Open Banking Introduction

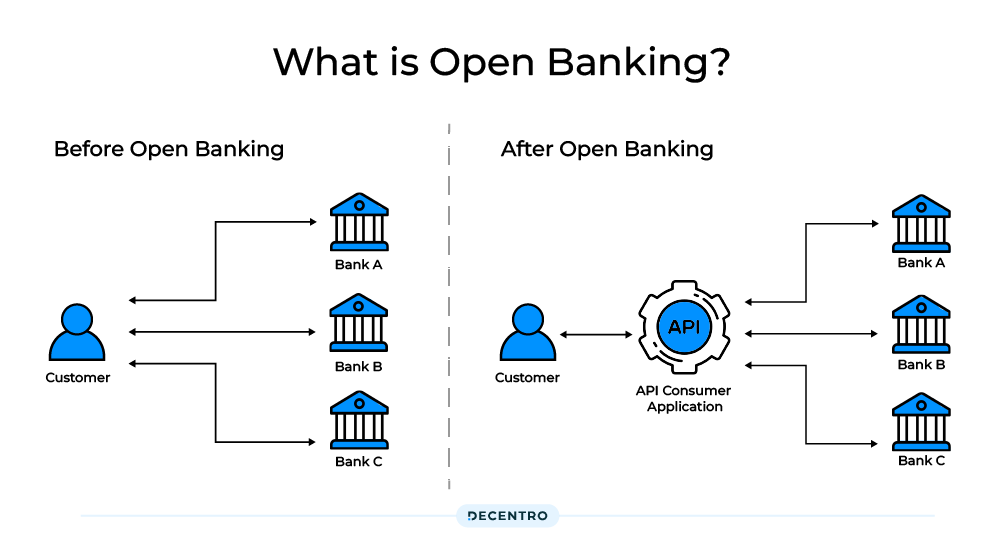

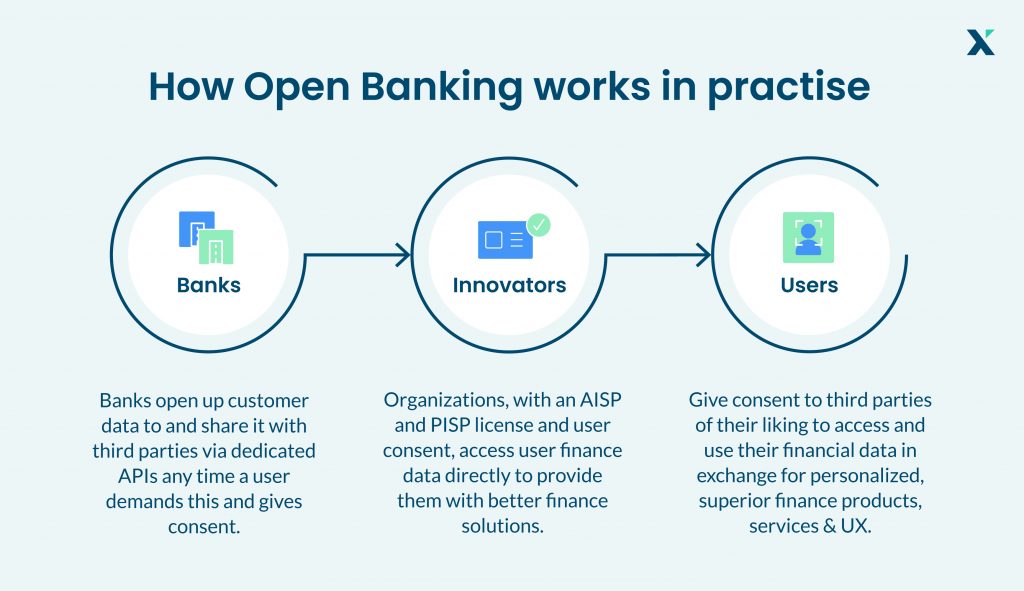

Open Banking What Is It And How Does It Work Decentro Open banking is the system of allowing access and control of consumer banking and financial accounts through third party applications. open banking has the potential to reshape the competitive. Open banking. in financial services, open banking allows for financial data to be shared between banks and third party service providers through the use of application programming interfaces (apis). traditionally, banks have kept customer financial data within their own closed systems. open banking allows customers to share their financial.

Open Banking An Introduction Bizl Open banking is helping fuel a revolution in financial services. it can provide people with more convenient ways to view and manage their money and simpler ways to access credit. open banking can also power different kinds of payment services, such as payments in video games or business accounting apps. the practice is already helping to widen. Open banking is the practice of securely sharing financial data between banks and third party service providers, such as fintech apps. before open banking became available, consumer financial data. Here are some of the ways in which open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer's bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. With the introduction of open banking, new players have access to the same data as big banks, allowing them to innovate and create new, more affordable alternatives to traditional financial services. open banking has democratised the space, tearing down barriers to entry. banks will have to improve their offerings.

Everything You Need To Know About Open Banking Here are some of the ways in which open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer's bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. With the introduction of open banking, new players have access to the same data as big banks, allowing them to innovate and create new, more affordable alternatives to traditional financial services. open banking has democratised the space, tearing down barriers to entry. banks will have to improve their offerings. Open banking: definition, real world examples, and impact. open banking is a financial innovation that revolves around the secure sharing of financial data, allowing third party developers and financial institutions to access and utilize a customer’s banking information through open application programming interfaces (apis). Introduction to open banking: everything you need to know. open banking really came to light when the second payment services directive (psd2) was released in 2018. it was predicted then to hold immense potential for businesses and consumers, and it has certainly performed. there’s also no sign of the industry slowing down any time soon; a.

Comments are closed.