Namibia Tax Reference And Rate Card 2023 Namibia Tax Reference And

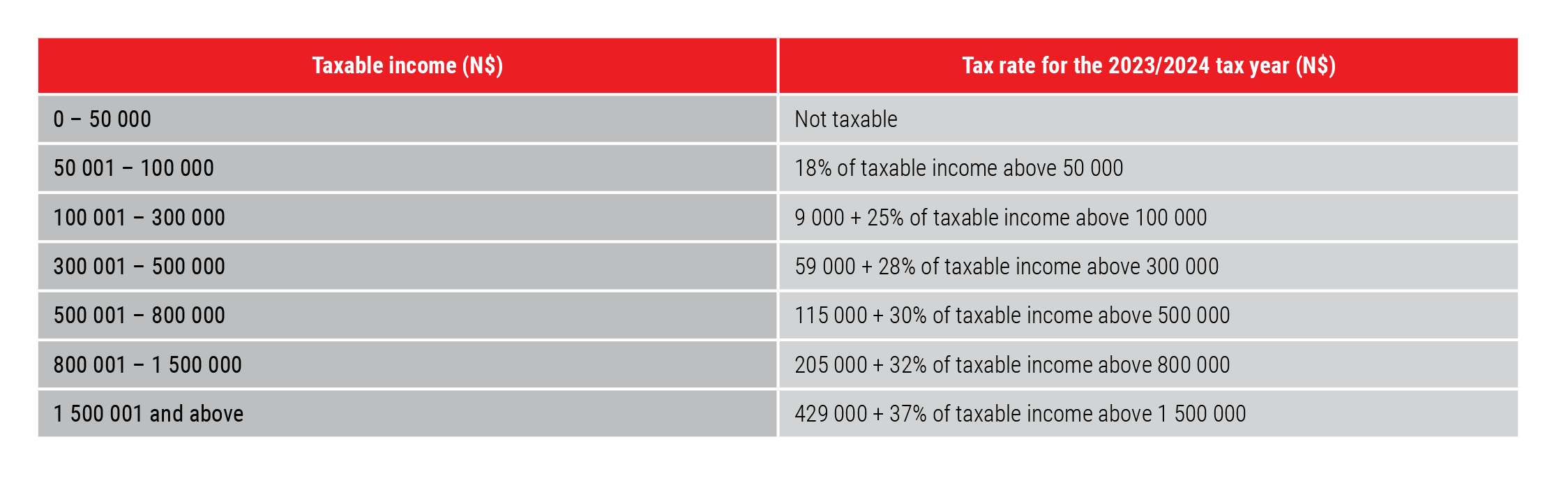

Namibia Tax Reference And Rate Card 2023 Namibia Tax Reference And Normal tax is levied on taxable income of companies, trusts and individuals from sources within or deemed to be within namibia. individual income tax all individuals (incl. deceased estates and trusts) other than companies. taxable income n$ rates of tax from years of assessment ending 2022 23 (n$) 0 50 000 not taxable. Associate director, pwc namibia. tel: 264 61 284 1035. our namibia tax rate and reference card is up to date and serves as a guideline and a quick reference for taxes and tax compliance in namibia.

Namibian Tax Table Compass Employee Management Solutions Windhoek The taxable value in respect of a loan granted by an employer is determined in relation to the official rate of interest which is currently 12%. the taxable benefit will be: where no interest is payable, 1% per month on the outstanding balance of the loan. where interest is payable, 1% per month less nominal monthly interest paid by the. 37%. income from n$ 1,500,000.01. and above. namibia non residents income tax tables in 2023. personal income tax rates and thresholds (annual) tax rate. taxable income threshold. 0%. income from n$ 0.000.00. Individual residence. last reviewed 28 june 2024. the namibian tax system is based on source and not on residency. income derived or deemed to be derived from sources within namibia is subject to tax. the source is determined as the place where income originates or is earned, not the place of payment. if goods are sold pursuant to a. Nrst is payable at the standard rate of 10% where a company holds more than 25% shares in the namibian company. in all other cases, nrst payable is 20%. the rate of nrst may be reduced if a dta is in place with namibia. nrst is payable within 20 days following the month in which the dividends were declared.

Namibian Tax Tables 2024 Pdf Moira Bridget Individual residence. last reviewed 28 june 2024. the namibian tax system is based on source and not on residency. income derived or deemed to be derived from sources within namibia is subject to tax. the source is determined as the place where income originates or is earned, not the place of payment. if goods are sold pursuant to a. Nrst is payable at the standard rate of 10% where a company holds more than 25% shares in the namibian company. in all other cases, nrst payable is 20%. the rate of nrst may be reduced if a dta is in place with namibia. nrst is payable within 20 days following the month in which the dividends were declared. The namibia revenue agency (namra) is the nation’s tax collecting authority. established in terms of the namibia revenue agency act 12 of 2017 as an autonomous agency, we are responsible for administering the namibian tax laws and customs and excise services. our outcomes are: increase public trust and credibility. During the 2023 2024 annual budget speech, the minister of finance communicated that there will be tax relief for individuals in the 50,000 to 100,000 namibian dollars (nad) tax bracket. this will mean that individuals earning less than nad 100,000 per annum would not be subject to tax. this will be effective in fiscal year (fy) 2024 25.

Comments are closed.