Plan Your Retirement In 6 Simple Steps Beginners Guide

6 Step Guide For Retirement Planning Effective Easy To Implement Learn how to create a retirement plan from scratch. this is a step by step beginner’s guide designed to guide you through the entire process from learning. These 6 steps will help you get started. image source: getty images. 1. determine when you want to retire. picking a retirement year lets you set a time horizon a key measure for retirement.

Retirement Planning For Beginners Guide Superguide Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return. 6. diversify your investments . invest the money that's in your retirement portfolio based on your age, your risk tolerance, and your income goals. as a rule of thumb, 110 minus your age is the percentage of the money you should keep in equities (stocks), with the rest in bonds and cash equivalents. if you're 30, for example, keep 110 30 = 80. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can.

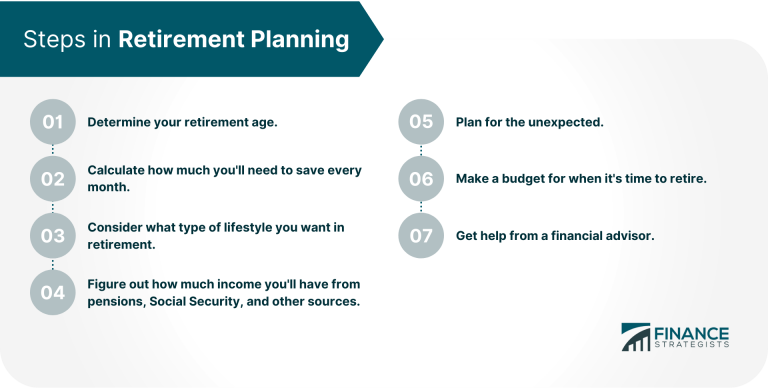

6 Steps To Retirement Success Douglas Total Financial Solutions The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before. Read viewpoints on fidelity : 5 ways hsas can help with your retirement. fidelity's guideline: save 15% of your income annually, including any match you get from your employer. this assumes you start saving at age 25 and plan to retire at age 67. 3. if 15% is too much, start where you can. For 2025, the contribution limit is set at $23,500 for 401 (k) accounts (before employer match) and $7,000 for an ira. workers over age 50 can add an additional $7,500 to a 401 (k) as a catch up. Take a deep breath and check out these simple steps you can take to get your plan rolling. step 1: set your retirement goals. step 2: save 15% of your income for retirement. step 3: contribute to your 401 (k). step 4: invest in a roth ira. step 5: pay off your mortgage early. step 6: study your social security options.

Step By Step Guide To Efficient Retirement Planning For 2025, the contribution limit is set at $23,500 for 401 (k) accounts (before employer match) and $7,000 for an ira. workers over age 50 can add an additional $7,500 to a 401 (k) as a catch up. Take a deep breath and check out these simple steps you can take to get your plan rolling. step 1: set your retirement goals. step 2: save 15% of your income for retirement. step 3: contribute to your 401 (k). step 4: invest in a roth ira. step 5: pay off your mortgage early. step 6: study your social security options.

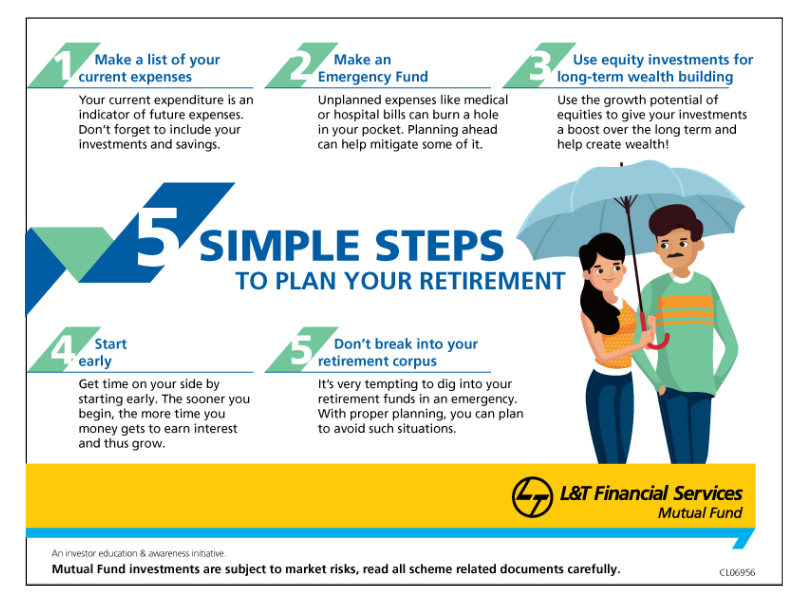

5 Simple Steps To Retirement Planning The Economic Times

Your Guide To Retirement Planning

Comments are closed.