Mutual Funds Vs Etfs Which Is Right For You

Etf Vs Mutual Fund What S The Difference Ramsey While mutual funds and etfs are different, both can offer exposure to a diversified basket of securities, and can be good vehicles to help meet investor objectives. it is important for investors to pick the best choice for their specific investing needs, whether an etf, an open ended mutual fund, or a combination of both. At vanguard, we offer more than 80 etfs and 160 mutual funds. both are overseen by professional portfolio managers. etfs and mutual funds are managed by experts. those experts choose and monitor the stocks or bonds the funds invest in, saving you time and effort. although most etfs—and many mutual funds—are index funds, the portfolio.

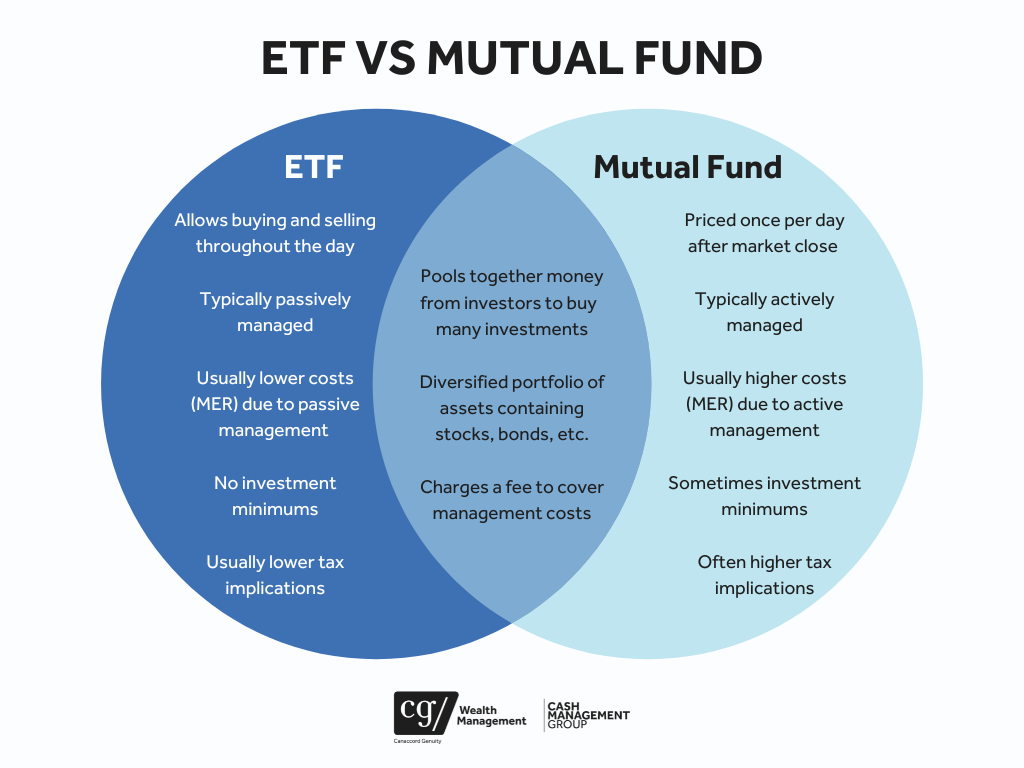

Etfs Vs Mutual Funds Which Is Right For You Cg Cash Management Group This is part of the reason why the average etf costs half as much as the average mutual fund (0.50% vs 1.01%). if you’re comparing an etf and a mutual fund that track the same index, the fee. So mutual funds are quite a bit more expensive than etfs, comparing their respective averages. for example, in 2022 an average mutual fund (asset weighted) would cost 0.44 percent of your assets. Etf vs. mutual fund. the main difference between etfs and mutual funds is an etf's price is based on the market price, and is sold only in full shares. mutual funds, however, are sold based on. Mutual funds’ and etfs’ annual fees, known as expense ratios, are quoted as a percentage of your total investment. you don’t pay the fee directly, but it’s reflected in the fund’s annual.

Etf Vs Mutual Fund Which Investment Is Right For You Dividend Power Etf vs. mutual fund. the main difference between etfs and mutual funds is an etf's price is based on the market price, and is sold only in full shares. mutual funds, however, are sold based on. Mutual funds’ and etfs’ annual fees, known as expense ratios, are quoted as a percentage of your total investment. you don’t pay the fee directly, but it’s reflected in the fund’s annual. Differences between mutual funds and etfs. etfs have lower investment minimums. in general, etfs have lower investment minimums than mutual funds. for beginner investors, the lower minimum can. Mutual funds are usually actively managed. index funds are passively managed and have become more popular. etfs are usually passively managed and track a market index or sector sub index. etfs can.

Etf Vs Mutual Fund Similarities And Differences The Motley Fool Differences between mutual funds and etfs. etfs have lower investment minimums. in general, etfs have lower investment minimums than mutual funds. for beginner investors, the lower minimum can. Mutual funds are usually actively managed. index funds are passively managed and have become more popular. etfs are usually passively managed and track a market index or sector sub index. etfs can.

Etf Vs Mutual Fund Which One Is Right For You

Comments are closed.