Penfold Pension A Comprehensive Guide To Retirement Planning

Penfold Pension A Comprehensive Guide To Retirement Planning Get started in 5 minutes. 1. get a penfold account by registering your details online or with our app. 2. transfer an existing pension, or make a one off or recurring payment (pause or adjust any time). done! check savings progress, change investment plan and more with our app or online dashboard. get started now. Penfold pension: a comprehensive guide to retirement planning when we first looked at penfold pension, they were a pension provider built for the self employed. a lot has changed since then. they have restructured their business to accommodate the employed and self employed. penfold is a digital pension company that offers a simple and user friendly way for individuals to save for their.

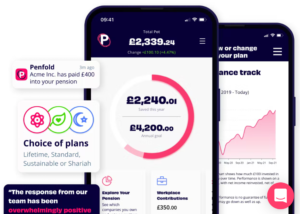

Penfold Pension A Comprehensive Guide To Retirement Planning The pension plan is known as the penfold pension and is designed to let you: save for retirement in a tax efficient and flexible way. build up a pension fund to give you an income and a tax free cash sum at minimum pension age (currently age 55). take control of your pension fund investments. make transfer payments into your penfold pension. You can pay 100% of your yearly income into your pension if you earn £60,000 or under per year; where your salary is the maximum you’re allowed to contribute into your pension a year. for example, if you earned £30,000 a year, you can only pay £30,000 into your pension, and receive tax top ups. 1. get a penfold account by registering your details online or with our app. 2. transfer an existing pension, or make a one off or recurring payment (pause or adjust any time). done! check savings progress, change investment plan and more with our app or online dashboard. get started now. setting up a private pension requires a uk address. Penfold charges one bundled platform and fund management fee, starting at 0.75% to 0.88% for portfolios of up to £100,000. customers will also have to pay transaction costs of around 0.1%.

Penfold Pension A Comprehensive Guide To Retirement Planning 1. get a penfold account by registering your details online or with our app. 2. transfer an existing pension, or make a one off or recurring payment (pause or adjust any time). done! check savings progress, change investment plan and more with our app or online dashboard. get started now. setting up a private pension requires a uk address. Penfold charges one bundled platform and fund management fee, starting at 0.75% to 0.88% for portfolios of up to £100,000. customers will also have to pay transaction costs of around 0.1%. For employees enrolled into penfold’s pension download our welcome guide, which contains: everything you need to know to get started. how to transfer old pensions to penfold. faqs. pension plan choices and how our fees work. penfold welcome guide.pdf. did this answer your question?. Use our pension calculator to help you decide how much to save into your penfold pension. your age. your yearly earnings. current pension pot. the state pension would give you enough for 2 3 your current earnings at retirement. you might need more than this by then though. it’s also a good benchmark to compare with what you would like to earn.

Penfold Pension A Comprehensive Guide To Retirement Planning For employees enrolled into penfold’s pension download our welcome guide, which contains: everything you need to know to get started. how to transfer old pensions to penfold. faqs. pension plan choices and how our fees work. penfold welcome guide.pdf. did this answer your question?. Use our pension calculator to help you decide how much to save into your penfold pension. your age. your yearly earnings. current pension pot. the state pension would give you enough for 2 3 your current earnings at retirement. you might need more than this by then though. it’s also a good benchmark to compare with what you would like to earn.

Penfold Pension A Comprehensive Guide To Retirement Planning

Comments are closed.