Non Life Reinsurance Market To See Continued Growth Swiss Re

Switzerland Non Life Insurance Market Summary Competitive Analysis And Against this backdrop, the non life reinsurance market is expected to grow above gdp, driven mainly by inflation and urbanisation. the 10 year outlook for the market in usd shows nominal growth of approximately 5.4% per year, or around 3% if adjusted for inflation. Global reinsurer swiss re has noted that the non life reinsurance market is expected to grow above gdp for the next decade, driven mainly by inflation and urbanisation. “the 10 year outlook for the market in usd shows nominal growth of approximately 5.4% per year, or around 3% adjusted for inflation,” swiss re explained.

Advanced Markets Drive Non Life Re Insurance Growth In 2015 Swiss Re Swiss re expects growth momentum for non life reinsurance to increase faster than overall economic growth during the next decade as losses rise from natural catastrophes, the company said on monday. Swiss re expects central themes to be the increasing demand for re insurance protection in an environment marked by heightened volatility and the continued need for risk adequate returns. against this backdrop, the non life reinsurance market is expected to grow above gdp, driven mainly by inflation and urbanisation. Swiss re’s non life gross premium rose 2.7%. berkshire hathaway reported 24% growth in third party reinsurance premium to us$27.5 billion in 2023, up from us$22.1 billion in 2022. Market rebound reflects resilience of insurance industry swiss re institute estimates that global non life premiums will grow by 3.3% in 2021, 3.7% in 2022 and 3.3% in 2023. property catastrophe rates are forecast to improve in 2022 after a year of above average losses. casualty rates should also be stronger next year due to ongoing social.

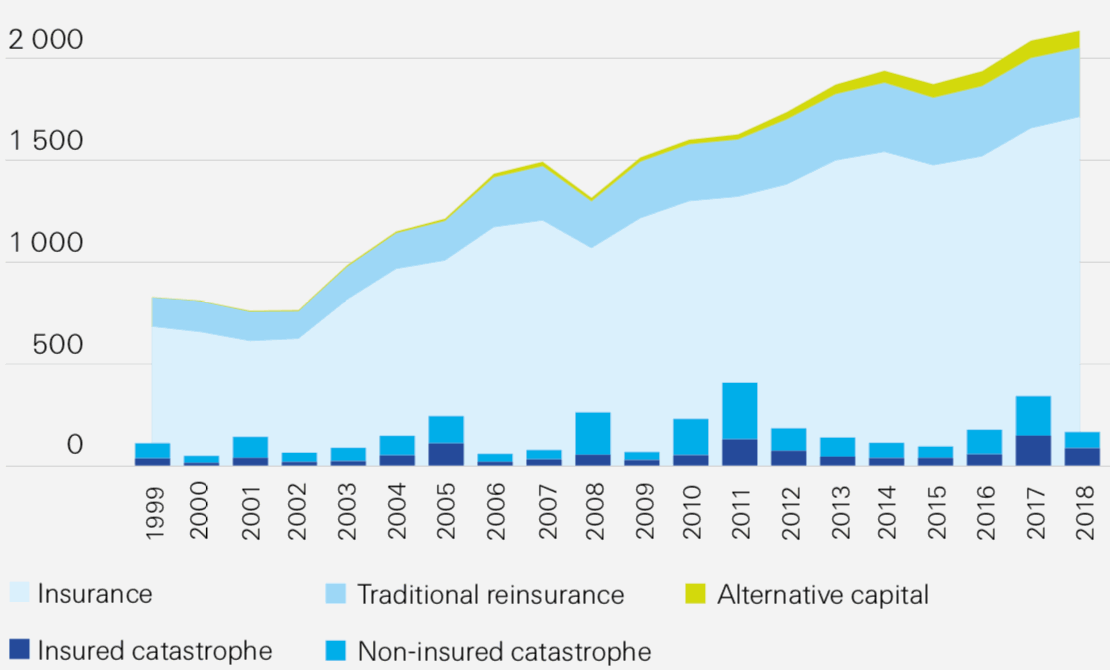

Alternative Capital Now 4 Of 2 Trillion Non Life Insurance Market Swiss re’s non life gross premium rose 2.7%. berkshire hathaway reported 24% growth in third party reinsurance premium to us$27.5 billion in 2023, up from us$22.1 billion in 2022. Market rebound reflects resilience of insurance industry swiss re institute estimates that global non life premiums will grow by 3.3% in 2021, 3.7% in 2022 and 3.3% in 2023. property catastrophe rates are forecast to improve in 2022 after a year of above average losses. casualty rates should also be stronger next year due to ongoing social. All was due to additional value creation for shareholders. the strong increase was largely a result of the interest r. te driven erosion of the book value of insurers’ equity. between january 2022 and june 2023, our composite global non life insurer book value fell by 19%, but the market capitalisa. Sept. 28, 2023 – as risk awareness and demand for re insurance is increasing, swiss re highlights the importance of improved underwriting data, enhanced modelling and rebalancing of the insurance value chain for a sustainable reinsurance market. swiss re remains committed to engaging with primary insurers to anticipate and manage risk, respond to catastrophic events and help them grow in an.

Non Life Reinsurance Market To See Continued Growth Swiss Re All was due to additional value creation for shareholders. the strong increase was largely a result of the interest r. te driven erosion of the book value of insurers’ equity. between january 2022 and june 2023, our composite global non life insurer book value fell by 19%, but the market capitalisa. Sept. 28, 2023 – as risk awareness and demand for re insurance is increasing, swiss re highlights the importance of improved underwriting data, enhanced modelling and rebalancing of the insurance value chain for a sustainable reinsurance market. swiss re remains committed to engaging with primary insurers to anticipate and manage risk, respond to catastrophic events and help them grow in an.

Comments are closed.