Nine Charts About Wealth Inequality In America Updated

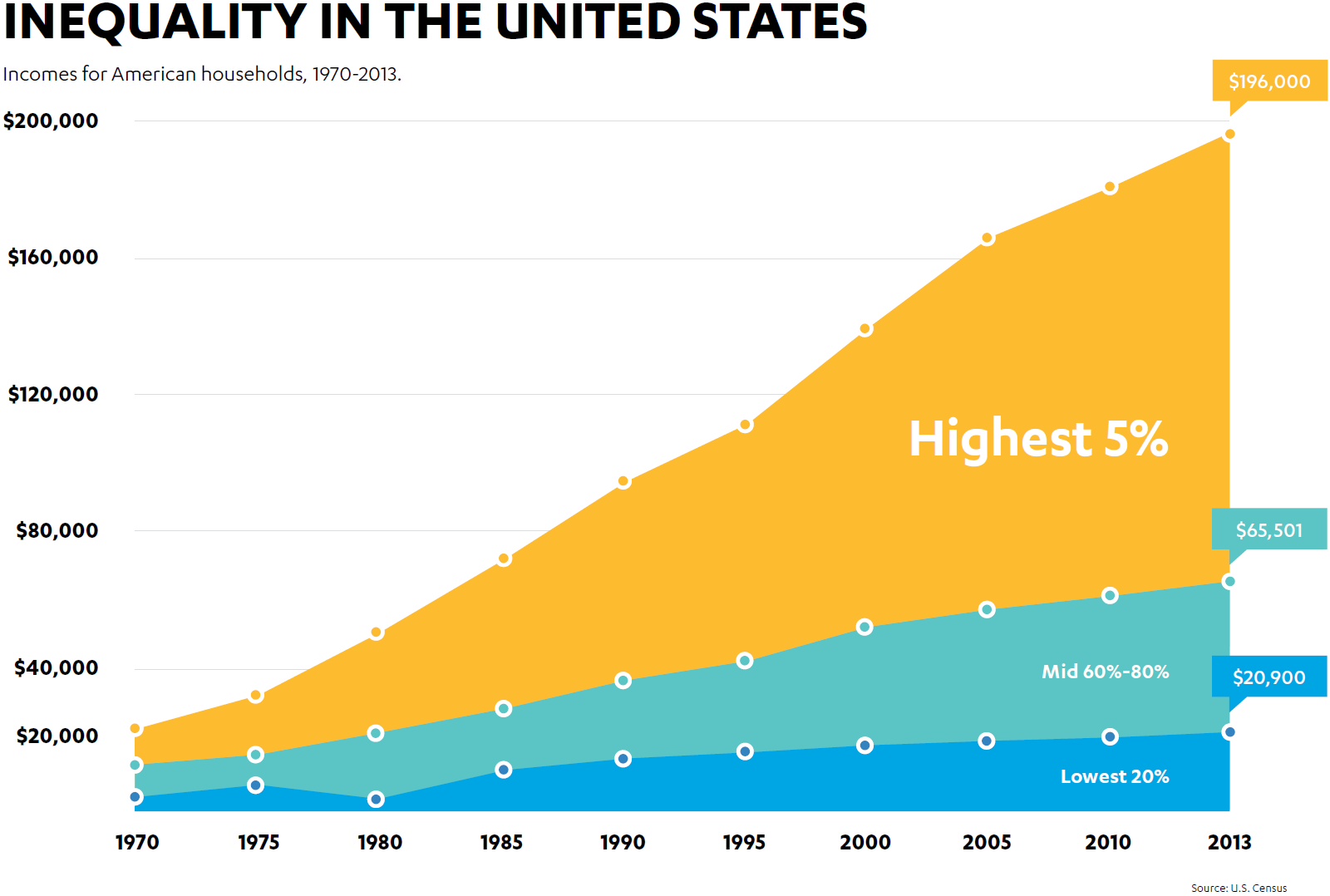

Nine Charts About Wealth Inequality In America Updated These nine charts illustrate how income inequality, earnings gaps, homeownership rates, retirement savings, student loan debt, and lopsided asset building subsidies have contributed to these growing wealth disparities. this story was updated with new data on october 5, 2017. this feature is out of date. Nine charts about wealth inequality in america. april 25, 2024. wealth inequality is higher in the united states than in almost any other developed country and has risen for much of the past 60 years. racial wealth inequities have persisted for generations, reflecting the long standing effects of racist policies, not individual intentions or.

Nine Charts About Wealth Inequality In America Updated Liquid retirement savings include dollars in accounts such as 401(k), 403(b), and iras. median liquid retirement savings for black and hispanic families were zero from 1989 to 2013. median liquid retirement savings for whites were zero through the mid 1990s, about $1,500 in 1998, and $10,000 in 2016. u r b a n i n s t i t u t e. Nine charts about wealth inequality in america. signe mary mckernan, caroline ratcliffe and c. eugene steuerle. march 27, 2015. editors’ note: this article is from npq ‘s new, spring 2015 edition, “inequality’s tipping point and the pivotal role of nonprofits,” and was originally published by the urban institute in february 2015. This repository is the source code for the 2024 update to the urban institute's '9 charts on wealth inequality' feature. development requirements node.js >= 18.0.0. And the wealth of those at the 99th percentile—in other words, those wealthier than 99 percent of all families—grew sevenfold. these changes have increased wealth inequality significantly. in 1963, families near the top had six times the wealth (or, $6 for every $1) of families in the middle. by 2016, they had 12 times the wealth of.

Nine Charts About Wealth Inequality In America Updated This repository is the source code for the 2024 update to the urban institute's '9 charts on wealth inequality' feature. development requirements node.js >= 18.0.0. And the wealth of those at the 99th percentile—in other words, those wealthier than 99 percent of all families—grew sevenfold. these changes have increased wealth inequality significantly. in 1963, families near the top had six times the wealth (or, $6 for every $1) of families in the middle. by 2016, they had 12 times the wealth of. By peter ciurczak net wealth is the difference of two values; that is, assets (the positive side of the ledger) minus liabilities, or debt (the negative side). while most of… contact boston indicators: (617) 338 1700 (617) 338 1700. This bar chart shows the average inflation adjusted wealth for black, hispanic and white households in the second quarter of 2024. black families had about $1 million less wealth, on average, compared with white families, while hispanic families had about $1.1 million less wealth, on average, than white families.

Nine Charts About Wealth Inequality In America Updated By peter ciurczak net wealth is the difference of two values; that is, assets (the positive side of the ledger) minus liabilities, or debt (the negative side). while most of… contact boston indicators: (617) 338 1700 (617) 338 1700. This bar chart shows the average inflation adjusted wealth for black, hispanic and white households in the second quarter of 2024. black families had about $1 million less wealth, on average, compared with white families, while hispanic families had about $1.1 million less wealth, on average, than white families.

Comments are closed.