Open Banking What Is It Examples Risks Opportunities

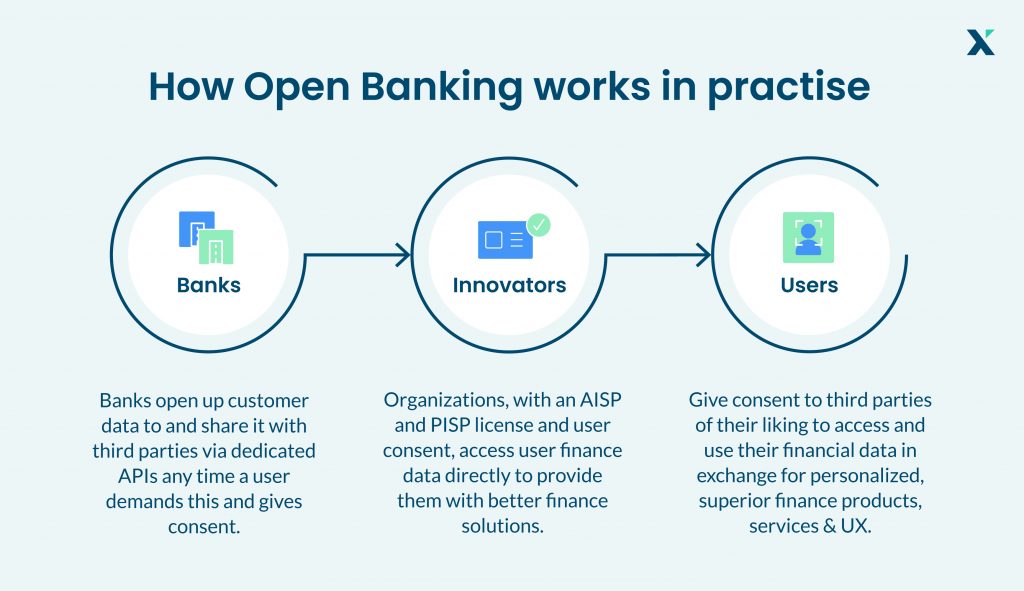

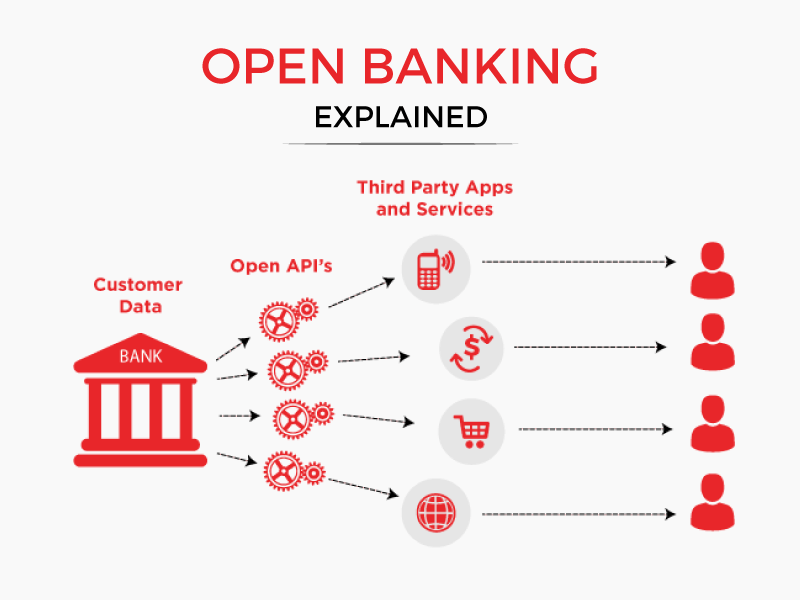

Open Banking What Is It Examples Risks Opportunities Open banking refers to the practice of allowing third party service providers to use consumers' banking data to build new financial applications and services. it often employs open source technologies and application programming interfaces (apis) to exchange client financial data, increasing financial transparency. Open banking is the system of allowing access and control of consumer banking and financial accounts through third party applications. open banking has the potential to reshape the competitive.

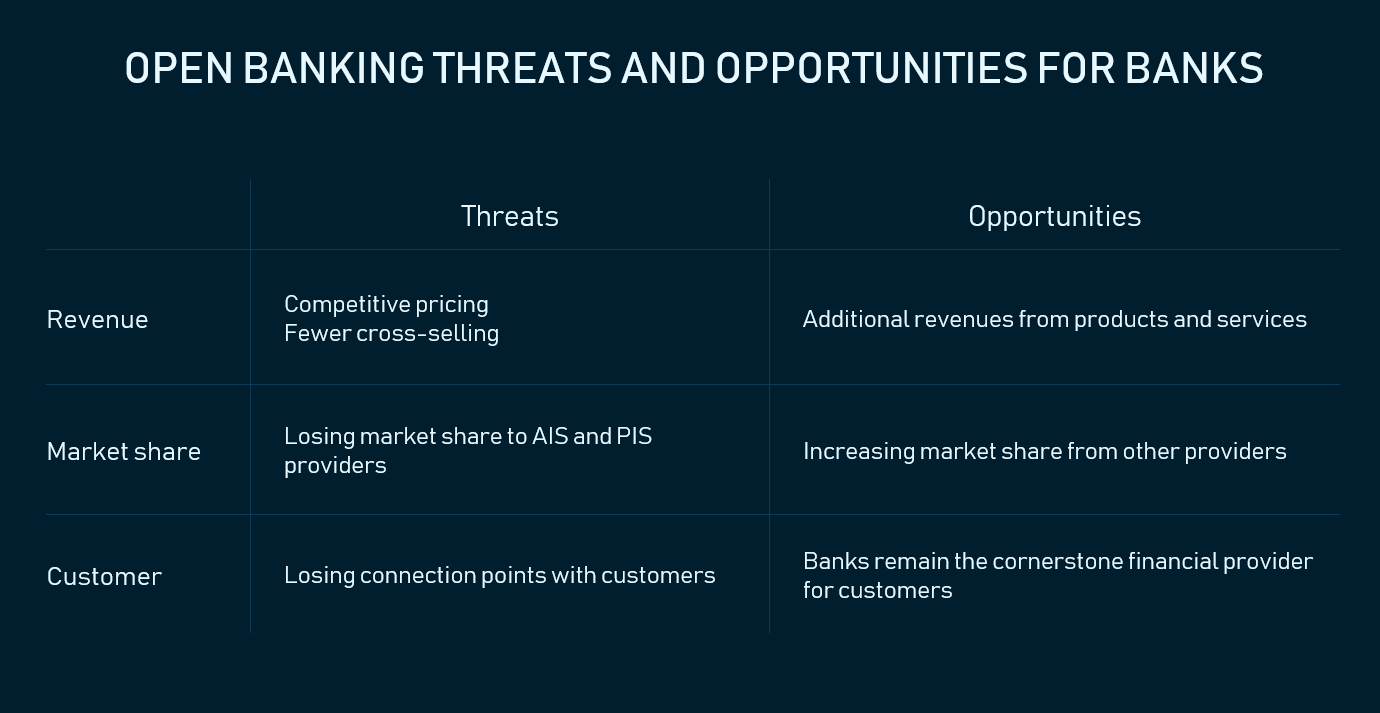

Open Banking Key Threats Opportunities Ndgit Next Digital Finance Abstract and figures. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom. Open banking, also known as “open bank data,” is reshaping the financial industry by providing third party financial service providers with open access to consumer banking and financial data. this article delves into the intricacies of open banking, explaining its definition, how it works, and the inherent risks involved. Abstract. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom, open banking is on the rise in many countries. thanks to open banking, consumers and businesses can access innovative financial services and products easily and. Examples of open banking services. open banking is not one discrete product or service. rather, it's a framework within which any number of financial services can be enabled. this is an actively evolving field, so the scope of financial services coming to market is likely to expand. here are some of the ways in which open banking is currently used:.

Everything You Need To Know About Open Banking Abstract. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom, open banking is on the rise in many countries. thanks to open banking, consumers and businesses can access innovative financial services and products easily and. Examples of open banking services. open banking is not one discrete product or service. rather, it's a framework within which any number of financial services can be enabled. this is an actively evolving field, so the scope of financial services coming to market is likely to expand. here are some of the ways in which open banking is currently used:. Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Open banking is the practice of securely sharing financial data between banks and third party service providers, such as fintech apps. before open banking became available, consumer financial data.

What Open Banking Means For Accounting Firms Experlu Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Open banking is the practice of securely sharing financial data between banks and third party service providers, such as fintech apps. before open banking became available, consumer financial data.

Open Banking Api Integration Examples Of Fintech Apis Altexsoft

Open Banking To Open Finance Risks Benefits Opportunities

Comments are closed.