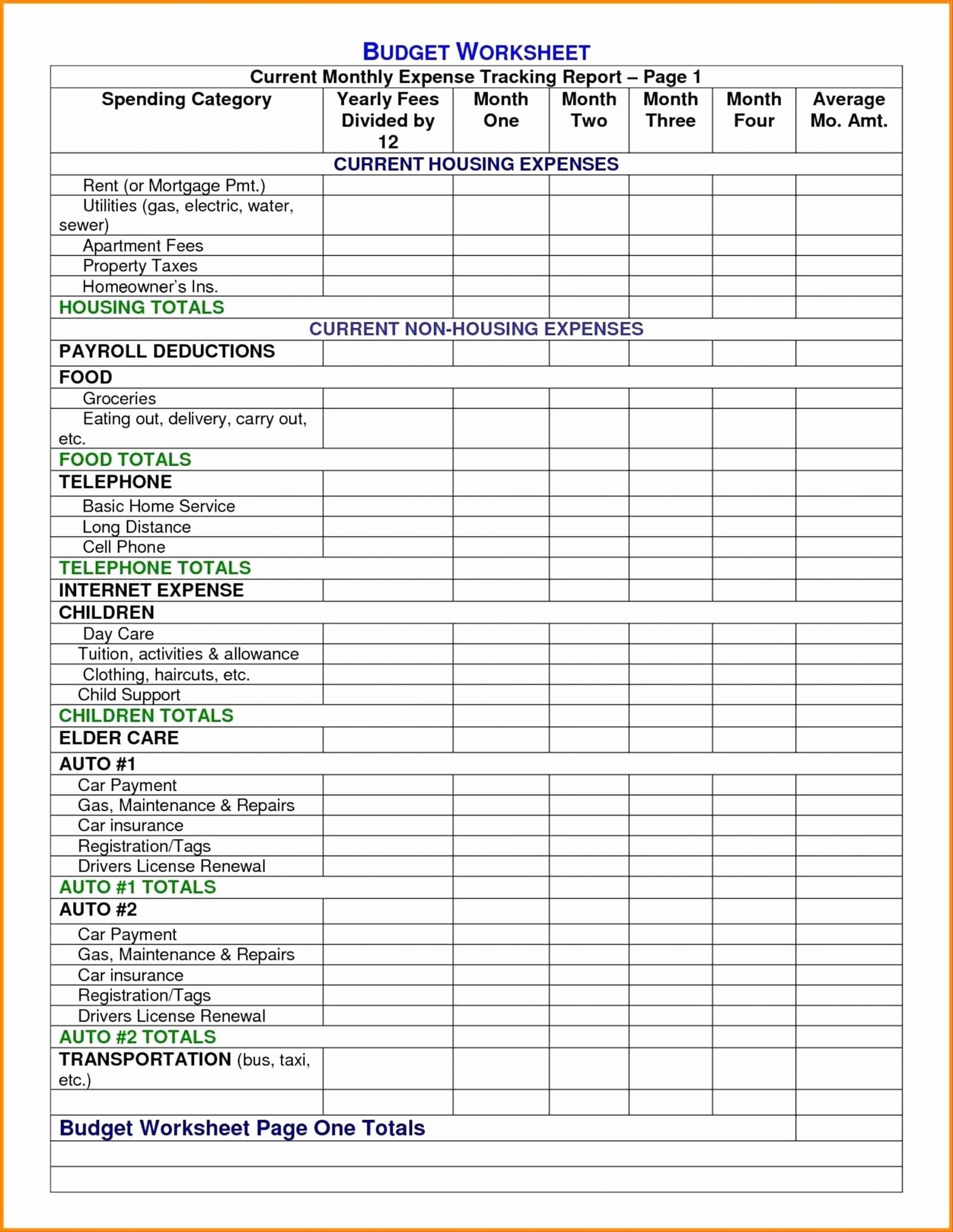

Real Estate Agent Tax Deductions Worksheet Excel Fill Out Sign Real estate agents invest a significant amount of money in their businesses, with average annual expenses ranging from $6,500 to more than $10,000. understanding and maximizing tax deductions available to you is essential for agents to net more income: enter the real estate agent tax deductions worksheet!. Contact joe. this downloadable spreadsheet simplifies the process of tracking tax deductions and deductible expenses, ensuring your real estate business complies with the latest tax laws and forms. consult with your tax professional to identify all eligible deductions and deduct expenses effectively for optimal financial benefit.

Printable Real Estate Agent Tax Deductions Worksheet Here’s a tax deductions cheat sheet for real estate agents: real estate license expenses. licensure costs (including your state license fees, exam fees, fingerprint fees, etc.) association dues (such as mls, nar, chamber of commerce, etc.) brokerage and franchise fees. The irs allows agents to deduct expenses related to maintaining and operating this space, like rent, mortgage interest, utilities, and repairs. to calculate the deduction, agents can use the simplified method ($5 per square foot) or the regular method, based on the percentage of the home used for business. You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business.

Real Estate Agent Tax Deductions Worksheet You can deduct the cost of gas and wear and tear on your car as a real estate agent. you claim the expense in miles traveled for work, and you can claim both local travel for showings and longer travel for business trips. the irs pays a standard mileage rate for business travel, which is 67 cents per mile for 2024 and $0.65 cents per mile in 2023. 3. marketing & advertising . this deduction includes all costs related to marketing and promoting a real estate business, like digital advertising, print ads, billboards, and promotional materials. these expenses are 100% tax deductible, so agents can deduct all costs of marketing their business. Method 2: go by the standard mileage rate. with this method, you don’t have to track all your auto related expenses. just your mileage. the irs sets three federal mileage rates for tax deductions each year. to give you a rough idea, it’s approximately $0.60 per business related mile. Communication tools are essential for real estate agents. if used for business, these expenses may be deductible: cell phone and wireless service plans – percentage used for business. landline phones, answering services, voip. fax line and internet services. website hosting, seo services, crm tools.

Comments are closed.