Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate Permanent life insurance can provide the security of lifelong protection, a tax free death benefit and can also build cash value over time. allstate has three types of policies: whole, universal and variable universal. with whole life insurance you'll have: guaranteed growth potential. cash value increases regardless of market conditions. Allstate life insurance issued by direct general life insurance co., 911 chestnut street, orangeburg sc 29115 and american heritage life ins. co., 1776 american heritage life dr., jacksonville fl 32224. life insurance also offered and issued by third party companies not affiliated with allstate.

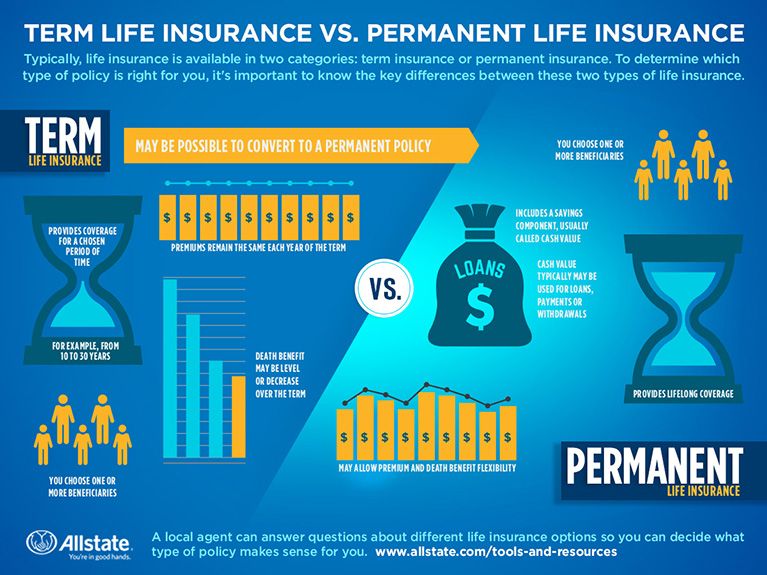

Permanent Life Insurance 101 What You Need To Know Allstate Life Coverage calculator. life insurance can help protect your family financially. that's why it's important to customize your policy based on your needs, your expenses and your assets. in just five simple steps, this tool can help you get an estimate of how much life insurance you might need. get started. Allstate’s term life insurance policy is available in short term and long term coverage lengths, from a minimum of 10 to a maximum of 40 years. prices start at $10 a month. applicants must be. Permanent life insurance is an umbrella term applied to life insurance policies that last your lifetime, as long as your policy premiums are paid. this is in contrast to a term life insurance. How to file a claim with allstate. there are two ways to file a life insurance claim through allstate: fill out the online claim notification form or call 800 366 3495 to speak to an allstate.

Permanent Life Insurance 101 Allstate Permanent life insurance is an umbrella term applied to life insurance policies that last your lifetime, as long as your policy premiums are paid. this is in contrast to a term life insurance. How to file a claim with allstate. there are two ways to file a life insurance claim through allstate: fill out the online claim notification form or call 800 366 3495 to speak to an allstate. Features and benefits of our group universal life insurance: pays a lump sum cash benefits if death occurs before age 95. builds tax deferred cash value accessible by loan or partial surrender. opportunity to build a tax advantaged fund that may be used for retirement, children's education or emergencies. see the universal life video. Term life insurance costs an average of $480 a year for a 20 year, $1 million policy for a 30 year old male in good health. the same policy costs $348 a year for a 30 year old female in good.

Life Insurance 101 What You Need To Know Money Chutney Features and benefits of our group universal life insurance: pays a lump sum cash benefits if death occurs before age 95. builds tax deferred cash value accessible by loan or partial surrender. opportunity to build a tax advantaged fund that may be used for retirement, children's education or emergencies. see the universal life video. Term life insurance costs an average of $480 a year for a 20 year, $1 million policy for a 30 year old male in good health. the same policy costs $348 a year for a 30 year old female in good.

Life Insurance 101 All The Basics You Need To Know About

Comments are closed.