Navigating Open Banking Regulations And Psd2

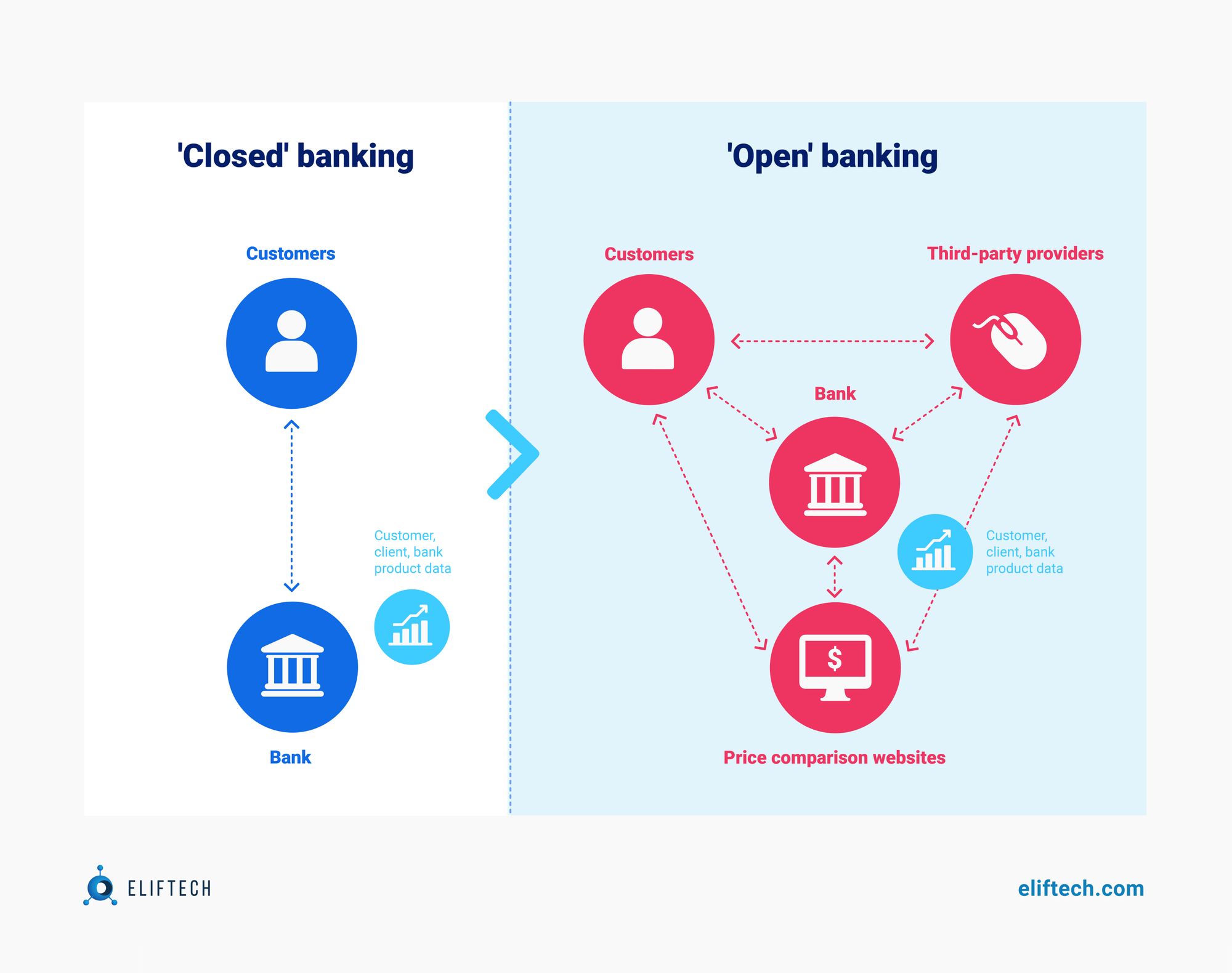

Navigating Open Banking Regulations And Psd2 Open banking regulations and psd2 around the world. in recent years, the finance industry has been exposed to major digitization. online banking, financial technology, and other services have created unprecedented opportunities for customer experience improvements. open banking is one of the most promising new chapters in fintech. It is clear in psd2 that data holders must be compliant with gdpr and all national data protection laws (article 94). this means that financial institutions must follow gdpr when processing open banking transactions, including gaining “explicit consent” from the consumer (article 9) and taking responsibility if the data falls into the wrong.

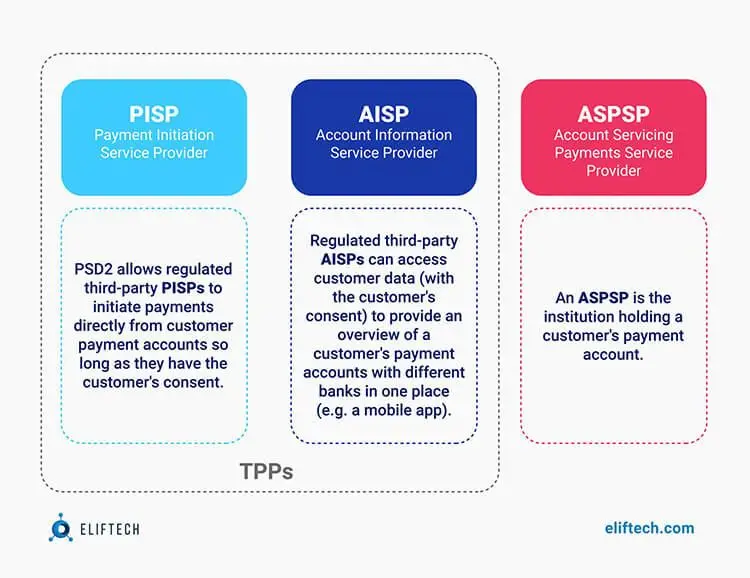

Navigating Open Banking Regulations And Psd2 On october 22, 2024, the consumer financial protection bureau (cfpb) finalized its long anticipated “personal financial data rights” rule (and executive summary) – more commonly known as the “open banking” rule – under section 1033 of the dodd frank act. this landmark regulation aims to empower consumers by granting them greater. The second payment services directive (psd2) is part of a global trend in bank regulation emphasizing security, innovation, and market competition. by requiring banks to provide other qualified payment service providers (psps) connectivity to access customer account data and to initiate payments, psd2 represents a significant step toward commoditization in the eu banking sector. Regulations play a critical role in shaping the landscape of open banking, ensuring the security, privacy, and compliance of financial data shared among institutions and third party providers. the general data protection regulation (gdpr) in the european union mandates strict guidelines on the processing and protection of personal data. The cfpb held a symposium in february 2020 to further consider whether open banking or similar regulations may be warranted. it recently announced that it plans to issue an advance notice of proposed rulemaking on this topic later this year, which may ultimately lead to the adoption of open banking regulations in the united states.

Navigating Open Banking Regulations And Psd2 Regulations play a critical role in shaping the landscape of open banking, ensuring the security, privacy, and compliance of financial data shared among institutions and third party providers. the general data protection regulation (gdpr) in the european union mandates strict guidelines on the processing and protection of personal data. The cfpb held a symposium in february 2020 to further consider whether open banking or similar regulations may be warranted. it recently announced that it plans to issue an advance notice of proposed rulemaking on this topic later this year, which may ultimately lead to the adoption of open banking regulations in the united states. Wired explains. open banking (aka psd2) forces the biggest uk banks to open up their precious data, which could mean big changes for the way we use money. our need to know open banking guide. The directive requires that all member states implement these rules as national law by 13 january 2018, with the exception of certain rules around strong customer authentication and secure communication, implementation of which will run to a different timetable. psd2 is a significant evolution of existing regulation for the payments industry.

Explained What Is Open Banking And Psd2 Wired explains. open banking (aka psd2) forces the biggest uk banks to open up their precious data, which could mean big changes for the way we use money. our need to know open banking guide. The directive requires that all member states implement these rules as national law by 13 january 2018, with the exception of certain rules around strong customer authentication and secure communication, implementation of which will run to a different timetable. psd2 is a significant evolution of existing regulation for the payments industry.

Open Banking Apis Psd2 Govinfosecurity

The Ultimate Guide To Open Banking And Psd2 Smartbear

Comments are closed.