Out Of Pocket Maximums How It S Helpful For You

What S The Difference Deductibles Vs Out Of Pocket Maximums Getty. a deductible is what you pay for healthcare services before your health insurance plan begins paying for care. the out of pocket maximum is the most you can pay for in network care during a. An out of pocket maximum, also referred to as an out of pocket limit, is the most a health insurance policyholder will pay each year for covered healthcare expenses. when this limit is reached.

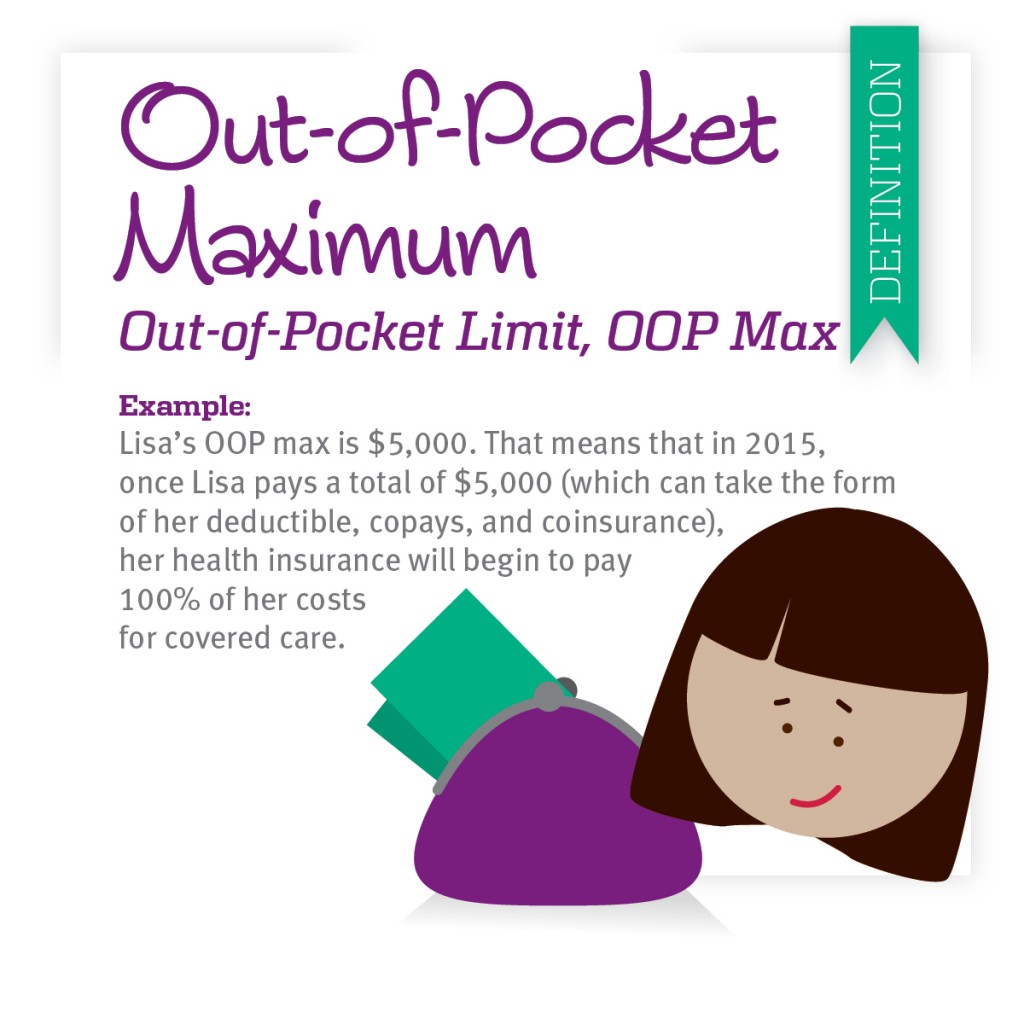

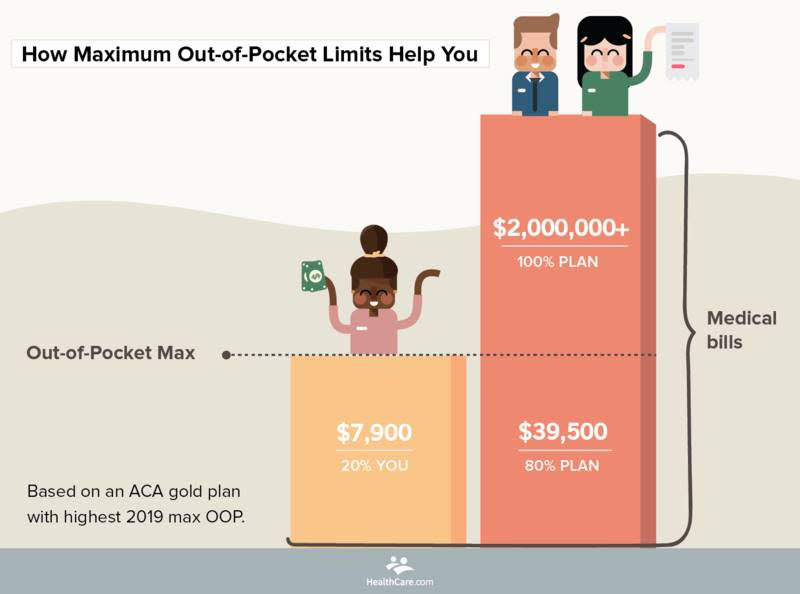

Out Of Pocket Maximums How It S Helpful For You Additionally, all health insurance plans are required to have an out of pocket maximum that limits the amount of money people spend out of pocket on medical expenses in a given year. the maximum out of pocket limit is federally mandated. the most that individuals will have to pay out of pocket in 2021 is $8,550 and $17,100 for families. For the 2023 plan year: the out of pocket limit for a marketplace plan is $9,100 for an individual plan and $18,200 for a family plan (before any subsidies are applied). the aca also stipulates that in addition to the family out of pocket limit, family plans are required to have an embedded individual out of pocket maximum, which applies to. The amount of your out of pocket maximum – however, by law, the out of pocket limit for marketplace plans can’t be above a set limit each year. for the 2024 plan year, the out of pocket limit for marketplace plans can’t exceed $9,450 for an individual and $18,900 for a family. not every plan has an out of pocket max, so if this is a. For the 2019 plan year: the out of pocket limit for a marketplace plan was $7,900 for an individual plan and $15,800 for a family plan (before any subsidies are applied). the aca also stipulates that in addition to the family out of pocket limit, which (in 2019) cannot exceed $15,800, family plans are required to have an embedded individual out.

Definitions And Meanings Of Health Care And Health Insurance Terms The amount of your out of pocket maximum – however, by law, the out of pocket limit for marketplace plans can’t be above a set limit each year. for the 2024 plan year, the out of pocket limit for marketplace plans can’t exceed $9,450 for an individual and $18,900 for a family. not every plan has an out of pocket max, so if this is a. For the 2019 plan year: the out of pocket limit for a marketplace plan was $7,900 for an individual plan and $15,800 for a family plan (before any subsidies are applied). the aca also stipulates that in addition to the family out of pocket limit, which (in 2019) cannot exceed $15,800, family plans are required to have an embedded individual out. Updated oct 18, 2024. a deductible is the amount you'll have to pay for medical care at the beginning of your insurance policy. the out of pocket max is the most you'll pay for medical expenses in a year. for each policy year, you'll pay the full cost of most medical care until your total spending reaches the deductible amount. Example of an out of pocket maximum . let’s say you’re enrolled in a health insurance plan with a $1,500 deductible, a $3,000 out of pocket maximum, and 20% coinsurance. here’s how your out of pocket maximum will apply if you need knee surgery that costs $10,000:.

Out Of Pocket Maximum How It Could Help You Save On Medical Expenses Updated oct 18, 2024. a deductible is the amount you'll have to pay for medical care at the beginning of your insurance policy. the out of pocket max is the most you'll pay for medical expenses in a year. for each policy year, you'll pay the full cost of most medical care until your total spending reaches the deductible amount. Example of an out of pocket maximum . let’s say you’re enrolled in a health insurance plan with a $1,500 deductible, a $3,000 out of pocket maximum, and 20% coinsurance. here’s how your out of pocket maximum will apply if you need knee surgery that costs $10,000:.

Comments are closed.