Open Banking What Small Businesses Need To Know

Open Banking What Small Businesses Need To Know Open banking cuts out the intermediaries in bank payment processing, saving businesses up to 2% per transaction. improve acceptance ratios: with open banking, payment acceptance rates are as high as 98%. the average acceptance rate for credit cards is 70%, and for online wallets, it’s 80%. decrease time to market for startups and small. 3. gather documents and apply. at a minimum, you'll need your name, address, date of birth and a government issued photo id to open a business account. beyond that, the documents and information.

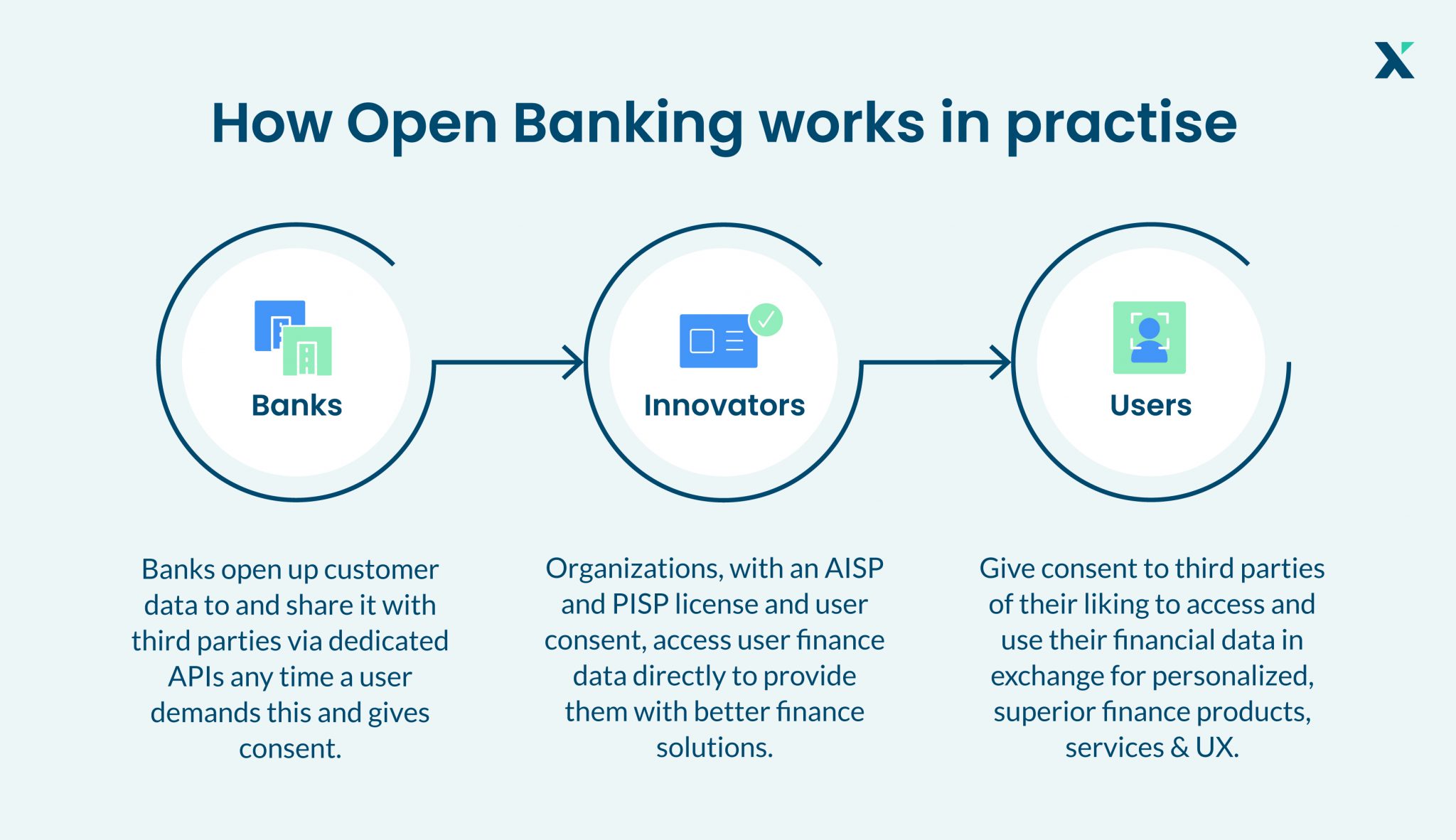

Everything You Need To Know About Open Banking Here are the basic steps. 1. get an ein. if you haven’t already, you’ll need to get an official irs ein (employer identification number). also known as a tax id number, an ein is a unique. The banks on this list offer all around solid business banking. we'll go ahead and spoil it for you: small business bank is our favorite bank overall. it offers a free business checking account and two affordable high yield savings account options. plus, it's available in all 50 states. Step 1: gather the required documents. opening a business bank account has special requirements to be aware of before starting the process. the following lists may vary from bank to bank, but the required documents are listed below. personal requirements. business requirements. full legal name. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation.

Open Banking Api Everything You Need To Know Fortunesoft Step 1: gather the required documents. opening a business bank account has special requirements to be aware of before starting the process. the following lists may vary from bank to bank, but the required documents are listed below. personal requirements. business requirements. full legal name. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. Here’s a rundown of the most common materials needed to open a business bank account: two forms of identification. your tax id number (tin) business documentation (certificate of good standing. Some banks require hefty deposits to open a business bank account. others require as little as $25 or even less. check the bank’s other requirements before you open an account, however. a bank that has little to no minimum requirement to open a new account may require you to keep a hefty daily balance of $1,500 or more.

Comments are closed.