Navigating The Ins And Outs Of Retirement Planning Ellis Bates

Navigating The Ins And Outs Of Retirement Planning Ellis Bates The past few decades have witnessed significant transformations in retirement planning. the security of a fixed income from a final salary pension is now a rarity, and eligibility for the…. Ellis bates ifa harrogate. clarendon house, victoria ave, harrogate, hg1 1jd tel: 01423 520 052. ellis bates ifa newcastle. the pearl suite 19, floor 2, new bridge st w, newcastle upon tyne, ne1 8aq tel: 0191 232 8391. ellis bates ifa london. 15 19 bloomsbury way, holborn, london, wc1a 2ba tel: 020 3011 5252. ellis bates ifa bristol. 40.

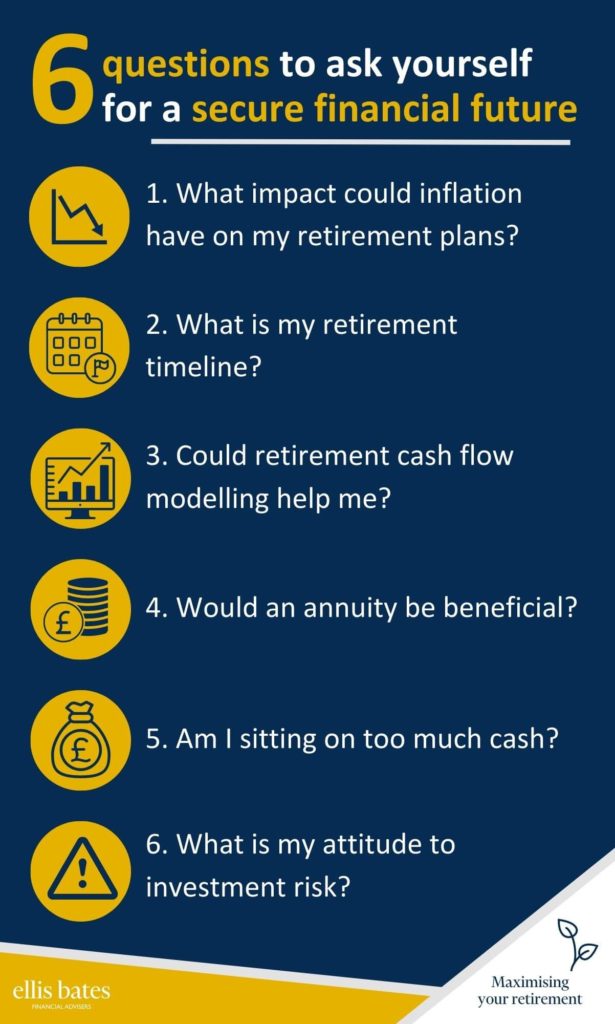

Planning For Retirement Ellis Bates Financial Advisers A retirement plan is one of the most influential benefits that an employer may offer. one question that employers may ask is “how can we help participants get the most out of our retirement plan?” first, they need to make it personal. employers can help participants understand their retirement goals considering their unique personal. Navigating the ins and outs of retirement planning requires a strategic approach, both when contributing to your retirement account and when it’s time to start making withdrawals. the landscape shifted with the enactment of the setting every community up for retirement enhancement (secure) 2.0 act in december 2022. First, take inflation into account when planning for retirement. when you have your long term income and spending projections (again, at least 30 years’ worth, ideally), have your spending rise by 2 3% per year. that is what historical inflation has averaged out to be over the past few decades. Learn how to combat some of the universal issues presented by retirement plan investments and the agreements, practice standards, and minutes associated with them. learn the ins and outs of retirement plan agreements, practice standards and minutes.

Retirement Planning Advice Ellis Bates Financial Advisers First, take inflation into account when planning for retirement. when you have your long term income and spending projections (again, at least 30 years’ worth, ideally), have your spending rise by 2 3% per year. that is what historical inflation has averaged out to be over the past few decades. Learn how to combat some of the universal issues presented by retirement plan investments and the agreements, practice standards, and minutes associated with them. learn the ins and outs of retirement plan agreements, practice standards and minutes. For tax year 2021, an individual can contribute up to $6,000, and if you’re 50 or older, you can contribute up to $7,000.00. you must also have “earned income” to contribute into a roth ira, which basically means your w 2 wages. (some exclusions of “earned income” are unemployment benefits, rental property income, and child support.). Ellis bates financial advisers are expert financial planners, specialising in pensions, investments, mortgages, life, health and critical illness insurances. since 1980, our experience has helped our clients to keep and grow their money, as well as make sensible financial decisions for their future. our advisers help our clients with their.

Comments are closed.