Planning For Retirement At Different Stages In Life S3 E18

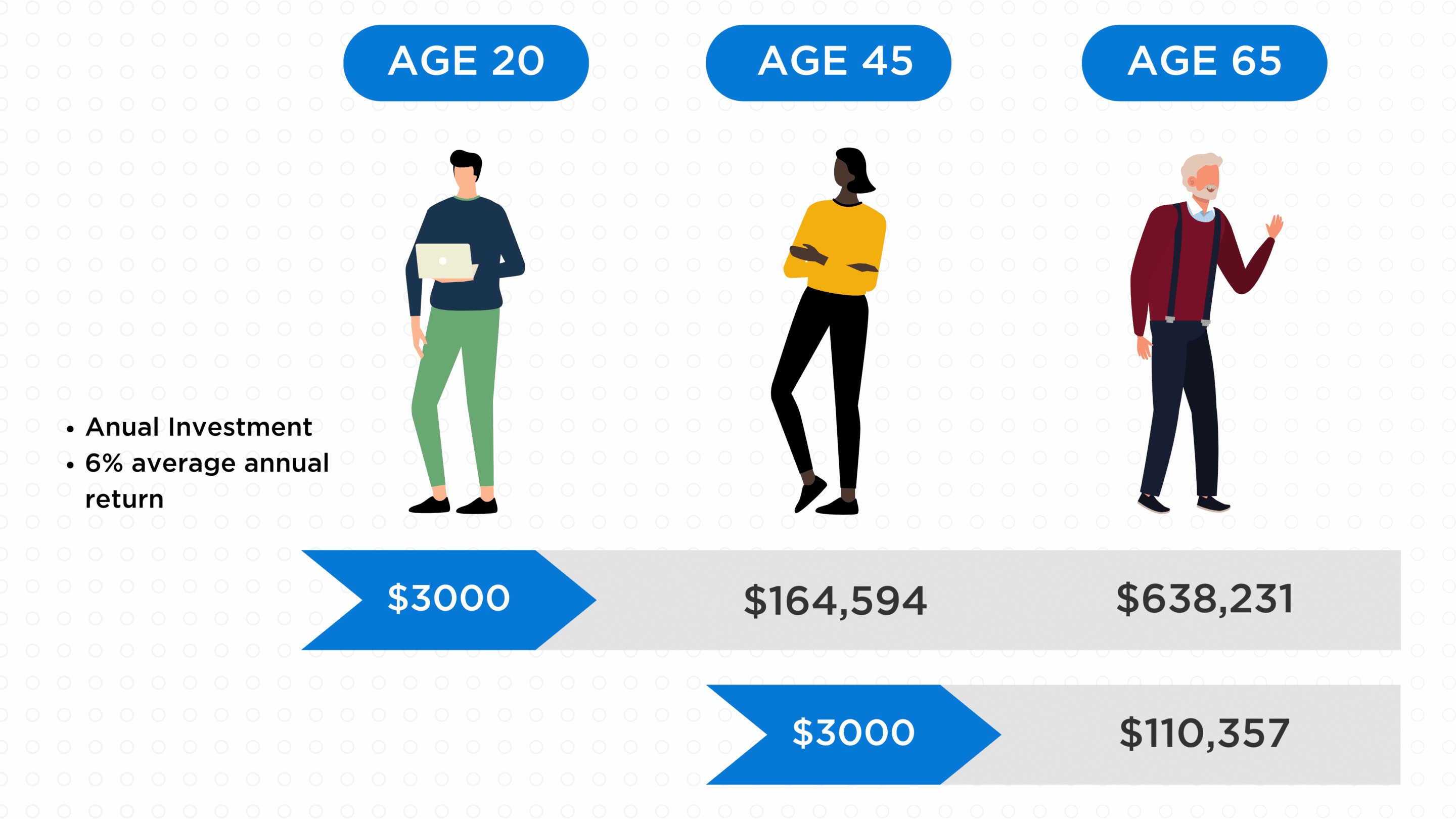

Retirement Planning Vs Life Stages Life Stages How To Plan At its core, life cycle financial planning serves as a personalized compass. it helps you navigate the nuanced financial requirements that characterize the different stages of life. life cycle. Age 45. $3,000. 6%. $110,357. at age 20, you begin investing $3,000 a year for retirement. assuming 6% average annual return, you'd have invested $135,000 and accumulated a total of $638,231. at age 45, you'd have invested $60,000, and accumulated a total of $110,357. even though you'd have invested $75,000 more by starting early, you would.

Retirement Plan Considerations At Different Stages Of Life Tcg A Hub Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return. You should also meet with a financial advisor to discuss the myriad of new challenges that retirement brings, such as: creating a distribution plan to ensure that your savings last. managing your money in a tax advantaged way. preparing for healthcare needs and health insurance. keeping up with inflation. Saving for retirement in your 50s is usually about catching up. you can take advantage of catch up contributions by adding $6,500 more to your 401 (k) per year and $1,000 more to your ira. these contributions help you put more money toward retirement at a faster rate. even if you can't contribute the full amount, take advantage of catch up. At age 65, you would have invested $135,000. assuming a 6% average annual return, you would have accumulated a total of $638,231 by age 65. however, if you wait until age 45 to begin investing that $3,000 annually and earn the same 6% return, by age 65, you would have invested $60,000 and accumulated a total of $110,357.

Retirement Planning For Different Life Stages Saving for retirement in your 50s is usually about catching up. you can take advantage of catch up contributions by adding $6,500 more to your 401 (k) per year and $1,000 more to your ira. these contributions help you put more money toward retirement at a faster rate. even if you can't contribute the full amount, take advantage of catch up. At age 65, you would have invested $135,000. assuming a 6% average annual return, you would have accumulated a total of $638,231 by age 65. however, if you wait until age 45 to begin investing that $3,000 annually and earn the same 6% return, by age 65, you would have invested $60,000 and accumulated a total of $110,357. In this article. 1 of 5: stage one: early adulthood (age 20 to 35) saving for retirement is often compared to marathon training. and it’s clear to see why. in either scenario, the earlier you start preparations, the better chance you’ll have of success. and it’s not just the timeframe that matters. those who are committed every step of. Online tools can help you devise a retirement plan for living a financially comfortable retirement. for example, with the empower retirement planner, you can: run different scenarios in a side by side comparison. review the impact of large expenses on your retirement. add sources of income to your overall plan.

Retirement Planning For Different Life Stages Fulfilling Life Tips In this article. 1 of 5: stage one: early adulthood (age 20 to 35) saving for retirement is often compared to marathon training. and it’s clear to see why. in either scenario, the earlier you start preparations, the better chance you’ll have of success. and it’s not just the timeframe that matters. those who are committed every step of. Online tools can help you devise a retirement plan for living a financially comfortable retirement. for example, with the empower retirement planner, you can: run different scenarios in a side by side comparison. review the impact of large expenses on your retirement. add sources of income to your overall plan.

Here S How You Can Start Retirement Planning At Every Stage Of Your Life

Stages Of Retirement Learn About Various Stages Start Planning

Comments are closed.