Prestige Consumer Healthcare Taking My Winnings Off The Table

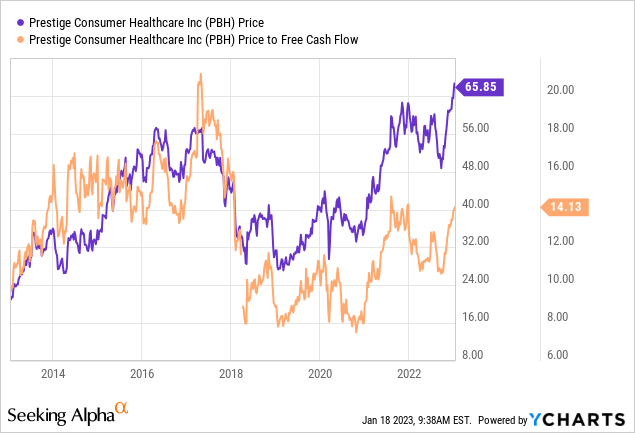

Prestige Consumer Healthcare Taking My Winnings Off The Table It's been about 4 1 2 months since i wrote my latest piece on prestige consumer healthcare inc. (nyse:pbh), and in that time, the shares are up about 30% against a gain of about 1.4% for the s&p 500. Also, prestige consumer healthcare operates through the e commerce channel. pbh is a #3 (hold) on the zacks rank, with a vgm score of b. momentum investors should take note of this medical stock.

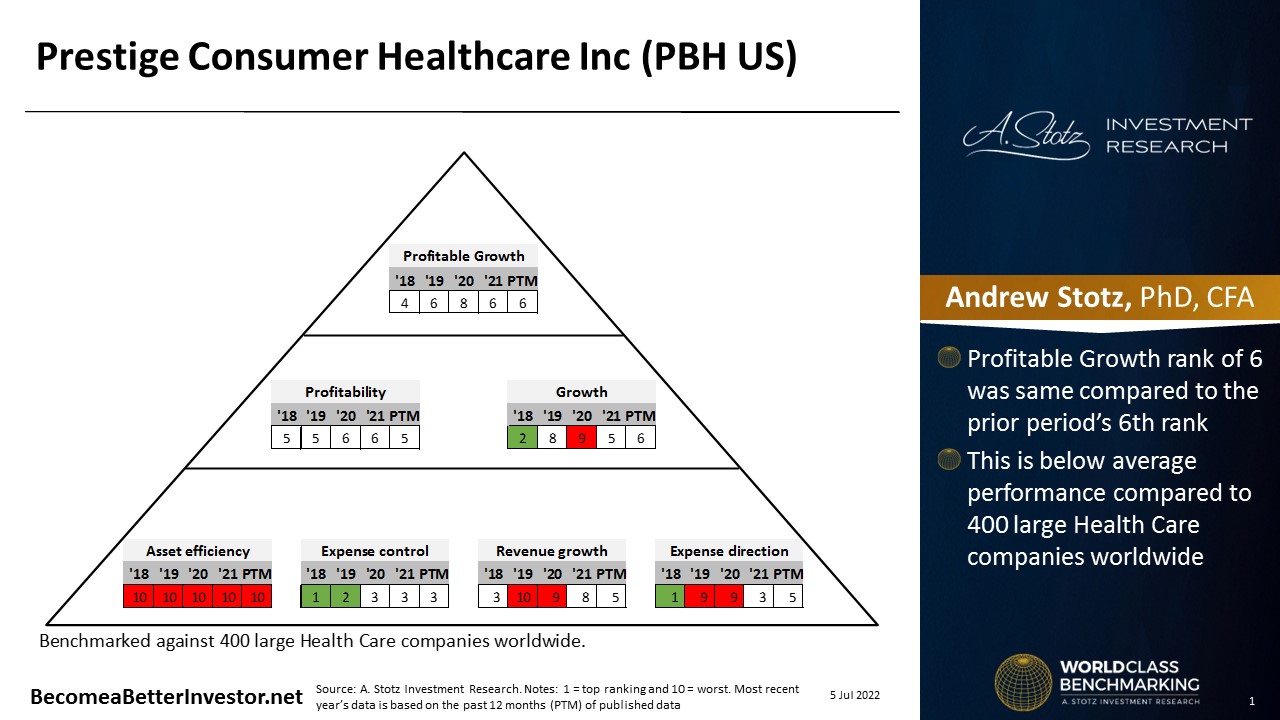

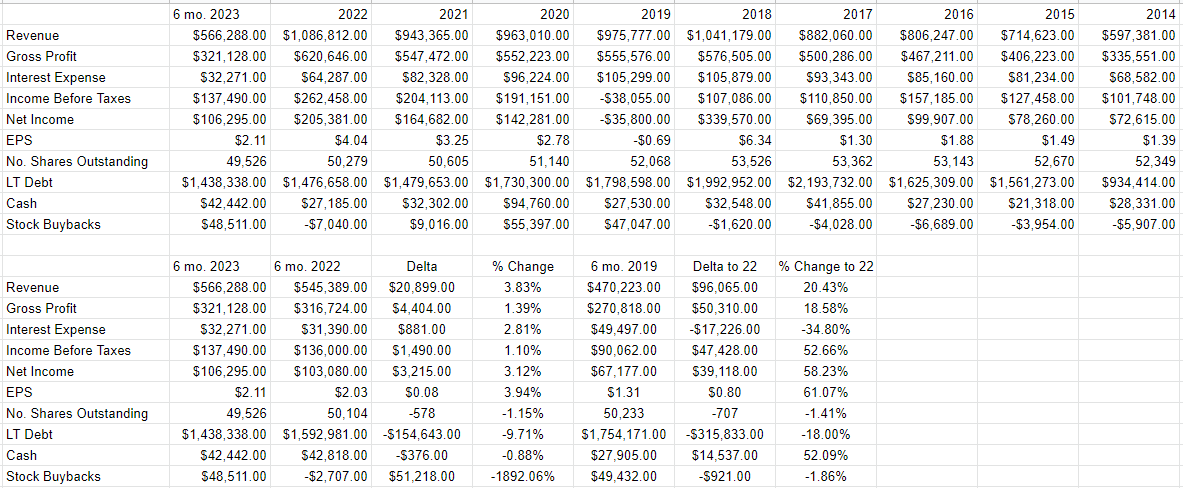

Andrew Stotz U S Stock Prestige Consumer Healthcare Talkmarkets Pbh sits at a zacks rank #2 (buy), holds a value style score of b, and has a vgm score of b. compared to the medical products industry's p e of 19.4x, shares of prestige consumer healthcare are. We think prestige consumer healthcare (nyse:pbh) can stay on top of its debt. prestige consumer healthcare gaap eps of $1.09 beats by $0.05, revenue of $277.1m beats by $8.18m. prestige consumer healthcare inc. to report q1, 2023 results on aug 04, 2022. Reported net income for the first quarter of fiscal 2024 totaled $53.3 million, compared to the prior year first quarter’s net income of $55.3 million. diluted earnings per share of $1.06 for. We often see insiders buying up shares in companies that perform well over the long term. the flip side of that is that there are more than a few examples of insiders dumping stock prior to a.

Prestige Consumer Healthcare Inc 2020 Q1 Results Earnings Call Reported net income for the first quarter of fiscal 2024 totaled $53.3 million, compared to the prior year first quarter’s net income of $55.3 million. diluted earnings per share of $1.06 for. We often see insiders buying up shares in companies that perform well over the long term. the flip side of that is that there are more than a few examples of insiders dumping stock prior to a. Prestige consumer healthcare has been growing earnings at an average annual rate of 1.5%, while the pharmaceuticals industry saw earnings declining at 0.3% annually. revenues have been growing at an average rate of 4.5% per year. prestige consumer healthcare's return on equity is 12.2%, and it has net margins of 18.4%. Find the latest prestige consumer healthcare inc. (pbh) stock analysis from seeking alpha’s top analysts: exclusive research and insights from bulls and bears.

Prestige Consumer Healthcare Taking My Winnings Off The Table Prestige consumer healthcare has been growing earnings at an average annual rate of 1.5%, while the pharmaceuticals industry saw earnings declining at 0.3% annually. revenues have been growing at an average rate of 4.5% per year. prestige consumer healthcare's return on equity is 12.2%, and it has net margins of 18.4%. Find the latest prestige consumer healthcare inc. (pbh) stock analysis from seeking alpha’s top analysts: exclusive research and insights from bulls and bears.

Over The Counter Healthcare Products From Prestige Consumer Healthcare

Comments are closed.