My 3 Biggest Monthly Expenses In Retirement

How To Plan For The Top 3 Expenses In Retirement 1. housing. housing is most retirees' largest expense. out of the $49,952 the average household headed by an adult 65 or older spends each year, $16,668 of that goes toward housing, according to. Plan ahead for inflation. budgeting ahead of retirement will help reduce stress later in life. you'll find that some expenses can be reduced or eliminated, while others may even increase as you.

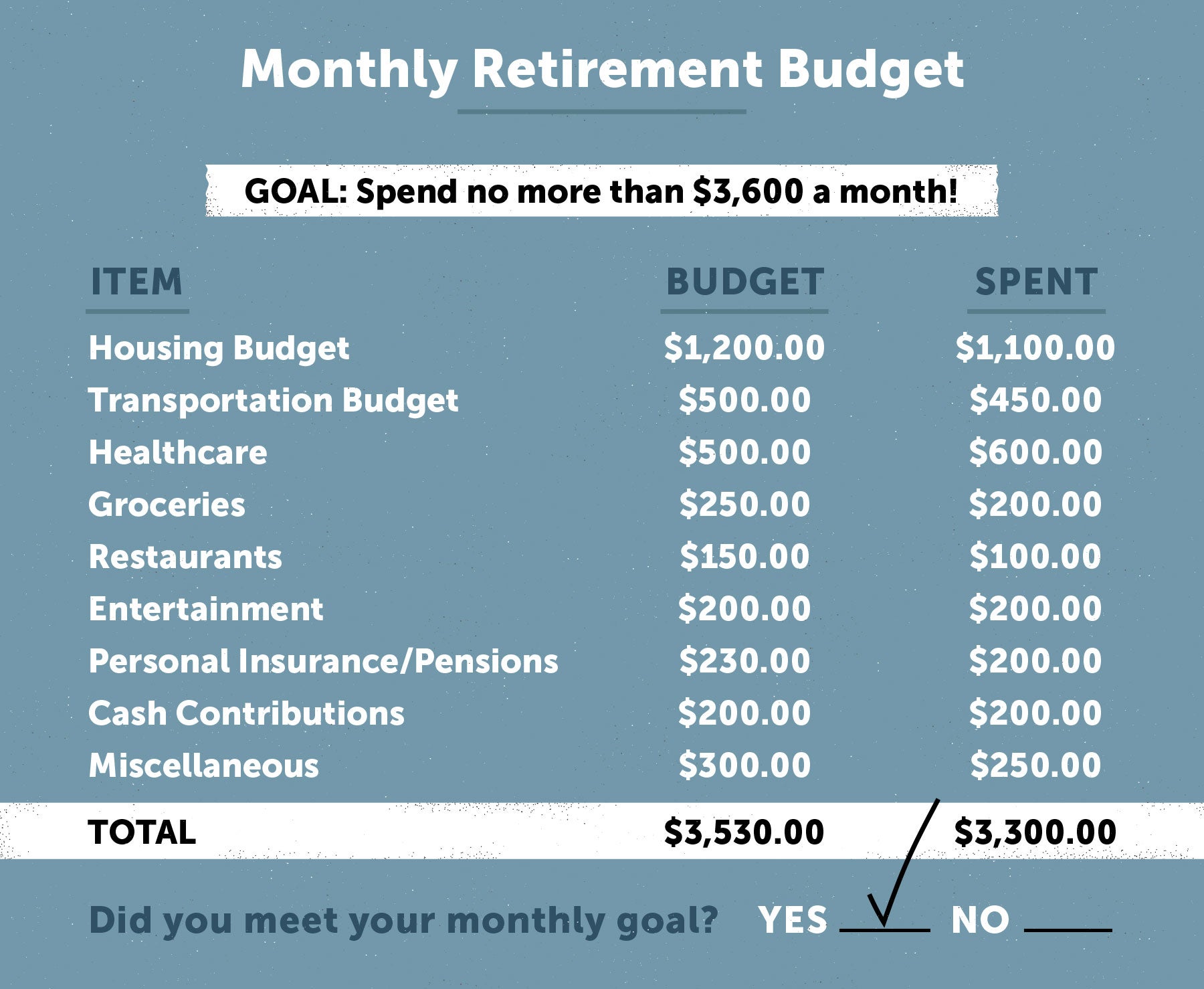

Top 3 Retirement Expenses Infographic Blackrock Budgeting Fidelity estimates that on average a 65 year old retired couple needs $300,000 to spend on health care over the course of retirement 3. for planning purposes, you may want to factor in an even higher number, because many people experience above average expenses—often due to chronic illnesses, longevity, or long term care costs. People ages 65 and older had an average income of $55,335 in 2021. average annual expenses for people ages 65 and older totaled $52,141 in 2021. 48% of retirees surveyed reported spending less than $2,000 a month in 2022. 1 in 3 retirees reported spending between $2,000 and $3,999 per month. 18% reported spending more than $3,999 per month. Jan 2. written by vision retirement. the most recent bureau of labor statistics (bls) data claims retiree households (led by someone age 65 or older) spent $57,818 in 2022, a figure 10.9% higher than the previous year. by comparison, average spending across all u.s. households rang in at $72,967—a year over year increase of 9%. To gauge the accuracy of your forecasted budget, you may want to track your expenses for a few months to check whether your estimates are aligned with your actual expenses. it’s also important to realize that your retirement budget will change based on when you plan to retire: if you retire early, say at age 63, you may need a bigger nest egg.

Retirement Planning Guide For Seniors Lexington Law Jan 2. written by vision retirement. the most recent bureau of labor statistics (bls) data claims retiree households (led by someone age 65 or older) spent $57,818 in 2022, a figure 10.9% higher than the previous year. by comparison, average spending across all u.s. households rang in at $72,967—a year over year increase of 9%. To gauge the accuracy of your forecasted budget, you may want to track your expenses for a few months to check whether your estimates are aligned with your actual expenses. it’s also important to realize that your retirement budget will change based on when you plan to retire: if you retire early, say at age 63, you may need a bigger nest egg. Use lined paper or a computer spreadsheet program to account for the timing of expenses. list the months, january through december, across the top in separate columns. down the left side of the spreadsheet, list each expense on a separate line. if your utility bill runs an average of $200 a month, put $200 in each monthly column. 1. estimating your retirement expenses can help you gauge the nest egg you’ll need. 2. start with the basics but plan for nice to haves and big potential costs like long term care. 3. don’t forget inflation, local living costs and taxes, and income you expect outside your savings. no matter where you are on the road to retirement, getting.

Comments are closed.