Mortgage Rates Soar To 3 Year High Following First Fed Interest Rate Hike

Mortgage Rates Soar To 3 Year High Following First Fed Interest Rate Hike Yahoo finance's gabriella cruz martinez discusses the 30 year mortgage rate hitting 4.42%, the highest level in three years, and what it means for homebuyers. #mortgages #interestrates #fedratehikeyahoo finance's gabriella cruz martinez discusses the 30 year mortgage rate hitting 4.42%, the highest level in three y.

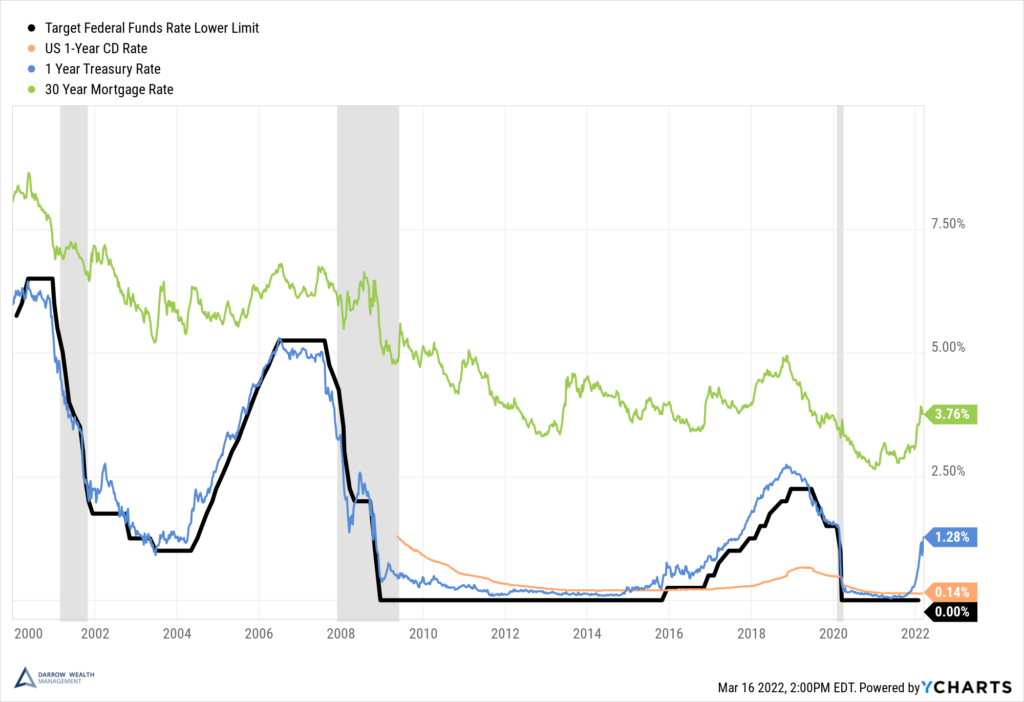

Mortgage Rates Soar To 3 Year High Following First Fed Interest Rate In 2019, for example, rates for a 30 year fixed rate mortgage ranged from about 3.75% to 4.5%. and they dropped to as low as 2.65% in early 2021 as the pandemic wore on. many forecasts have rates. The fed slashed rates to near zero in march 2020 in response to the sudden economic shocks covid 19 lockdowns. it then hiked rates in 2022 and 2023 to a two decade high of over 5% in response to. In a bid to kill high inflation, the fed hiked its interest rates from the 0% to 0.5% range (where it sat from march 2020 to march 2022) to a two decade high of 5.25% to 5.5% by last july, and. The average rate for a new 30 year mortgage is nearly 7.1%, according to mortgage giant freddie mac. but goldberg calculates that the average rate on all outstanding mortgages is just 3.8%, not much higher than 3.3% when the fed began to hike rates. the gap between new rates and the average outstanding is the highest since the 1980s.

The Fed Rate Hike Impact On Mortgage Rates Business Insider In a bid to kill high inflation, the fed hiked its interest rates from the 0% to 0.5% range (where it sat from march 2020 to march 2022) to a two decade high of 5.25% to 5.5% by last july, and. The average rate for a new 30 year mortgage is nearly 7.1%, according to mortgage giant freddie mac. but goldberg calculates that the average rate on all outstanding mortgages is just 3.8%, not much higher than 3.3% when the fed began to hike rates. the gap between new rates and the average outstanding is the highest since the 1980s. According to freddie mac, 30 year fixed mortgage rates have been remarkably low these past two years specifically, floating between 2.5% and 3.5% between 2020 and early 2022. The federal reserve hiked the fed funds rate by another 75 basis points in november to fight inflation. following those meetings, the average 30 year frm rose 55 basis points (0.55%), fell 24.

Does The Fed Funds Rate Affect Mortgage Rates And Interest On Cash Savings According to freddie mac, 30 year fixed mortgage rates have been remarkably low these past two years specifically, floating between 2.5% and 3.5% between 2020 and early 2022. The federal reserve hiked the fed funds rate by another 75 basis points in november to fight inflation. following those meetings, the average 30 year frm rose 55 basis points (0.55%), fell 24.

Comments are closed.