Pepsi Versus Coca Cola Market Share And Stock Market Or Forex

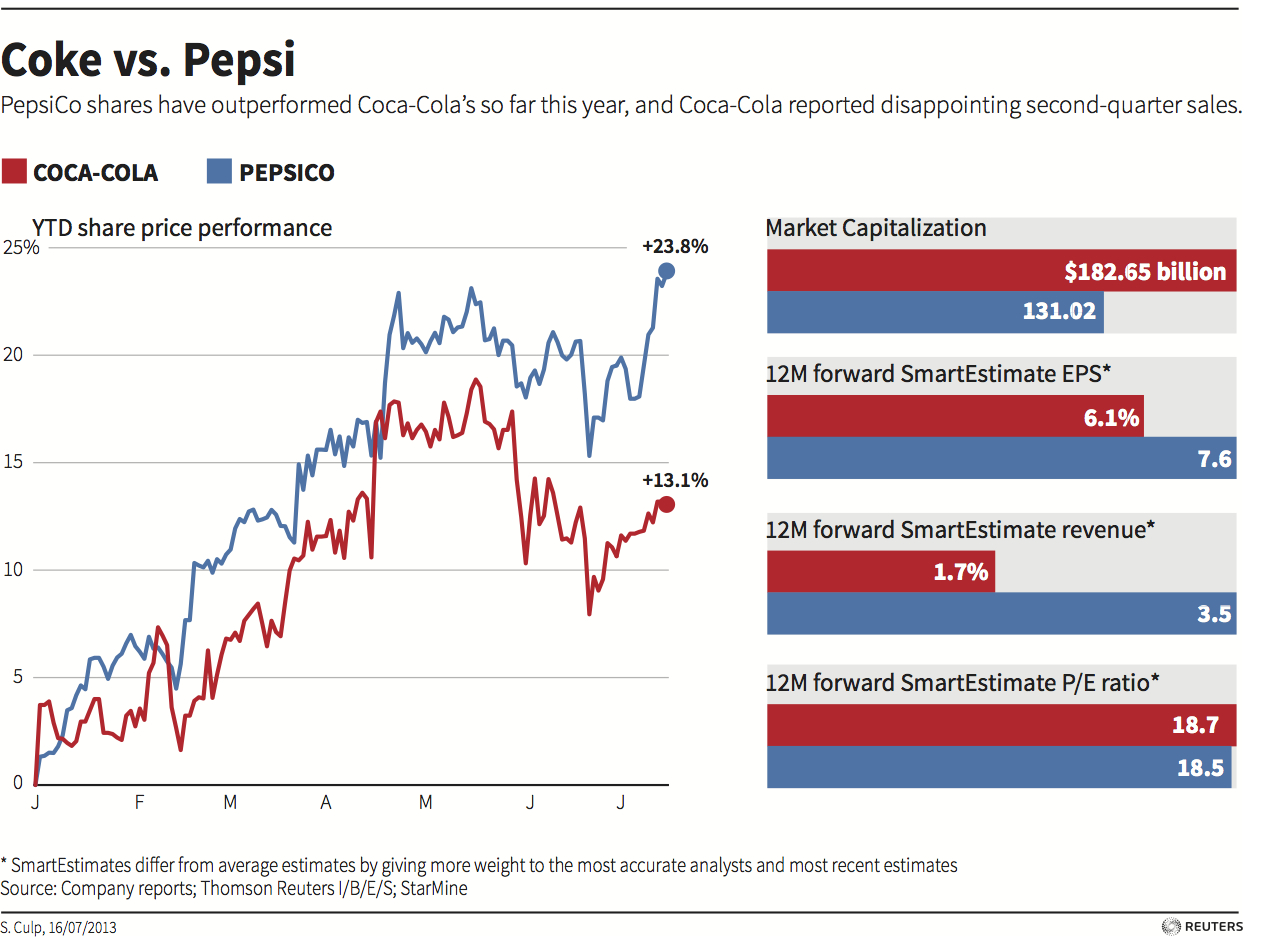

Pepsi Vs Coke Market Share Coca cola has a higher market capitalization than pepsico, with coke's market cap at $242 billion compared to pepsi's market cap at $189 billion. pepsico's revenue in 2020 was $70.37 billion, while coca cola's revenue was $33 billion in the same year. pepsico's net income for 2020 was $7.07 billion, while coca cola reported a net income of $7. Since 2004, coca cola has been the market leader. coca cola remains the world’s most valuable soft drink brand with a market cap of $266.173 billion as of april 26, 2024. pepsico. is a close.

:max_bytes(150000):strip_icc()/Clipboard01-4e89d4845c3e4ae89ca81bd830ad38c4.jpg)

Coke Vs Pepsi Market Share Meanwhile, coca cola, though certainly holding its own with revised expectations of 5% to 6% growth in adjusted earnings per share and an 8% to 9% increase in organic revenue, did not quite match. Final verdict. in conclusion, coca cola is poised for stronger growth in 2024, with an anticipated 6 7% increase in organic sales driven by robust demand for its core offerings and newer product lines such as sparkling waters and energy drinks. conversely, pepsi’s outlook is more conservative. it forecasts a modest 4% sales uptick due to. Pepsico continued to rise steadily during the bear market with a 6.77% gain in 2022 while coca cola achieved 10.61% growth. the s&p 500, which includes both stocks, was down 19.44% that year. The atlanta based group is beating its rival pepsico to the punch here, with an operating margin hovering around 30%. its return on equity is lower, however, hovering around 40%, again with only modest leverage. coca cola currently commands a market capitalization of $300 billion and an enterprise value of $327 billion.

Pepsi Versus Coca Cola Market Share And Stock Market Or Forex Pepsico continued to rise steadily during the bear market with a 6.77% gain in 2022 while coca cola achieved 10.61% growth. the s&p 500, which includes both stocks, was down 19.44% that year. The atlanta based group is beating its rival pepsico to the punch here, with an operating margin hovering around 30%. its return on equity is lower, however, hovering around 40%, again with only modest leverage. coca cola currently commands a market capitalization of $300 billion and an enterprise value of $327 billion. Currently, pepsico’s annual dividend yields 2.5% vs. ko’s 2.8%, a modest difference. zacks investment research. image source: zacks investment research. however, there’s a notable difference. Pepsi shares are down 1% in the last year while coca cola’s stock is down 5% with both underperforming the s&p 500’s 22% and their zacks beverages soft drinks market’s 7%. with that.

Better Buy Coca Cola Vs Pepsi Markets Stocks Journalstar Currently, pepsico’s annual dividend yields 2.5% vs. ko’s 2.8%, a modest difference. zacks investment research. image source: zacks investment research. however, there’s a notable difference. Pepsi shares are down 1% in the last year while coca cola’s stock is down 5% with both underperforming the s&p 500’s 22% and their zacks beverages soft drinks market’s 7%. with that.

Pepsi Vs Coca Cola Statistics

Coke Vs Pepsi Market Share

Comments are closed.