Open Banking With Superpowers

Open Banking With Superpowers Youtube Open banking powers a smarter, simpler and safer ach transaction, making “dumb ach” obsolete. the cost advantage the financial benefits of open banking payments extend beyond mere convenience. Open banking is helping fuel a revolution in financial services. it can provide people with more convenient ways to view and manage their money and simpler ways to access credit. open banking can also power different kinds of payment services, such as payments in video games or business accounting apps. the practice is already helping to widen.

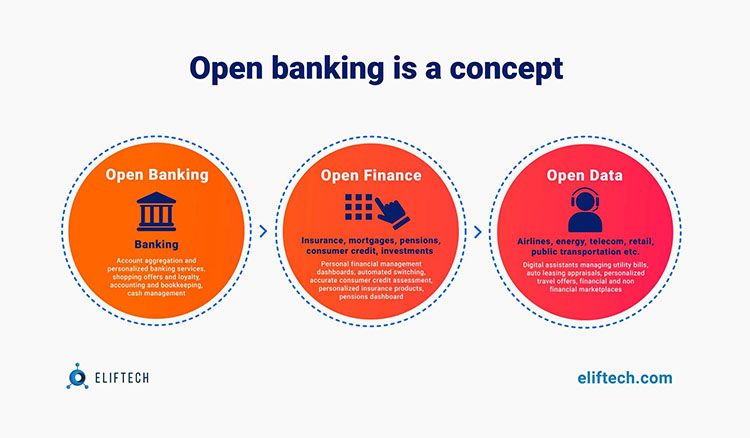

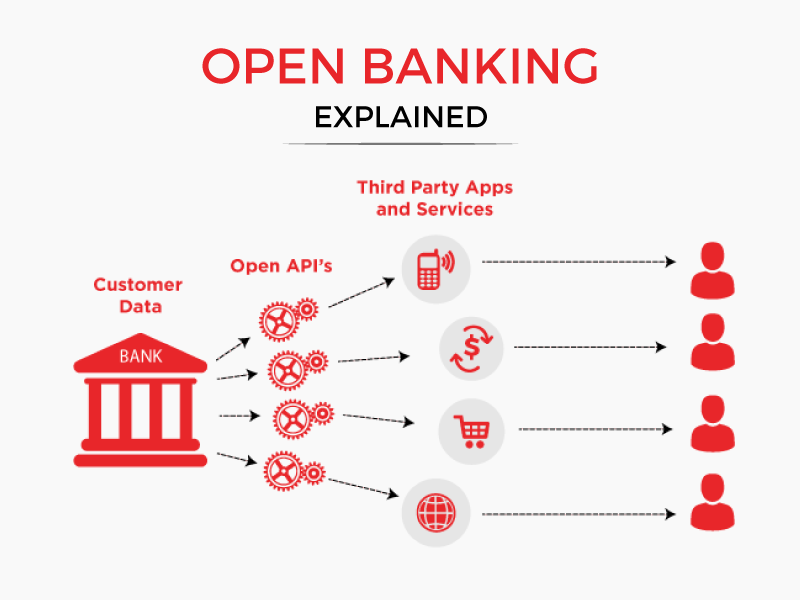

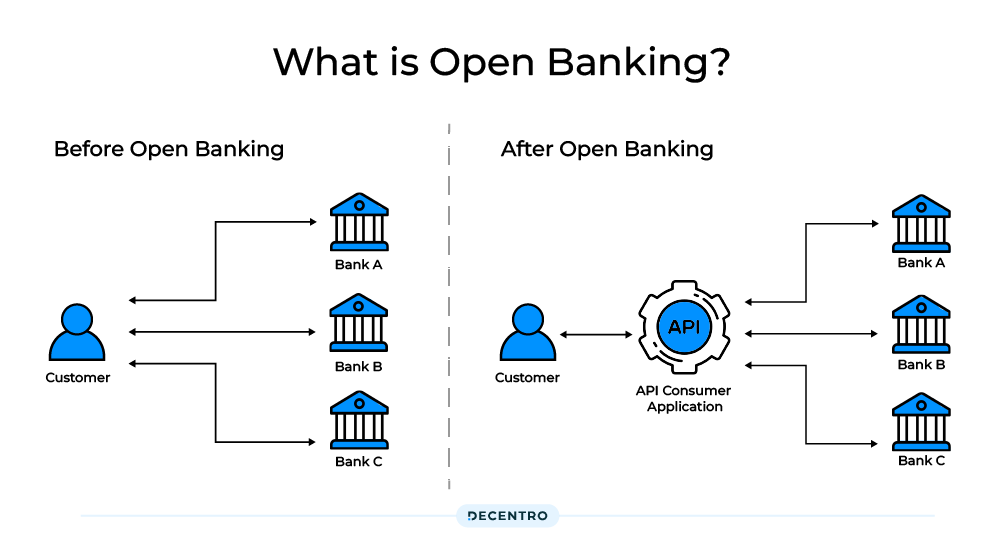

Open Banking App Ideas And Use Cases For Fintech Founders Open banking involves the sharing of comprehensive customer data, raising concerns about the potential misuse of this information. while the primary intention is to enhance services and provide personalized offerings, there is a risk that third party providers may misuse customer data for purposes other than those intended. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. Open banking is a simple, secure way to help you move, manage and make more of your money. savings or investments. budgeting or donating. affordable loans and cost effective payments. open banking powers new ways for consumers and businesses to access a wide range of financial services – all built on secure systems from. Open banking data sharing powers the delivery of personal finance management apps that offer a complete picture of consumers’ financial health along with data driven insights and advice. open banking apis also enable fintechs to add payment services, price comparisons, and other useful features to apps to increase convenience, improve.

Unlocking The Power Of Open Banking Payments Open banking is a simple, secure way to help you move, manage and make more of your money. savings or investments. budgeting or donating. affordable loans and cost effective payments. open banking powers new ways for consumers and businesses to access a wide range of financial services – all built on secure systems from. Open banking data sharing powers the delivery of personal finance management apps that offer a complete picture of consumers’ financial health along with data driven insights and advice. open banking apis also enable fintechs to add payment services, price comparisons, and other useful features to apps to increase convenience, improve. The open banking implementation entity (obie) was created by the cma to deliver the application programming interfaces (apis), data structures and security architectures that will enable developers to harness technology, making it easy and safe for individuals and smes to share the financial information held by their banks with third parties. The impact is both profound and widespread. the blend of personalization with open banking is shaping the future of banking. 1. evolution of ai in banking personalization. downs traces ai’s progress in banking, from microsoft research to today’s generative ai. he notes, “we’ve done so much better in understanding language. and the human.

Open Banking Meaning Benefits Risks Razorpayx The open banking implementation entity (obie) was created by the cma to deliver the application programming interfaces (apis), data structures and security architectures that will enable developers to harness technology, making it easy and safe for individuals and smes to share the financial information held by their banks with third parties. The impact is both profound and widespread. the blend of personalization with open banking is shaping the future of banking. 1. evolution of ai in banking personalization. downs traces ai’s progress in banking, from microsoft research to today’s generative ai. he notes, “we’ve done so much better in understanding language. and the human.

Open Banking Revolutionizes How Consumers Access Financial Data Sharp

Open Banking What Is It And How Does It Work Decentro

Comments are closed.