Ppt Chapter 9 Part 1 Current Liabilities Powerpoint Presentation

Ppt Chapter 9 Part 1 Current Liabilities Powerpoint Presentation Maturity > 1 year. current liabilities. noncurrent liabilities. liabilities are probable debts or obligations that result from past transactions, which will be paid with assets or services. current liabilities are short term obligations that will be paid within the current operating cycle or within one year of the balance sheet date, whichever. Current liabilities ppt. 1. 13 1 topic 5 & 6topic 5 & 6 current liabilities, provisions,current liabilities, provisions, and contingenciesand contingencies intermediate accounting ifrs edition kieso, weygandt, and warfield. 2. 13 2 1. describe the nature, type, and valuation of current liabilities. 2.

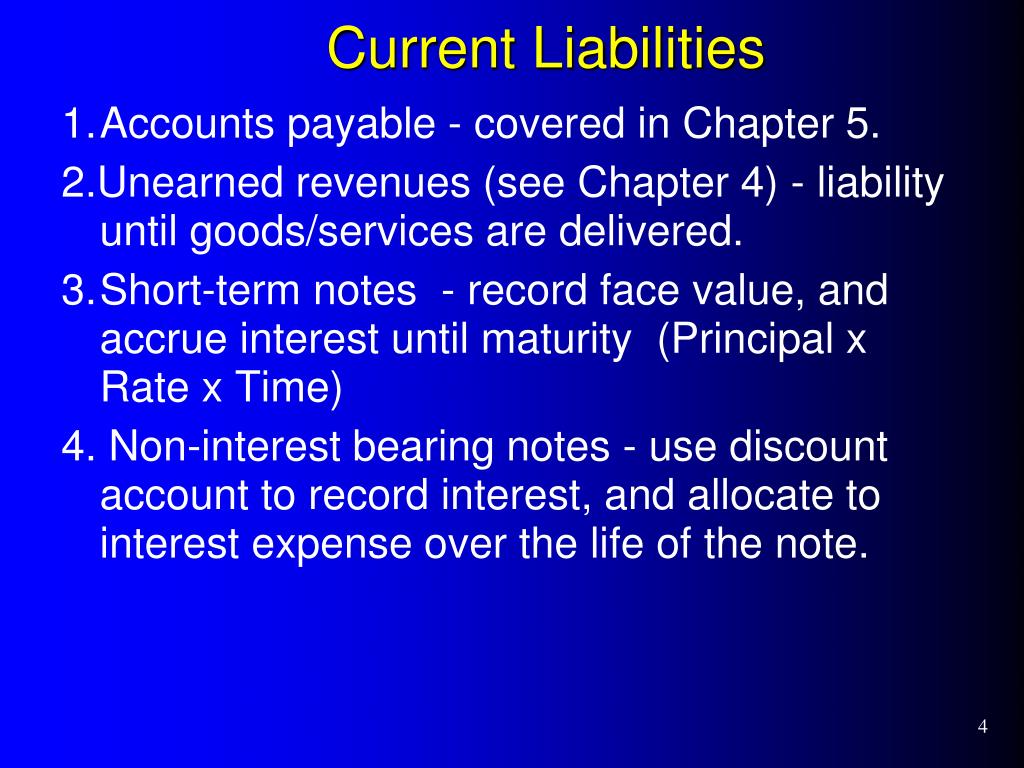

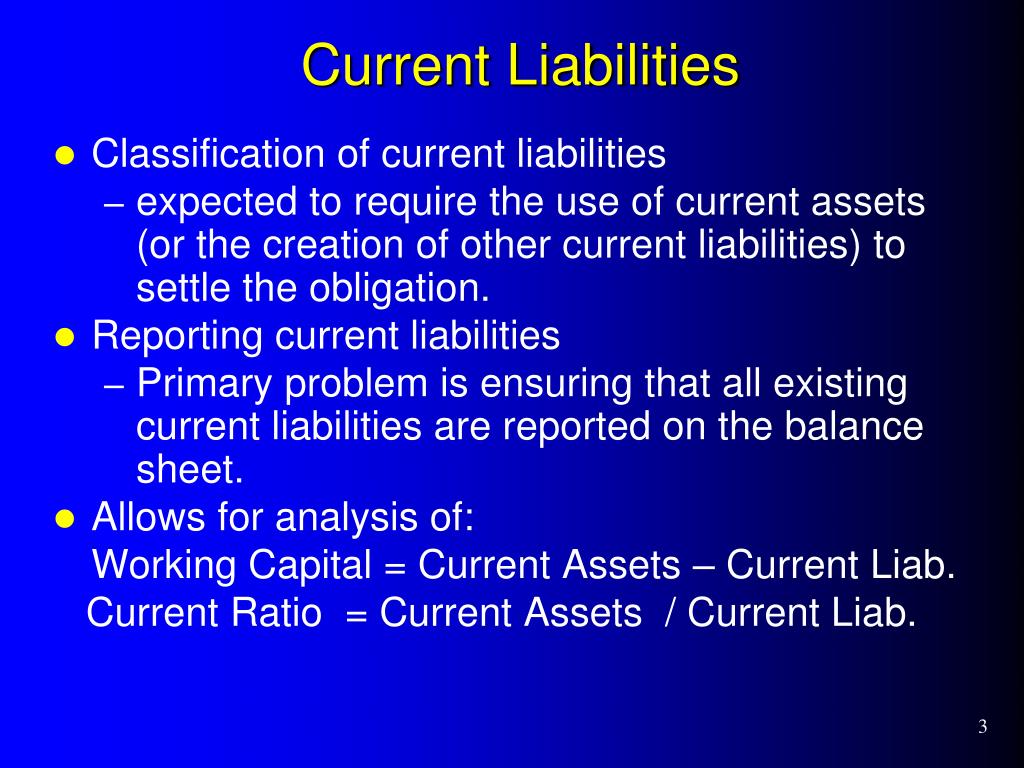

Ppt Chapter 9 Part 1 Current Liabilities Powerpoint Presentation Current liabilities management involves spontaneous sources of financing like trade credit and accrued expenses. trade credit is automatically obtained when purchasing goods on credit from suppliers and is more readily available than other short term credit. stretching payments beyond the credit period can eventually damage supplier relationships. Oct. 1 borrowed $75,000 from the shore bank by signing a 12 month, zero interest bearing $81,000 note. oct. 1 cash 75,000 notes payable 75,000 interest calculation = ($6,000 x 3 12) = $1,500 dec. 31 interest expense 1,500 notes payable 1,500 lo 1 describe the nature, type, and valuation of current liabilities. It defines current liabilities as debts or obligations due within one year. examples given are accounts payable and unearned revenue. accounts payable are financial obligations owed to suppliers for purchases made on credit. unearned revenue, also called deferred revenue, is advance payment from customers for products or services not yet provided. Liabilities • liability – a future payment of assets or services that a company is presently obligated to make as a result of a past transaction or event. • current liabilities – aka short term liabilities, are obligations expected to be settled within one year of the balance sheet date or within the company’s next operating cycle.

Ppt Chapter 9 Part 1 Current Liabilities Powerpoint Presentation It defines current liabilities as debts or obligations due within one year. examples given are accounts payable and unearned revenue. accounts payable are financial obligations owed to suppliers for purchases made on credit. unearned revenue, also called deferred revenue, is advance payment from customers for products or services not yet provided. Liabilities • liability – a future payment of assets or services that a company is presently obligated to make as a result of a past transaction or event. • current liabilities – aka short term liabilities, are obligations expected to be settled within one year of the balance sheet date or within the company’s next operating cycle. The document defines current liabilities as short term financial obligations due within one year or a normal operating cycle, including accounts payable, notes payable, income taxes payable. provisions are liabilities of uncertain timing or amount that are recognized if there is a present obligation from a past event that will likely require resources and can be reliably estimated. contingent. Presentation transcript. chapter 11 current liabilities 1. the nature of current liabilities 2. short term notes payable 3. contingent liabilities 4. payroll and payroll taxes 5. accounting systems for payroll 6. employees’ fringe benefits • financial analysis and interpretation learning objectives.

Comments are closed.