Non Life Re Insurance Growth Highlights Ils Influence And Opportunity

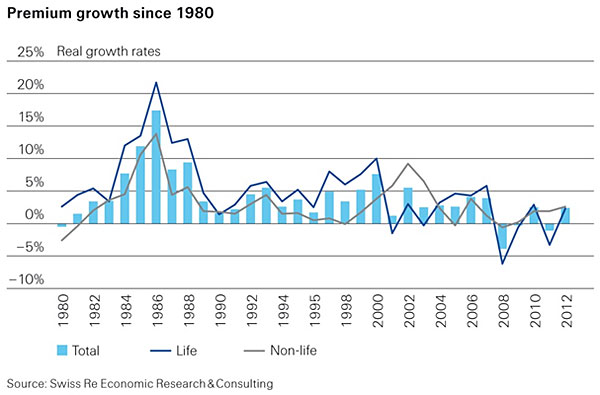

Non Life Re Insurance Growth Highlights Ils Influence And Opportunity Advanced non life markets, with the exception of oceania, which remained flat (0.1%), all recorded insurance and reinsurance premium growth in 2015, ranging from 4.1% in advanced asia, 3.2% in. Swiss re has revealed that the advanced markets of the world recorded solid non life insurance and reinsurance premium growth in 2015, while overall, the.

Non Life Insurance Premiums Set To Expand Ils Opportunities Will Fitch’s analysis shows munich re’s first half 2024 net reinsurance revenue at $20.6 billion—$14.2 billion for non life business and $6.4 billion, life. swiss re’s first half total revenue comes in at $17.2 billion—adding its $9.1 billion of non life premiums and $8.1 billion in life premiums for the period. varying results. 11 march 2024. rudy dcunha, global head of insurance services. following a remarkable performance in 2023, the insurance linked securities (“ils”) market continues to garner increased interest in the alternative capital sector. the surge in new capital raised in 2023 led to heavily oversubscribed and upsized issues, indicating robust market. Source: gallagher re. global reinsurance capital rose 5.4% in h1 2024, reaching $766 bn. since 2020, capital growth ( 14%) has lagged behind premium growth ( 21%) due to rising demand and inflationary pressures. the reinsurance capital of index companies, which account for 82% of total reinsurance capital, increased by 5.6% to $627 bn. This is also reflected in the fact that property re insurance — the line covering the largest part of natural catastrophes — has seen premium volume growth of 4.3% in primary insurance and 5.9.

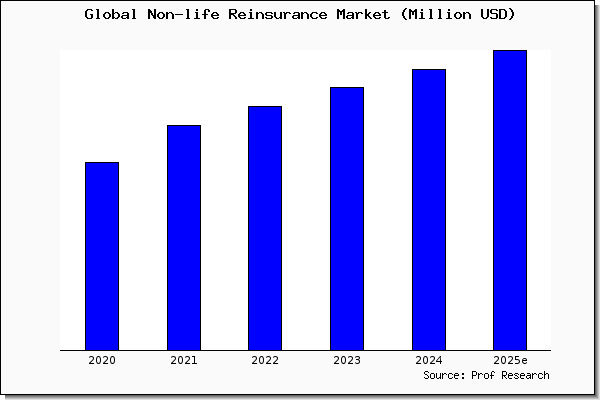

Non Life Reinsurance Market Size Share Trend And Forcarst To 2025 Source: gallagher re. global reinsurance capital rose 5.4% in h1 2024, reaching $766 bn. since 2020, capital growth ( 14%) has lagged behind premium growth ( 21%) due to rising demand and inflationary pressures. the reinsurance capital of index companies, which account for 82% of total reinsurance capital, increased by 5.6% to $627 bn. This is also reflected in the fact that property re insurance — the line covering the largest part of natural catastrophes — has seen premium volume growth of 4.3% in primary insurance and 5.9. Willis re: 7% growth in global reinsurance capital, with signs of underlying combined ratio improvement. 2021 04 12t09:13:00 01:00. total capital dedicated to the global reinsurance industry measured usd 658 billion at year end 2020 reflecting 7% year on year growth. the rise was driven primarily by strong investment market appreciation. It is the growth of these emerging market insurance premiums which will eventually present a huge opportunity to the insurance linked securities (ils), reinsurance convergence sectors and, of.

Comments are closed.