Out Of Pocket Maximum Awesomefintech Blog

Out Of Pocket Maximum Awesomefintech Blog An out of pocket maximum is the most a health insurance policyholder will pay each year for covered healthcare expenses. there is a range of out of pocket limits an individual or family may choose from, such as lower out of pocket maximums and higher premiums or higher out of pocket maximums and lower premiums. out of pocket maximum, also referred to as out of pocket limit, is the most a. Table of contents what are out of pocket expenses? more on out of pocket expenses maximums vs. deductibles examples the types of expenses that qualify are moving expenses — such as the cost of packing, crating, hauling a trailer, in transit storage, and insurance — storage expenses, and travel expenses. if the government provides and pays for any of your moving or storage expenses, you.

Out Of Pocket Maximum Awesomefintech Blog Reimbursable out of pocket costs are things that an employee pays for upfront and then are paid back for by their company. most companies have guidelines to help employees determine what expenses are considered reimbursable out of pocket costs and not. in the health insurance industry, out of pocket expenses refer to the portion of the bill that the insurance company doesn't cover and that the. An out of pocket maximum, also referred to as an out of pocket limit, is the most a health insurance policyholder will pay each year for covered healthcare expenses. when this limit is reached. However, oop maximums can’t exceed a certain amount. there’s a standard limit set each year as per the affordable care act (also known as the aca or obamacare). for the 2025 calendar year, the most you will pay out of pocket toward your maximum is $9,200 for an individual and $18,400 for a family. these amounts will most likely change for. Mammography. genetic tests. vasectomy or female sterilization. physical therapy (if needed for nagging injuries) iud insertion. therapist. sleep apnea testing. for me personally not much of this applies, but it's some great ideas! a read through my plan doc didn't come up with much.

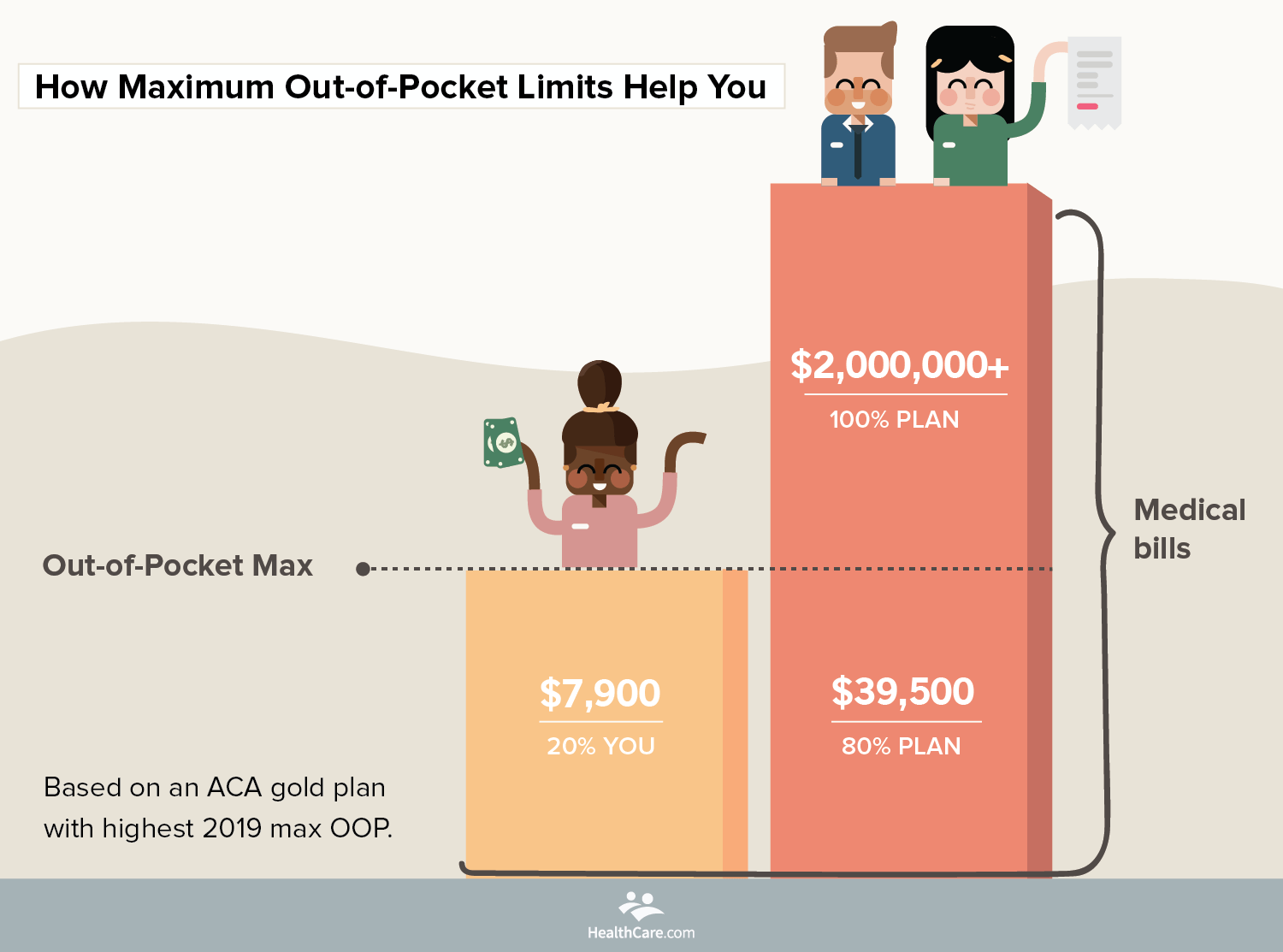

What You Need To Know About Your Out Of Pocket Maximum However, oop maximums can’t exceed a certain amount. there’s a standard limit set each year as per the affordable care act (also known as the aca or obamacare). for the 2025 calendar year, the most you will pay out of pocket toward your maximum is $9,200 for an individual and $18,400 for a family. these amounts will most likely change for. Mammography. genetic tests. vasectomy or female sterilization. physical therapy (if needed for nagging injuries) iud insertion. therapist. sleep apnea testing. for me personally not much of this applies, but it's some great ideas! a read through my plan doc didn't come up with much. Getty. a deductible is what you pay for healthcare services before your health insurance plan begins paying for care. the out of pocket maximum is the most you can pay for in network care during a. The out of pocket maximum is the most you can spend on your copays and deductibles before the insurance company starts to pay 100% of costs (on in network covered services, at least). i believe in the us that this was established as part of the aca. say your insurance plan has a 1000$ deductible, 10% copays, and an $8000 out of pocket maximum.

Out Of Pocket Maximums How It S Helpful For You Getty. a deductible is what you pay for healthcare services before your health insurance plan begins paying for care. the out of pocket maximum is the most you can pay for in network care during a. The out of pocket maximum is the most you can spend on your copays and deductibles before the insurance company starts to pay 100% of costs (on in network covered services, at least). i believe in the us that this was established as part of the aca. say your insurance plan has a 1000$ deductible, 10% copays, and an $8000 out of pocket maximum.

Comments are closed.