No Surprises Act Understanding Good Faith Estimates Patient Provider Dispute Resolution Reqs

No Surprises Act Understanding Good Faith Estimates Patient Provider A new patient provider dispute resolution (ppdr) process is available for uninsured (or self pay) individuals who get a bill from a provider that is substantially in excess of the expected charges on the good faith estimate. *enacted as part of the consolidated appropriations act, 2021 (pub. l. 116 260). Information for providers and facilities on the no surprises act requirements to provide good faith estimates to uninsured self pay patients, and information.

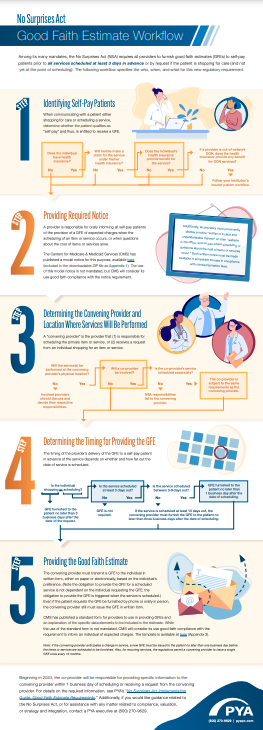

Infographic No Surprises Act Good Faith Estimates Workplan Pya Providers should complete this notice of payment settlement (pdf) (en español) (pdf), and send it and any supporting documents by encrypted email to [email protected]. get more information about the good faith estimate and the patient provider dispute resolution process. providers: what to expect when a patient starts payment. Consumers and consumer advocates. learn about rights and protections for consumers to end surprise bills and remove consumers from payment disagreements between their providers, health care facilities and health plans. policies & resourcesreview rules and fact sheets on what no surprises rules cover, and get additional resources with more. Building off of the latter requirement, the law also directed the secretary of the department of health and human services (hhs) to establish a patient provider dispute resolution (ppdr) process. under this process as implemented by hhs, if an uninsured or self pay individual receives a medical bill that is at least $400 more than the good. Final. issued by: centers for medicare & medicaid services (cms) issue date: march 18, 2022 disclaimer: the contents of this database lack the force and effect of law, except as authorized by law (including medicare advantage rate announcements and advance notices) or as specifically incorporated into a contract.

The No Surprises Act Guide For Providers Md Clarity Building off of the latter requirement, the law also directed the secretary of the department of health and human services (hhs) to establish a patient provider dispute resolution (ppdr) process. under this process as implemented by hhs, if an uninsured or self pay individual receives a medical bill that is at least $400 more than the good. Final. issued by: centers for medicare & medicaid services (cms) issue date: march 18, 2022 disclaimer: the contents of this database lack the force and effect of law, except as authorized by law (including medicare advantage rate announcements and advance notices) or as specifically incorporated into a contract. Step 1: identify no insurance or self pay patients. step 2: provide required notice. a physician or provider is responsible for informing all self pay patients of their right to a gfe of expected. Providers, facilities and air ambulance providers are also required to give uninsured (or self pay) individuals good faith estimates of expected charges for scheduled health care services, and may have to participate in a patient provider payment dispute resolution process if their billed charges are higher than the good faith estimates.

Good Faith Estimate No Surprises Act Template Step 1: identify no insurance or self pay patients. step 2: provide required notice. a physician or provider is responsible for informing all self pay patients of their right to a gfe of expected. Providers, facilities and air ambulance providers are also required to give uninsured (or self pay) individuals good faith estimates of expected charges for scheduled health care services, and may have to participate in a patient provider payment dispute resolution process if their billed charges are higher than the good faith estimates.

Comments are closed.