Press Kit For The Know Before You Owe Mortgage Disclosure Rule

Press Kit For The Know Before You Owe Mortgage Disclosure Rule In november 2013, after extensive testing of the new forms, the cfpb finalized the combined, easier to understand new know before you owe mortgage disclosures, the loan estimate and closing disclosure. Making the mortgage process easier. the know before you owe mortgage disclosure rule replaces four disclosure forms with two new ones, the loan estimate and the closing disclosure. the new forms are easier to understand and easier to use. the rule also requires that you get three business days to review your closing disclosure and ask questions.

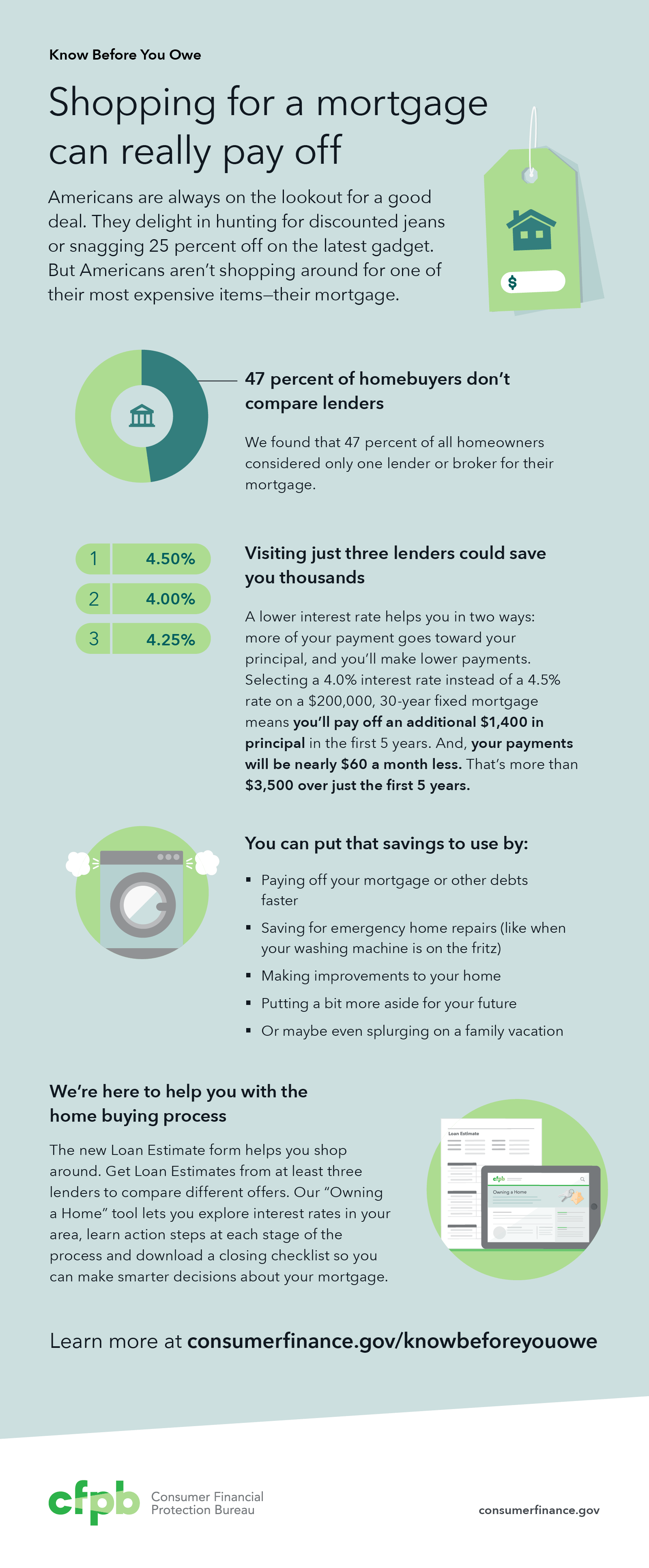

Press Kit For The Know Before You Owe Mortgage Disclosure Rule Washington, d.c. – the consumer financial protection bureau (cfpb) is issuing a rule today requiring easier to use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer. the new “know before you owe” mortgage forms will replace the existing federal disclosures and help consumers understand their options. All of these initiatives are designed to ease the process of taking out a mortgage, help you save money, and ensure that you know before you owe. four overlapping disclosure forms will be streamlined into two forms, the loan estimate and the closing disclosure. you’ll receive “your home loan toolkit” when you apply for a home purchase. Know before you owe: mortgages. new forms improve consumer understanding, make loan comparisons more straightforward, and help. prevent closing table surprises. the consumer financial protection bureau (cfpb) is issuing a rule today requiring easier to use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer. Updates to know before you owe rule effectivity. the rule, as updated, is effective 60 days after its publication date in the federal register. but its mandatory compliance starts on october 1st, 2018. in connection, the cfpb is submitting a proposal for the public to comment on when a creditor may use a closing disclosure instead of a loan.

Press Kit For The Know Before You Owe Mortgage Disclosure Rule Know before you owe: mortgages. new forms improve consumer understanding, make loan comparisons more straightforward, and help. prevent closing table surprises. the consumer financial protection bureau (cfpb) is issuing a rule today requiring easier to use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer. Updates to know before you owe rule effectivity. the rule, as updated, is effective 60 days after its publication date in the federal register. but its mandatory compliance starts on october 1st, 2018. in connection, the cfpb is submitting a proposal for the public to comment on when a creditor may use a closing disclosure instead of a loan. The bureau issued the tila respa integrated disclosure final rule in november of 2013 to implement provisions under the dodd frank wall street reform and consumer protection act. the bureau issued amendments to the tila respa integrated disclosure final rule in january and july of 2015. the final rule will take effect on october 3, 2015. Testing “know before you owe” mortgage forms. qualitative and quantitative tests show new forms improve consumer understanding, aid comparison. shopping, and help prevent surprises. the consumer financial protection bureau (cfpb) is issuing a rule today requiring mortgage disclosure forms that clearly lay out the terms of the loan for a.

Press Kit For The Know Before You Owe Mortgage Disclosure Rule The bureau issued the tila respa integrated disclosure final rule in november of 2013 to implement provisions under the dodd frank wall street reform and consumer protection act. the bureau issued amendments to the tila respa integrated disclosure final rule in january and july of 2015. the final rule will take effect on october 3, 2015. Testing “know before you owe” mortgage forms. qualitative and quantitative tests show new forms improve consumer understanding, aid comparison. shopping, and help prevent surprises. the consumer financial protection bureau (cfpb) is issuing a rule today requiring mortgage disclosure forms that clearly lay out the terms of the loan for a.

Know Before You Owe Archives Cherry Creek Title Services Inc

Know Before You Owe New Mortgage Disclosures New Rule Consumer

Comments are closed.