Open Banking Definition How It Works And Risks

:max_bytes(150000):strip_icc()/open_banking-final-8af075f74bb54196bbbd342f717e7716.jpg)

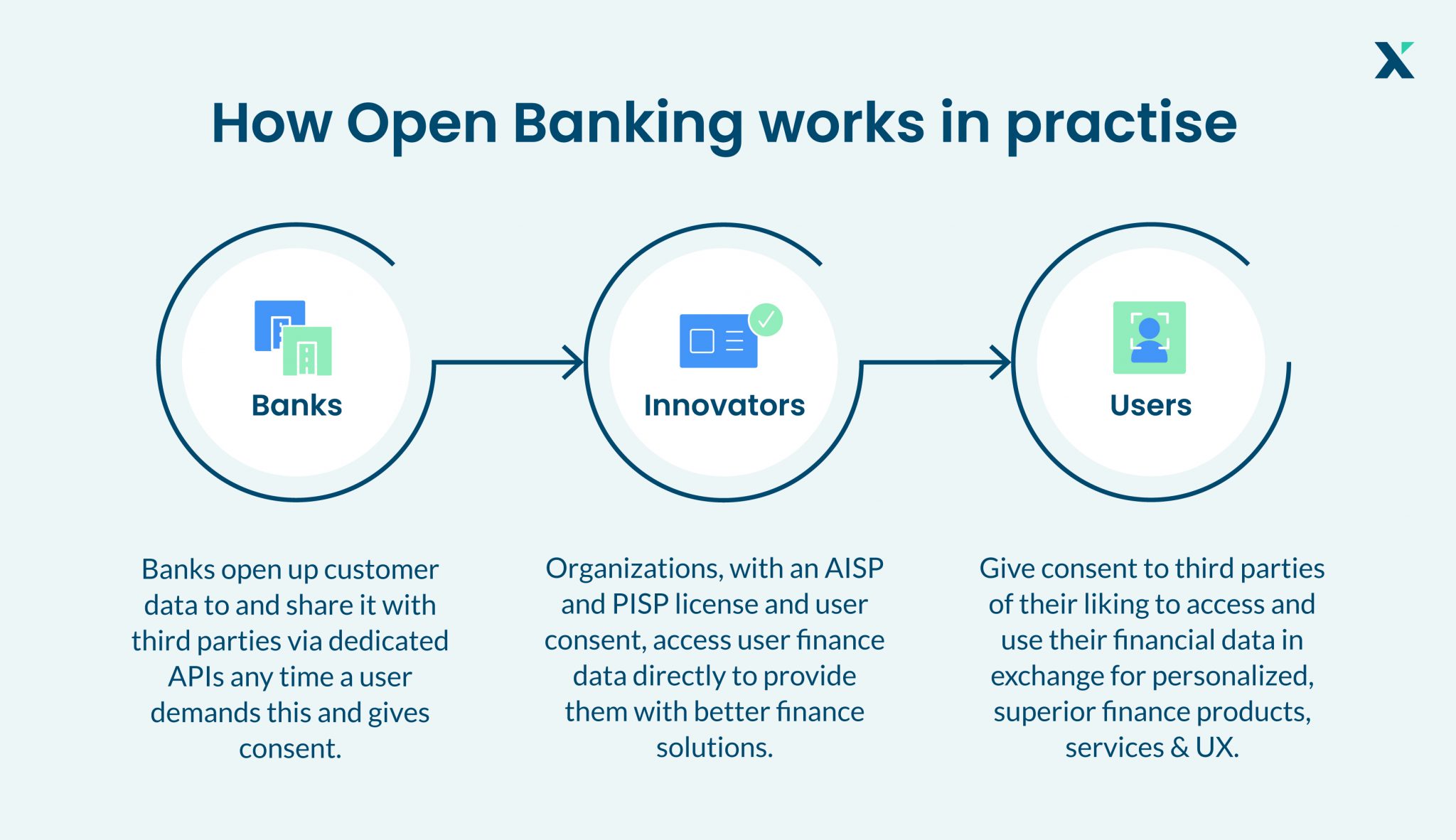

Open Banking Definition How It Works And Risks Open banking is a system that provides third party access to financial data through the use of application programming interfaces (apis). open banking: definition, how it works, and risks. by. Open banking, also known as “open bank data,” is reshaping the financial industry by providing third party financial service providers with open access to consumer banking and financial data. this article delves into the intricacies of open banking, explaining its definition, how it works, and the inherent risks involved.

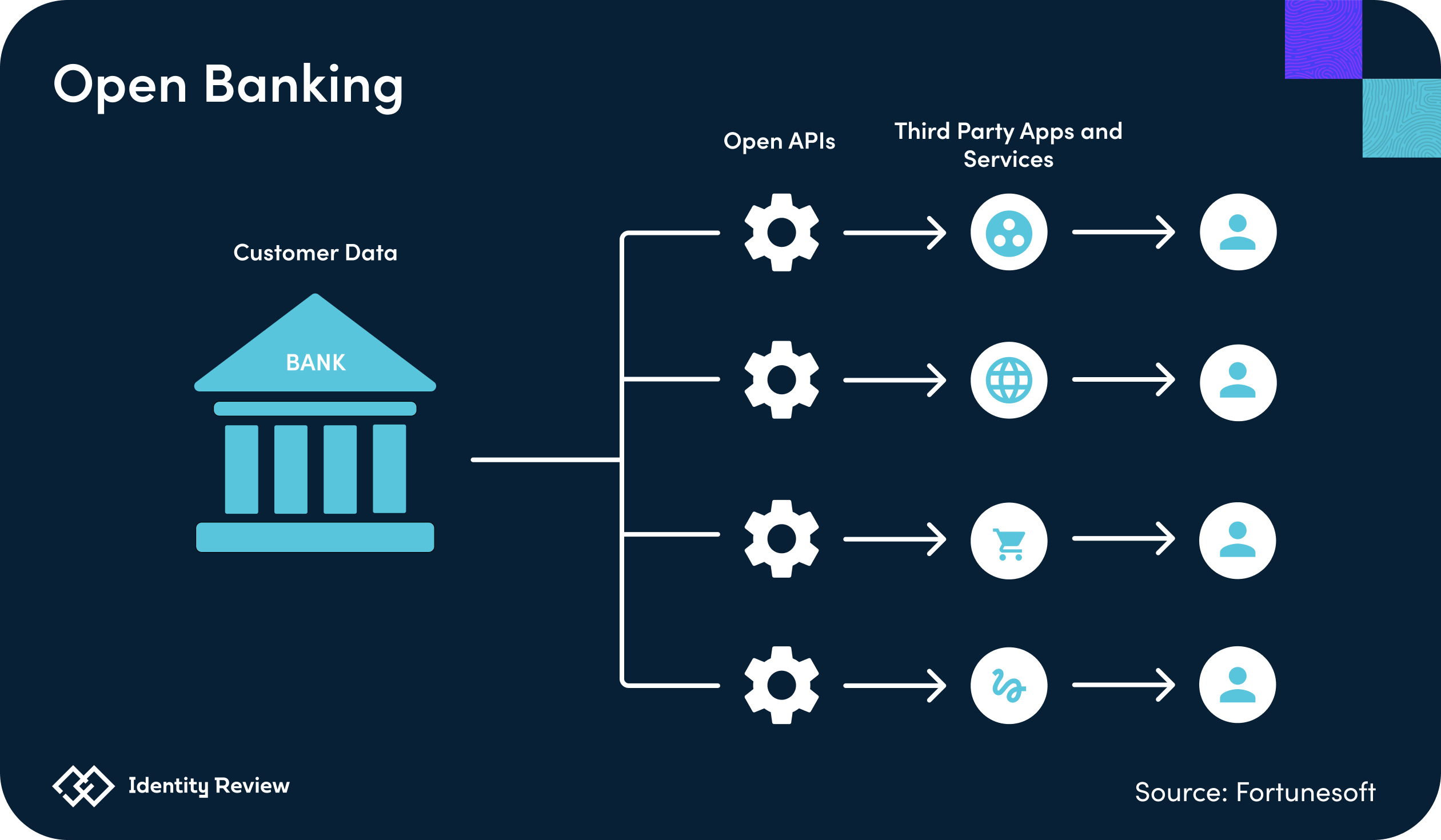

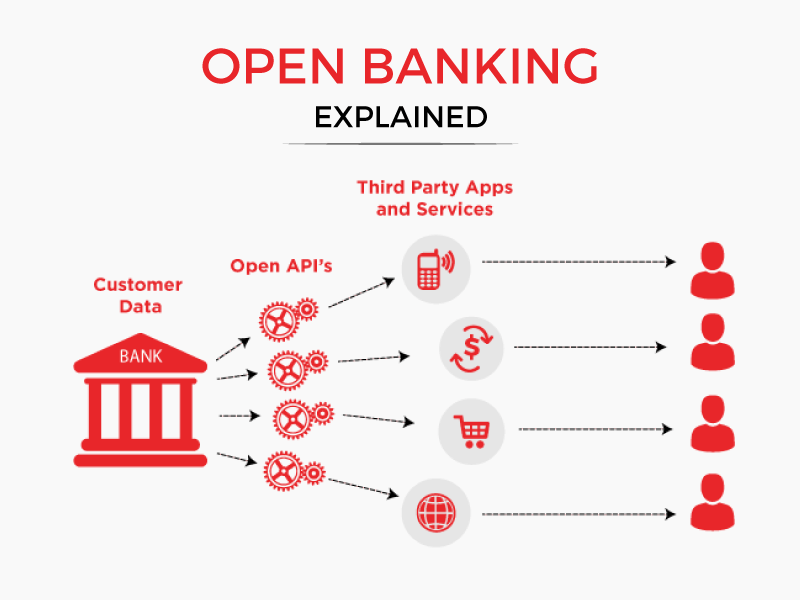

Everything You Need To Know About Open Banking Ultimately, open banking allows banks and third party service providers to offer a more personalized and streamlined experience to their customers. when it’s widely enacted in the u.s., it will. Key takeaways: open banking is a system that allows banks to share customer financial data securely and with consent. it offers numerous benefits, including increased competition, enhanced personal financial management, and access to innovative financial services. now, let’s dive into the details. Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. Open banking is a technology based framework for banking systems that facilitates secure data sharing between financial institutions and authorized third party providers through secure apis. it promotes competition, innovation, and greater customer control over financial data, allowing consumers to access a wider range of financial services and.

What Is Open Banking And How It Works Benefits Explained Bank2home Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. Open banking is a technology based framework for banking systems that facilitates secure data sharing between financial institutions and authorized third party providers through secure apis. it promotes competition, innovation, and greater customer control over financial data, allowing consumers to access a wider range of financial services and. Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Open banking relies on sharing data, but you might prefer to keep your information private. fortunately, open banking should not automatically reduce security or privacy. tpps and banks would need to take steps to protect confidential information and to educate consumers about the new risks they face.

What Open Banking Means For Accounting Firms Experlu Open banking transforms the financial landscape by promoting competition, innovation, and customer centric services. it gives individuals greater control over their financial data and choices and benefits both consumers and the banking industry as a whole. some of the key benefits include: increased competition. Open banking relies on sharing data, but you might prefer to keep your information private. fortunately, open banking should not automatically reduce security or privacy. tpps and banks would need to take steps to protect confidential information and to educate consumers about the new risks they face.

Open Banking Definition How It Works And Risks Open Banking

Comments are closed.