Peak Financial Planning Sequence Of Returns Risk

Peak Financial Planning Sequence Of Returns Risk At peak financial planning, it is our belief that properly planned for, sequence of returns risk can be mitigated, and better yet, it is actually in your direct control via good decision making. sequence of returns risk (sorr) is the risk of negative investment portfolio returns close to or in the early years of your retirement. Timing matters. at issue here is a phenomenon known as sequence of returns risk. "sequence" refers to the fact that the order and timing of poor investment returns can have a big impact on how long your retirement savings last. after all, a retirement portfolio generally isn't just a lump of cash in a savings account that you draw inexorably.

Peak Financial Planning Sequence Of Returns Risk If you start with a portfolio value of $10,000, withdraw $1,000 per year, and earn total returns of 10% one year, 10% the next year, and negative 10% the third year, you'd end up with $8,000 by. Lifetime sequence of return risk when seeking to use portfolio returns as a source of retirement spending, retirees must also deal with the sequence of return risk that amplifies the impact of traditional investment volatility. financial market returns near the retirement date matter a great deal. even with the. Even if your investments recover later, the initial losses can harm your long term financial health. here are a few ways to avoid sequence of returns risk: plan for market downturns. use a gradual. Conclusion. sequence of returns risk is an essential factor to consider when planning for retirement. the risk arises due to the timing of market fluctuations, which can significantly impact investment returns in the early years of retirement. the risk can have severe long term implications for investment portfolios and retirement income.

Sequence Of Return Risk Youtube Even if your investments recover later, the initial losses can harm your long term financial health. here are a few ways to avoid sequence of returns risk: plan for market downturns. use a gradual. Conclusion. sequence of returns risk is an essential factor to consider when planning for retirement. the risk arises due to the timing of market fluctuations, which can significantly impact investment returns in the early years of retirement. the risk can have severe long term implications for investment portfolios and retirement income. Sequence of returns risk is a crucial financial concept in retirement planning, highlighting the risk that the timing of withdrawals from a retirement account can negatively affect the overall rate of return. this risk is particularly significant in the ‘retirement red zone,’ the period just before and just after retirement. understanding. Also called sequence risk, this is the risk that comes from the order in which your investment returns occur. to put it another way, sequence of return risk is the risk that market declines in the.

Sequence Of Returns Risk How When You Retire Could Make Or Break Your Sequence of returns risk is a crucial financial concept in retirement planning, highlighting the risk that the timing of withdrawals from a retirement account can negatively affect the overall rate of return. this risk is particularly significant in the ‘retirement red zone,’ the period just before and just after retirement. understanding. Also called sequence risk, this is the risk that comes from the order in which your investment returns occur. to put it another way, sequence of return risk is the risk that market declines in the.

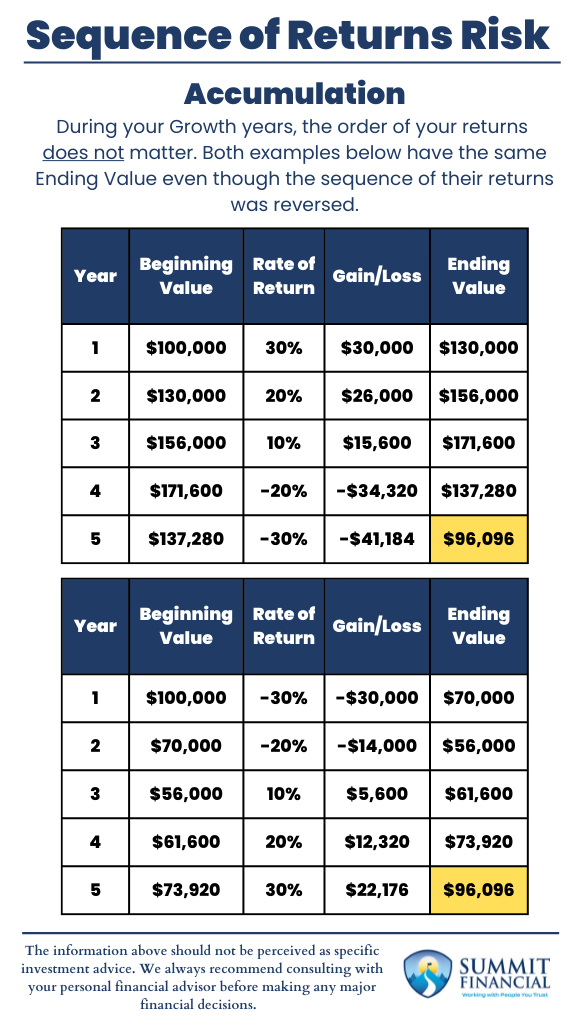

Understand Sequence Of Returns Risk Summit Financial

Comments are closed.