Overview Of The Tila Respa Integrated Disclosure Rule Ema Blog

Overview Of The Tila Respa Integrated Disclosure Rule Ema Blog What it looks like. this rule brings together four separate disclosures required under current respa and tila rules relating to closed end credit transactions. this applies to transactions that are secured by real property. instead of the separate disclosures, these forms are now consolidated into two: a loan estimate and a closing disclosure. Main trid provisions and official interpretations can be found in: § 1026.19 (e), (f), and (g), procedural and timing requirements. § 1026.37, content of the loan estimate. § 1026.38, content of the closing disclosure. supplement i to part 1026 (including official interpretations for the above provisions).

Nmls Exam Tila Respa Integrated Disclosure Rule Trid Youtube For mortgage lenders, the mortgage process can be daunting, with its myriad regulations and requirements. among these, the tila respa integrated disclosure (trid) rule, implemented by the consumer financial protection bureau (cfpb) in 2015, stands out for its impact on disclosure timing and tolerance requirements for mortgage lenders. in the first two posts of this series […]. The questions and answers below pertain to compliance with the tila respa integrated disclosure rule (trid or trid rule). this is a compliance aid issued by the consumer financial protection bureau. the bureau published a policy statement on compliance aids, available here, that explains the bureau’s approach to compliance aids. Cfpb provides guidance on the tila respa integrated disclosures rule. on june 17, 2014, the cfpb staff and federal reserve co hosted a webinar on the final tila respa integrated disclosures rule that will be effective for applications received by creditors or mortgage brokers on or after august 1, 2015. the webinar is the first in a planned. Written by brandy bruyere, regulatory compliance counsel on monday, the cfpb released its newest small entity compliance guide for the tila respa integrated disclosures rule. the guide is 89 pages long and intended to provide a plain english explanation of the.

Tila Respa Integration Disclosure Timeline Example Ppt Cfpb provides guidance on the tila respa integrated disclosures rule. on june 17, 2014, the cfpb staff and federal reserve co hosted a webinar on the final tila respa integrated disclosures rule that will be effective for applications received by creditors or mortgage brokers on or after august 1, 2015. the webinar is the first in a planned. Written by brandy bruyere, regulatory compliance counsel on monday, the cfpb released its newest small entity compliance guide for the tila respa integrated disclosures rule. the guide is 89 pages long and intended to provide a plain english explanation of the. Icba summary of the tila respa integrated disclosure (trid) rule background and scope in november 2013, the consumer financial protection bureau (cfpb) issued a final rule amending regulation z (truth in lending act) and regulation x (real estate settlement procedures act) to integrate several mortgage loan disclosures. on july 21, 2015. The tila respa integrated disclosure rule consolidates four existing disclosures required under tila and respa for most closed end consumer credit transactions secured by real estate into two forms: a loan estimate given 3 business days after application a closing disclosure given 3 business days prior to consummation.

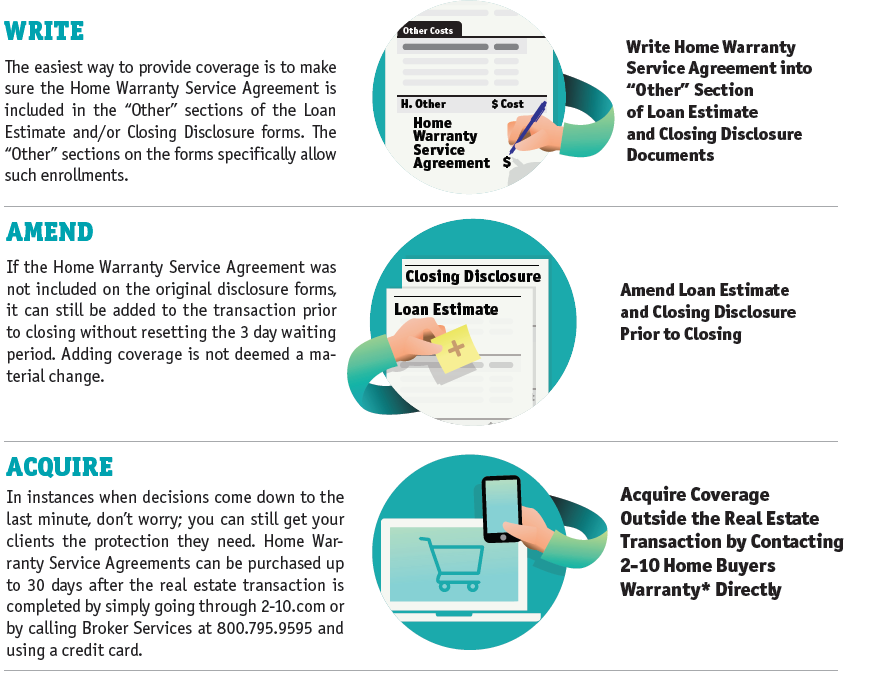

Understanding The New 2015 Tila Respa Integrated Disclosure Rule 2 10 Icba summary of the tila respa integrated disclosure (trid) rule background and scope in november 2013, the consumer financial protection bureau (cfpb) issued a final rule amending regulation z (truth in lending act) and regulation x (real estate settlement procedures act) to integrate several mortgage loan disclosures. on july 21, 2015. The tila respa integrated disclosure rule consolidates four existing disclosures required under tila and respa for most closed end consumer credit transactions secured by real estate into two forms: a loan estimate given 3 business days after application a closing disclosure given 3 business days prior to consummation.

The Tila Respa Integrated Disclosure Rule Trid Nmls Mortgage

The Tila Respa Integrated Disclosures

Comments are closed.