Open Banking Meaning Benefits Risks Razorpayx

Open Banking Meaning Benefits Risks Razorpayx Open banking is a system where banks and other financial institutions share their customers’ financial data with other banks and other authorized institutions. previously, customer information was kept closed and outside banks were not allowed to access internal data. with open banking, the data shared can be used to create innovative. Open banking is the system of allowing access and control of consumer banking and financial accounts through third party applications. open banking has the potential to reshape the competitive.

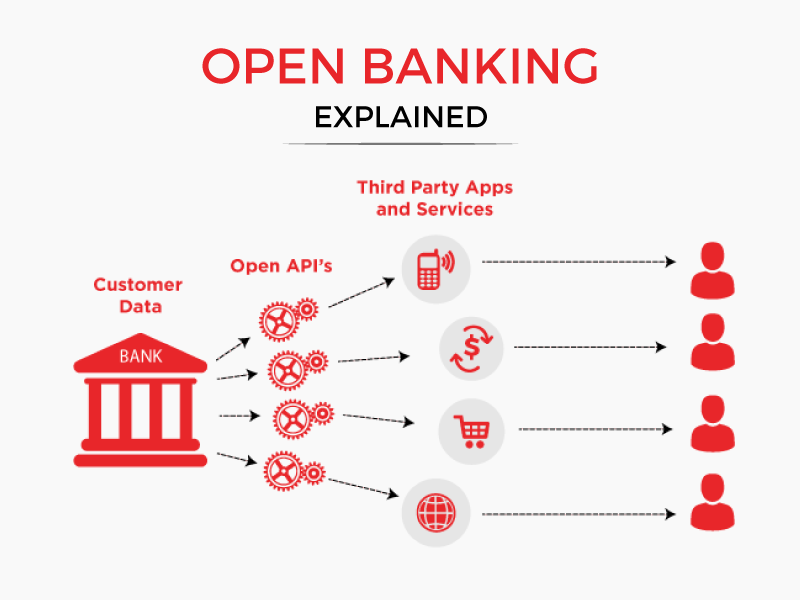

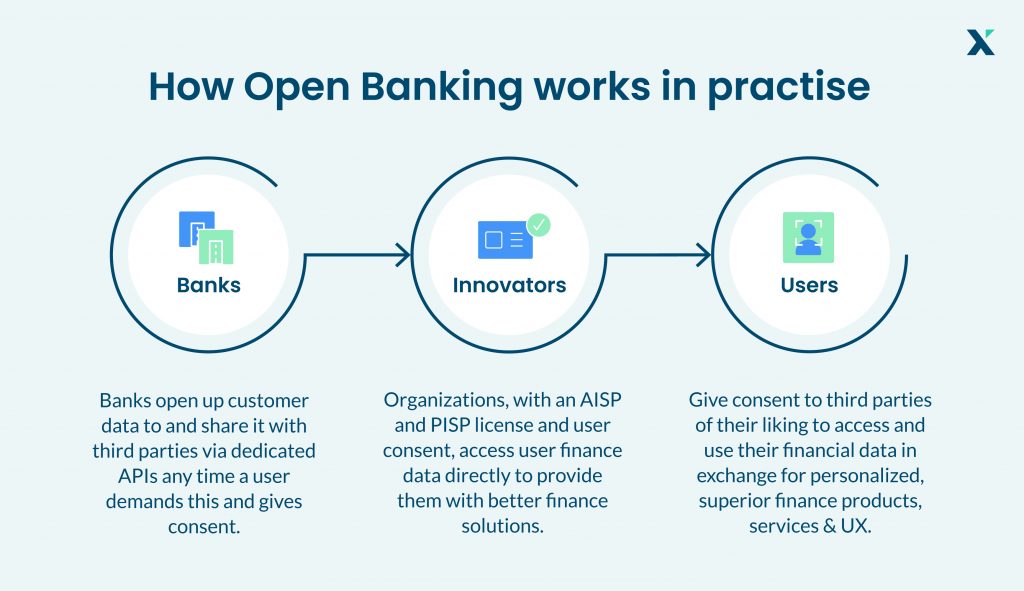

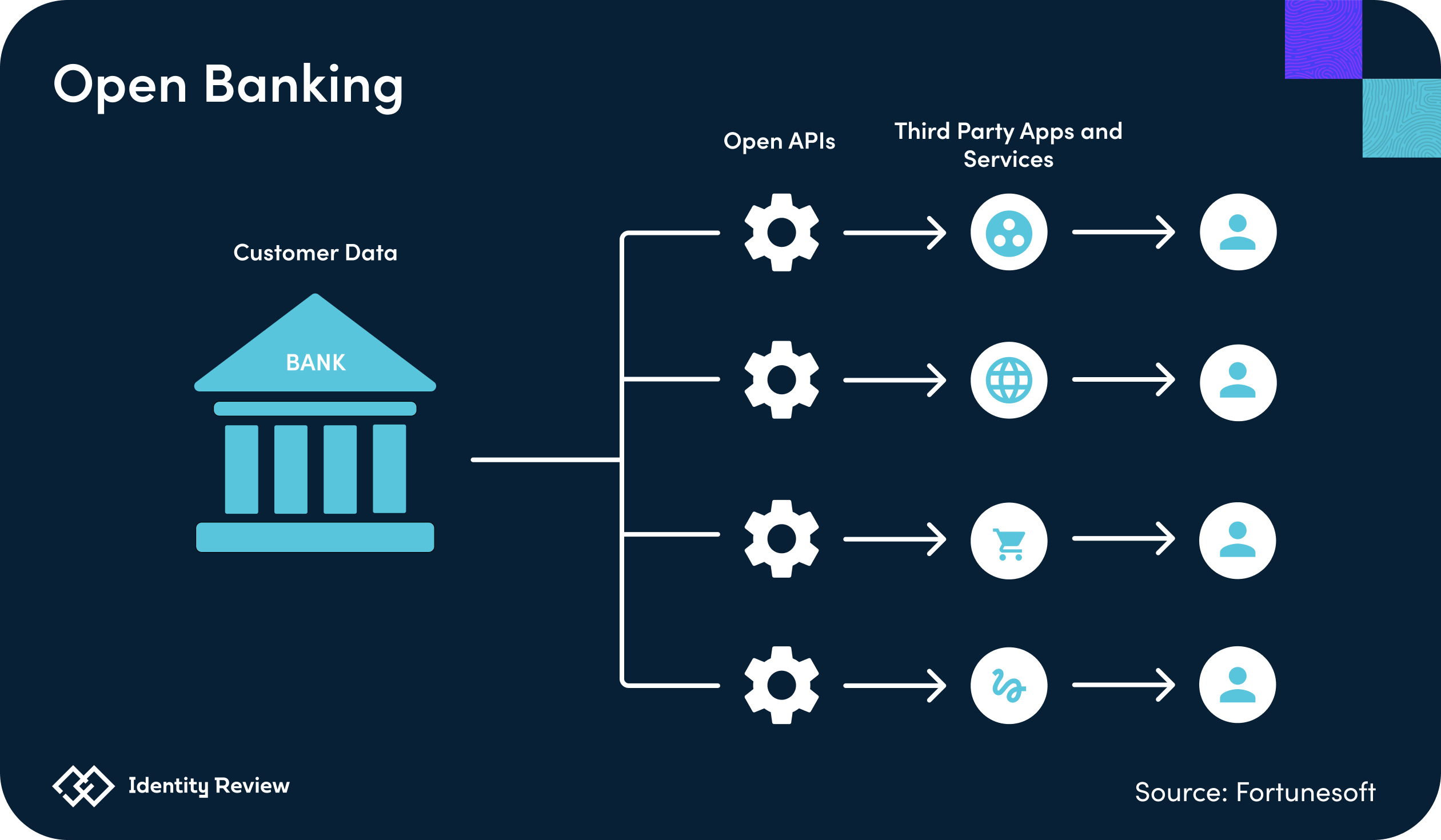

Open Banking Meaning Benefits Risks Razorpayx Open banking meaning simply refers to the sharing of financial data of customers with third party services with apis. it is a transformative thing for a financial sector that enhances transparency, competition and innovation. open banking in india is gaining popularity with supportive regulations and acceptance. Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Here are eight advantages: 1. you get safer transactions. consumer concerns that their data is not secure since it is now accessible to third parties and businesses are legitimate given the importance of data security. contrary to popular belief, security is integral to open banking. Key takeaways: open banking is a system that allows banks to share customer financial data securely and with consent. it offers numerous benefits, including increased competition, enhanced personal financial management, and access to innovative financial services. now, let’s dive into the details.

Everything You Need To Know About Open Banking Here are eight advantages: 1. you get safer transactions. consumer concerns that their data is not secure since it is now accessible to third parties and businesses are legitimate given the importance of data security. contrary to popular belief, security is integral to open banking. Key takeaways: open banking is a system that allows banks to share customer financial data securely and with consent. it offers numerous benefits, including increased competition, enhanced personal financial management, and access to innovative financial services. now, let’s dive into the details. Open banking is the practice of securely sharing financial data between banks and third party service providers, such as fintech apps. before open banking became available, consumer financial data. The term open banking refers to enabling third party software providers and banks to build new, customer centric financial applications and services with apis as the enabling technology. but there’s much more to it than that. at its heart, open banking is about giving customers control of their financial data.

What Is Open Banking Identity Review Identity Review Global Tech Open banking is the practice of securely sharing financial data between banks and third party service providers, such as fintech apps. before open banking became available, consumer financial data. The term open banking refers to enabling third party software providers and banks to build new, customer centric financial applications and services with apis as the enabling technology. but there’s much more to it than that. at its heart, open banking is about giving customers control of their financial data.

Open Banking What Is It Examples Risks Opportunities

Comments are closed.