Rank Real Estate Asset Classes By Risk Sarita Marr

Rank Real Estate Asset Classes By Risk Sarita Marr Here’s a ranking of real estate asset classes from riskiest to least risky based on their exposure to economic trends, structural challenges, and demand shifts. 1. hospitality properties (riskiest) hospitality real estate ranks as the riskiest asset class due to its high sensitivity to economic cycles and fluctuating travel demand. 5y. not always though. hospitality is known for being highly volatile but the cmbs delinquency rates are actually the lowest of any asset class except for multifamily. however, in past cycles we see hospitality shoot up and down for delinquency rates as it as much an operating business as it is a real estate business.

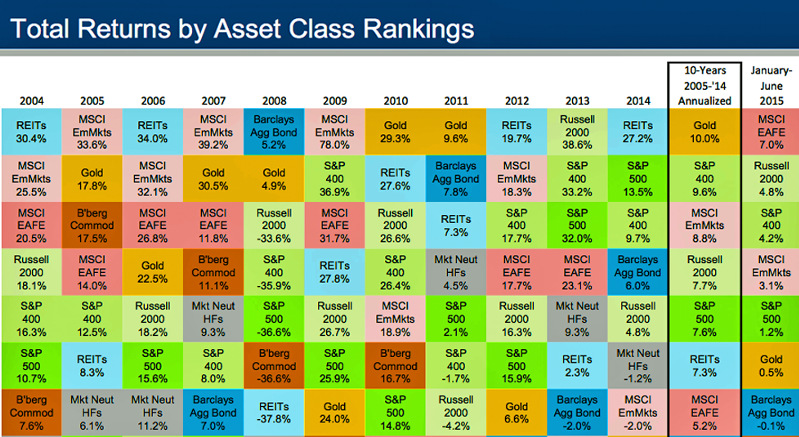

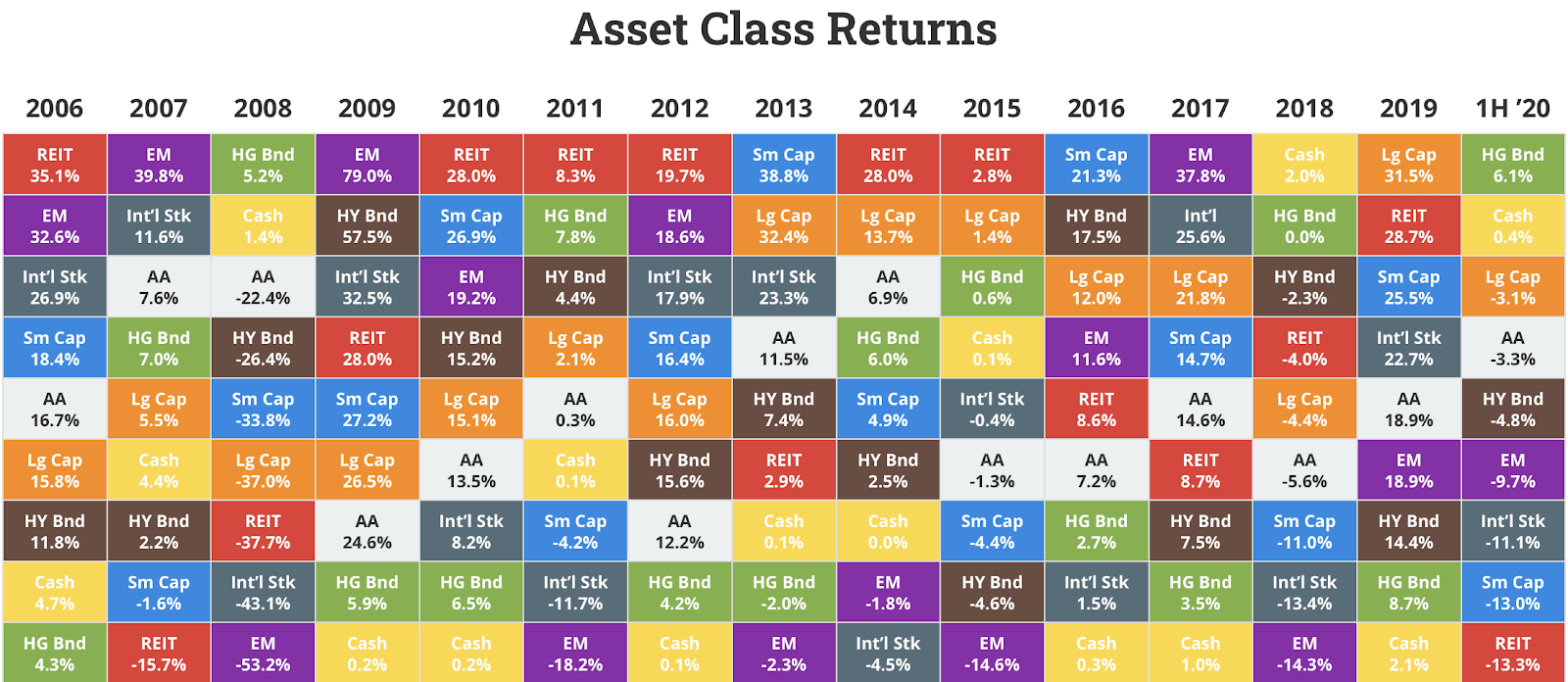

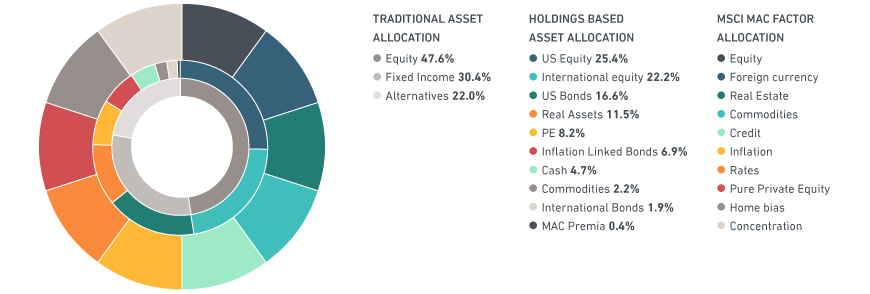

Rank Real Estate Asset Classes By Risk Sarita Marr Diversification: private commercial real estate provides diversification benefits, as it often has low correlation with other asset classes like stocks and bonds. appreciation: commercial properties have the potential for long term appreciation, offering investors capital gains. tax benefits: investors can take advantage of tax deductions such. Real estate comes with additional risks not present in other asset classes. environmental risks and maintenance costs must be weighed against potential profits when investing in real estate. When it comes to investing in commercial real estate, it’s important to understand the different asset classes and how they differ from one another. each asset class has its own unique characteristics, risks, and potential for returns. in this article, we’ll dive into the three main commercial real estate asset classes: retail, industrial. Tldr: broadly, commercial real estate investment strategies can be broken down into four categories: core, core plus, value add, and opportunistic. these terms are used by commercial real estate investors as shorthand for the risk profile, quality, location and strategy of an individual property. however, these terms are used liberally.

Rank Real Estate Asset Classes By Risk Sarita Marr When it comes to investing in commercial real estate, it’s important to understand the different asset classes and how they differ from one another. each asset class has its own unique characteristics, risks, and potential for returns. in this article, we’ll dive into the three main commercial real estate asset classes: retail, industrial. Tldr: broadly, commercial real estate investment strategies can be broken down into four categories: core, core plus, value add, and opportunistic. these terms are used by commercial real estate investors as shorthand for the risk profile, quality, location and strategy of an individual property. however, these terms are used liberally. Real estate risk spectrum. the real estate investment industry had established a set of common terminologies for classifying investment strategies and their typical risk return profile. broadly, these strategies fall into four categories: core; core plus; value add; and opportunistic. note that while there exists a general consensus on the. Commercial real estate asset classes serve as a classification system used widely by investors, lenders, and industry professionals to evaluate and compare various types of commercial properties. these classifications are pivotal in shaping investment strategies and assessing the suitability of properties based on their intended use, location.

Rank Real Estate Asset Classes By Risk Jama Dobbins Real estate risk spectrum. the real estate investment industry had established a set of common terminologies for classifying investment strategies and their typical risk return profile. broadly, these strategies fall into four categories: core; core plus; value add; and opportunistic. note that while there exists a general consensus on the. Commercial real estate asset classes serve as a classification system used widely by investors, lenders, and industry professionals to evaluate and compare various types of commercial properties. these classifications are pivotal in shaping investment strategies and assessing the suitability of properties based on their intended use, location.

Rank Real Estate Asset Classes By Risk Jama Dobbins

Comments are closed.