Questions To Ask A Mortgage Lender

17 Questions To Ask Your Mortgage Lender Mintlife Blog In this article you'll find a list of questions to ask: about the loan; about the lender; additional questions for lenders ; additional questions for mortgage brokers ; when buying a home, selecting a mortgage lender is a big decision. many home shoppers opt to use a lender that's recommended by their real estate agent, but that doesn't. In our example of receiving a 6% payment rate, you’re looking for the lowest apr based on that payment rate. maybe one lender offers you a 6.25% apr, and another a 6.5% apr. the 6.25% apr lender.

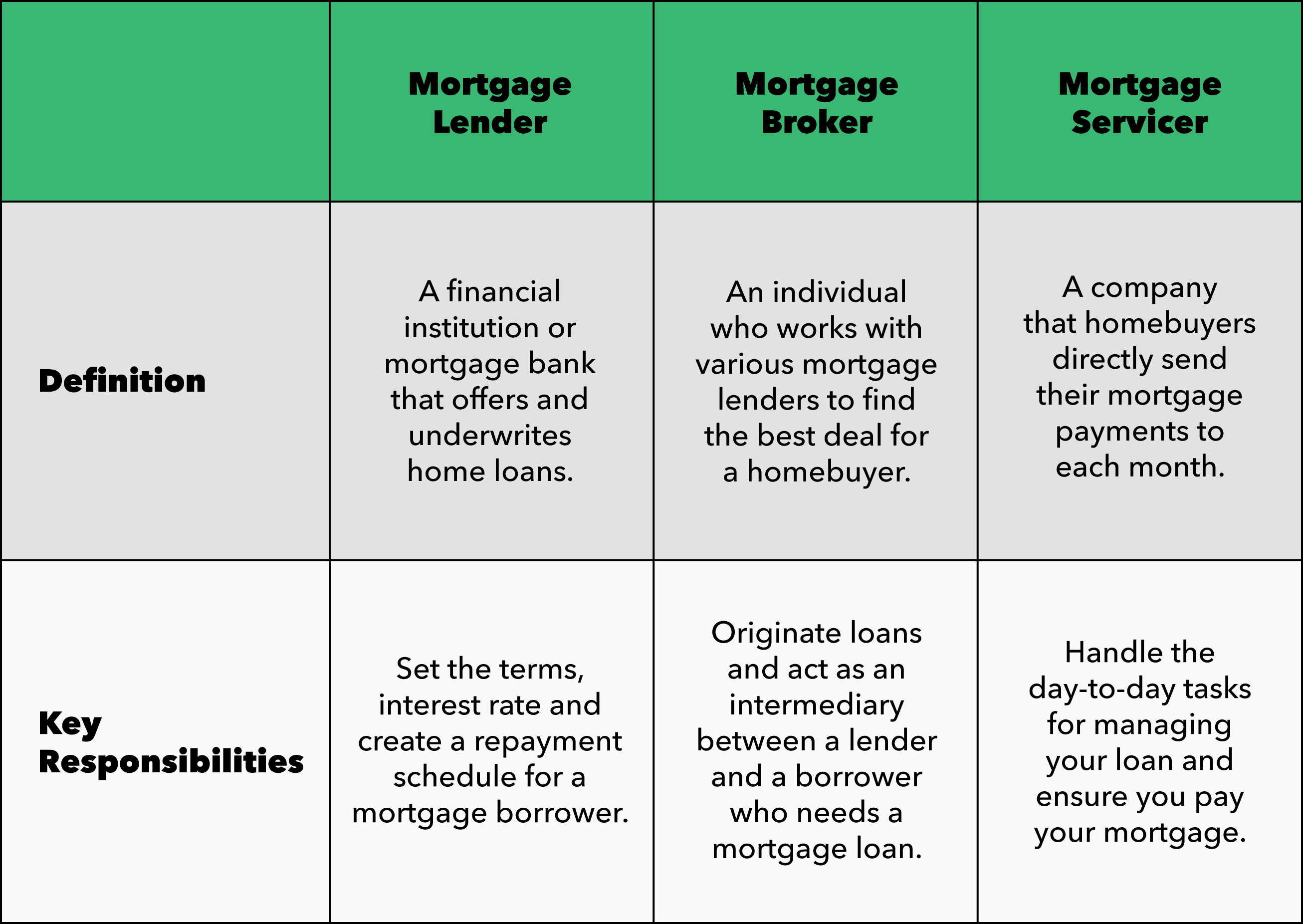

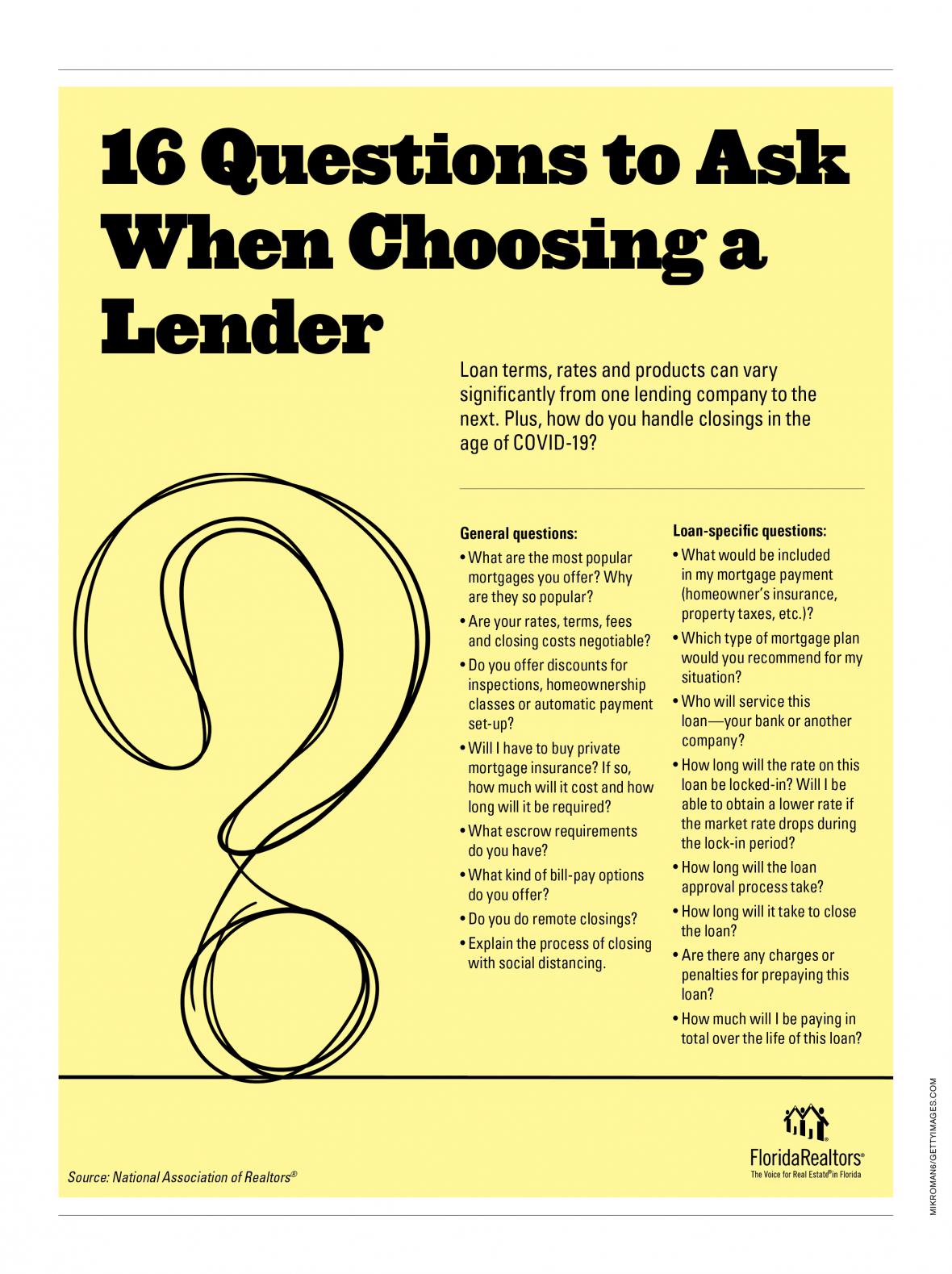

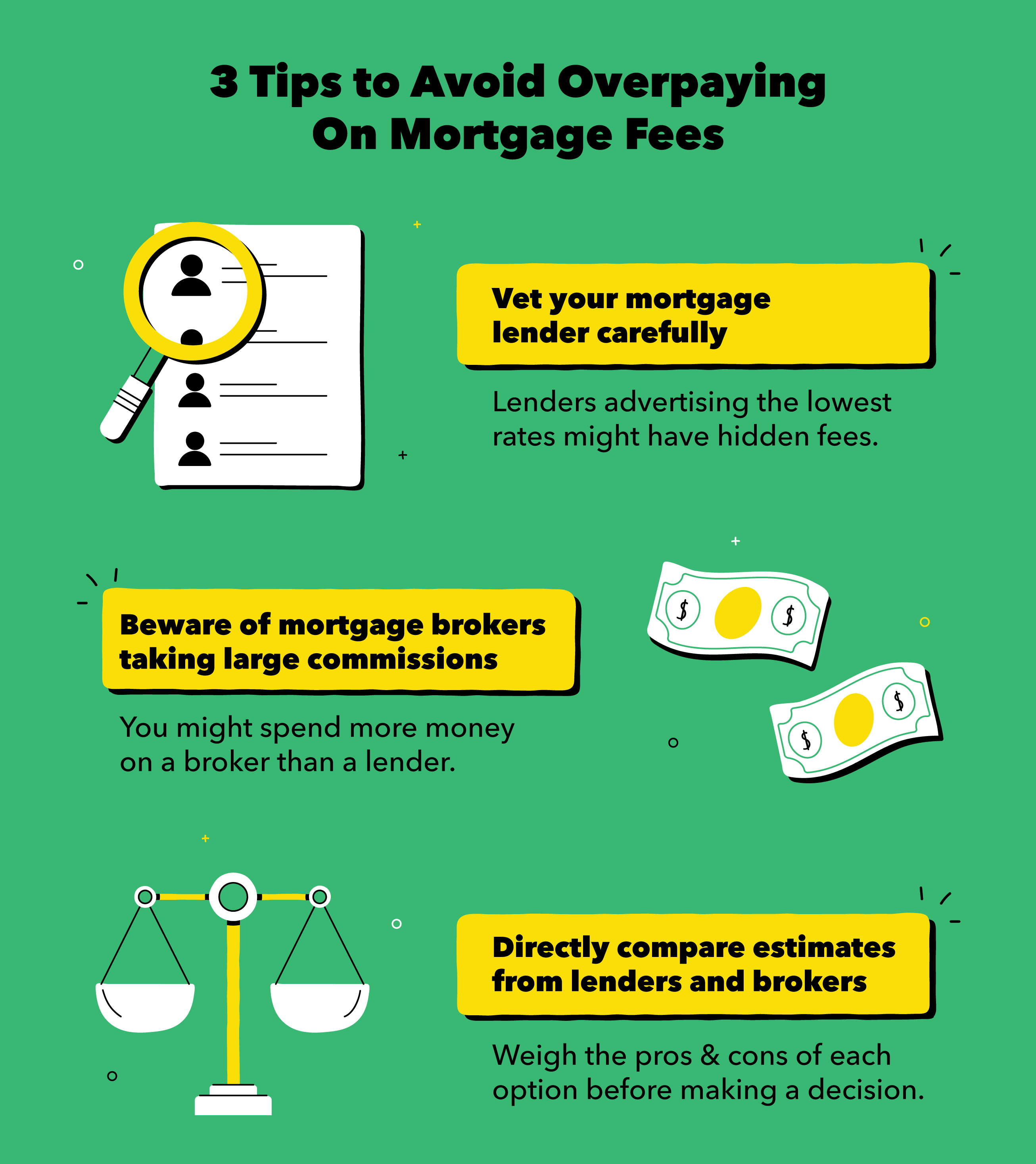

Questions To Ask A Lender Florida Realtors Don’t be afraid to ask questions. if you don’t understand a fee or don’t understand the need for a fee, make them explain it. if you think the lender knows what they’re talking about and has your best interest in mind, keep the conversation going. otherwise, feel free to move on to the next lender. 5. Not every lender has the same requirements, but in general, this is what lenders will look for to approve your mortgage application: → credit score requirement: most lenders look for scores of 620 or higher. lower scores may qualify, but higher scores will result in more mortgage approvals and better terms. You could ask a mortgage lender to help answer this or use a mortgage calculator 2 to help estimate your mortgage payments. a calculator typically asks for a home price, estimated down payment, your credit score and the property’s zip code. besides the mortgage payment, a calculator can also estimate your loan principal and interest rate. Mortgage questions lenders ask you. expect mortgage lenders to ask about various details, from the specific loan you are seeking to your desired closing timeline and whether you plan to have a co.

17 Questions To Ask Your Mortgage Lender Mintlife Blog You could ask a mortgage lender to help answer this or use a mortgage calculator 2 to help estimate your mortgage payments. a calculator typically asks for a home price, estimated down payment, your credit score and the property’s zip code. besides the mortgage payment, a calculator can also estimate your loan principal and interest rate. Mortgage questions lenders ask you. expect mortgage lenders to ask about various details, from the specific loan you are seeking to your desired closing timeline and whether you plan to have a co. Fixed rate mortgage: the interest rate for a borrower’s loan is set at the beginning of the loan term and cannot be changed. adjustable rate mortgage: the interest rate is periodically adjusted based on an index and margin. government backed loan: loans insured by a government agency. For example, if rates drop, your lender might allow you to re lock at the lower rate if you pay a float down fee. you also might have to pay a fee to extend your rate lock if your loan closes late.

The Best Questions To Ask A Mortgage Lender Youtube Fixed rate mortgage: the interest rate for a borrower’s loan is set at the beginning of the loan term and cannot be changed. adjustable rate mortgage: the interest rate is periodically adjusted based on an index and margin. government backed loan: loans insured by a government agency. For example, if rates drop, your lender might allow you to re lock at the lower rate if you pay a float down fee. you also might have to pay a fee to extend your rate lock if your loan closes late.

10 Questions To Ask A Mortgage Lender Especially As A First Time

Comments are closed.