Open Banking What Is It And Why Does It Matter Finconecta

Open Banking What Is It And Why Does It Matter Finconecta By increasing competition and innovation in the financial industry, open banking has the potential to revolutionize the way consumers interact with their banks. bringing win win opportunities to end users and financial institutions (fis), open banking is here to stay. let’s understand why this is. so how does open banking benefit end users?. Open banking helps traditional banks in various ways. firstly, it allows banks to access new customer segments and expand their reach, as well as provide them with the opportunity to develop new.

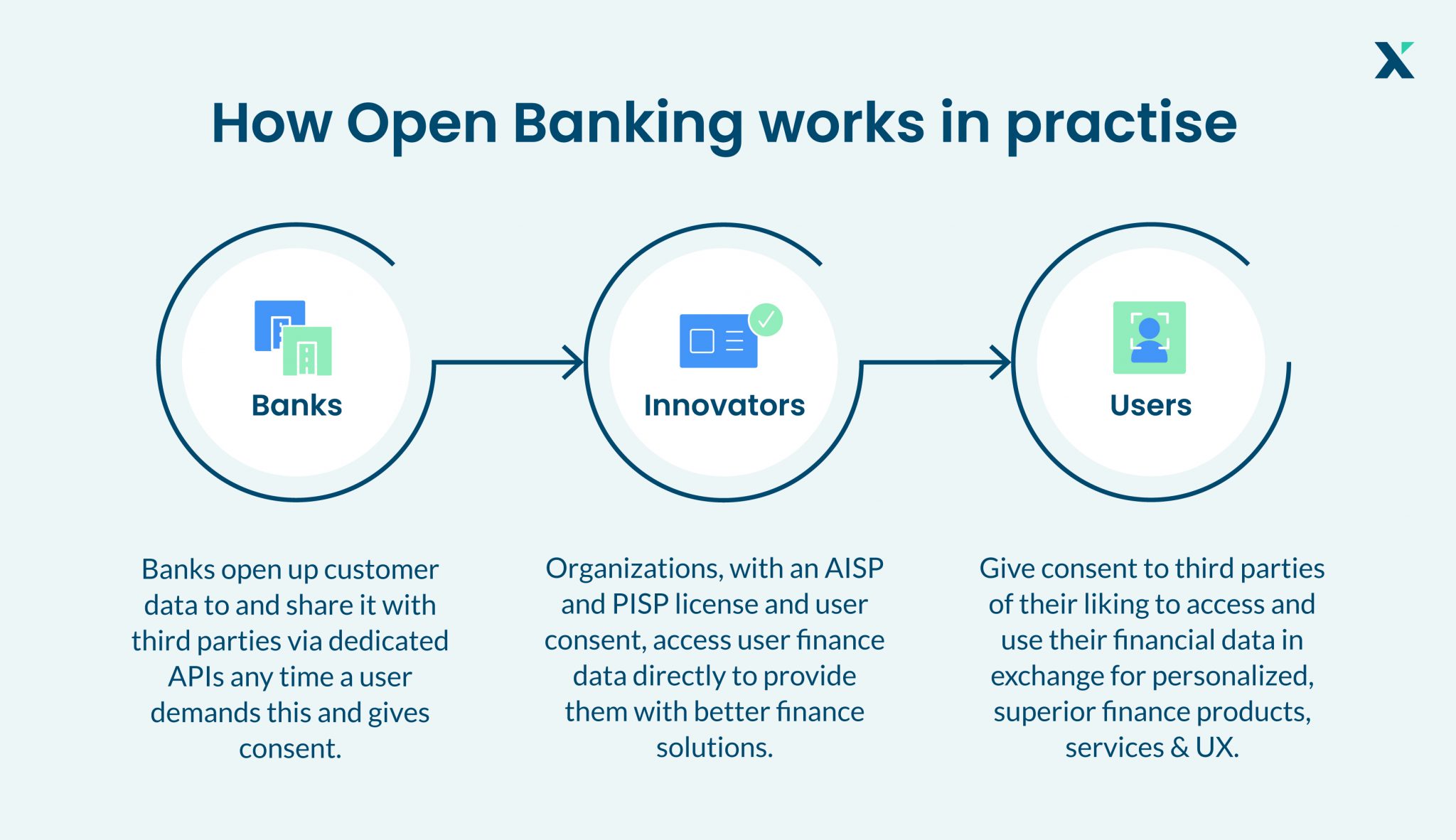

Everything You Need To Know About Open Banking Open banking: why it's crucial for financial institutions? 🏦 🔐 the financial landscape is evolving rapidly, and open banking is at the forefront of this…. Open banking emerges in the financial industry, as a new collaboration scheme between traditional financial institutions and third party providers (tpps). during the last decade, as this new type. Under the open banking standard, banking data will be shared through secure open apis so that customers, be it individuals or businesses, can more effectively manage their wealth. open apis would allow third party developers to create helpful services and tools that customers can utilize. currently, many small and medium sized enterprises use. Ultimately, open banking allows banks and third party service providers to offer a more personalized and streamlined experience to their customers. when it’s widely enacted in the u.s., it will.

Open Banking What Is It And Why Does It Matter Under the open banking standard, banking data will be shared through secure open apis so that customers, be it individuals or businesses, can more effectively manage their wealth. open apis would allow third party developers to create helpful services and tools that customers can utilize. currently, many small and medium sized enterprises use. Ultimately, open banking allows banks and third party service providers to offer a more personalized and streamlined experience to their customers. when it’s widely enacted in the u.s., it will. Why does open banking matter? proponents say customers should have access to their data so that they can get cheaper and better services. open banking would also foster greater competition, they. Open banking is the system of allowing access and control of consumer banking and financial accounts through third party applications. open banking has the potential to reshape the competitive.

What Is Open Banking And Why Does It Matter Business Why does open banking matter? proponents say customers should have access to their data so that they can get cheaper and better services. open banking would also foster greater competition, they. Open banking is the system of allowing access and control of consumer banking and financial accounts through third party applications. open banking has the potential to reshape the competitive.

Comments are closed.