Mortgage Loan Estimate The List Of Things One Should Know

Mortgage Loan Estimate The List Of Things One Should Know The bottom line: loan estimates provide valuable information. the loan estimate covers the key details of a loan, such as loan terms, projected payments, closing costs and estimated cash to close. it gives borrowers a clear picture of a mortgage loan’s costs and terms, empowering them to compare lender offers and choose the best financing. The loan estimate lists everything you need to know about a mortgage. it includes things like the interest rate, upfront loan costs, and monthly payments, as well as a breakdown of your closing costs.

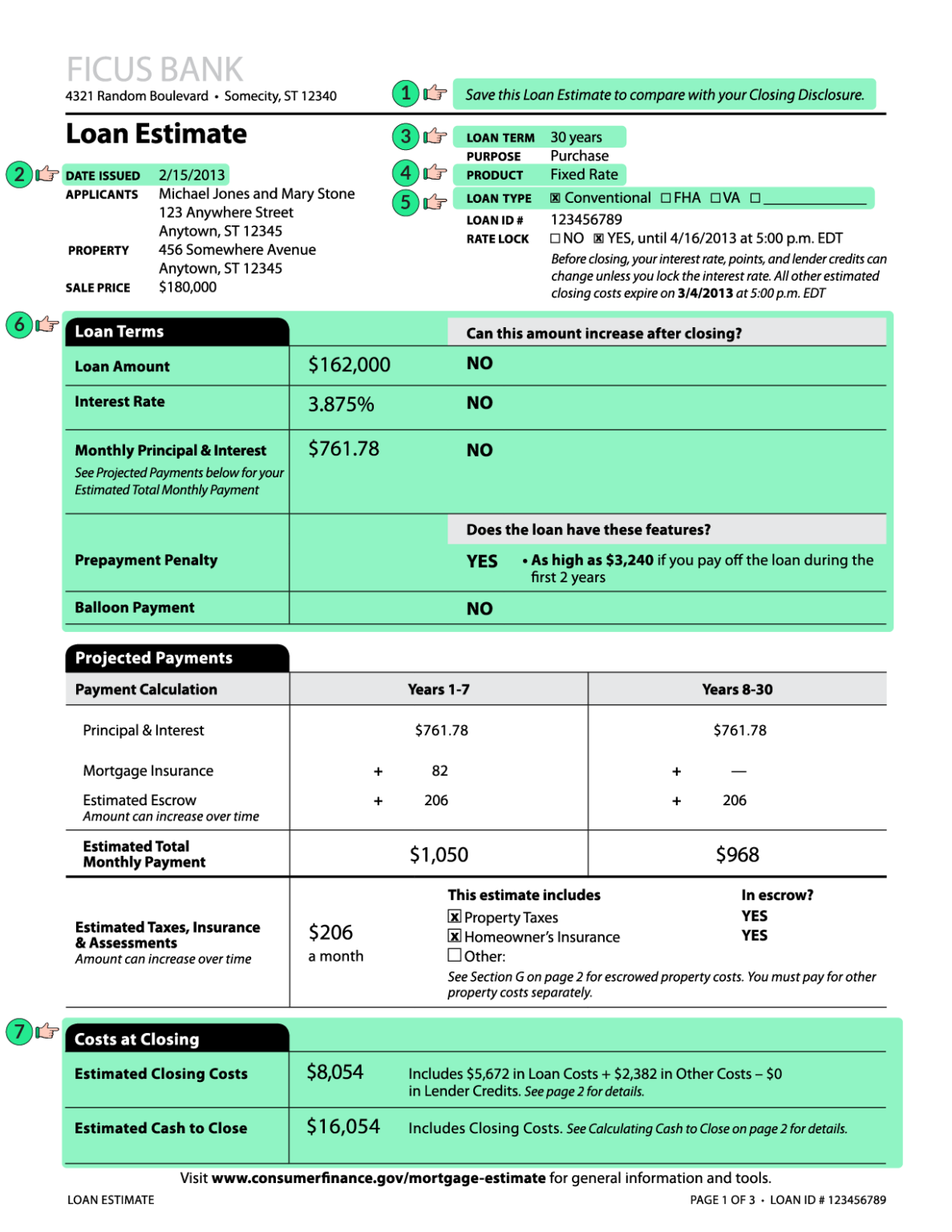

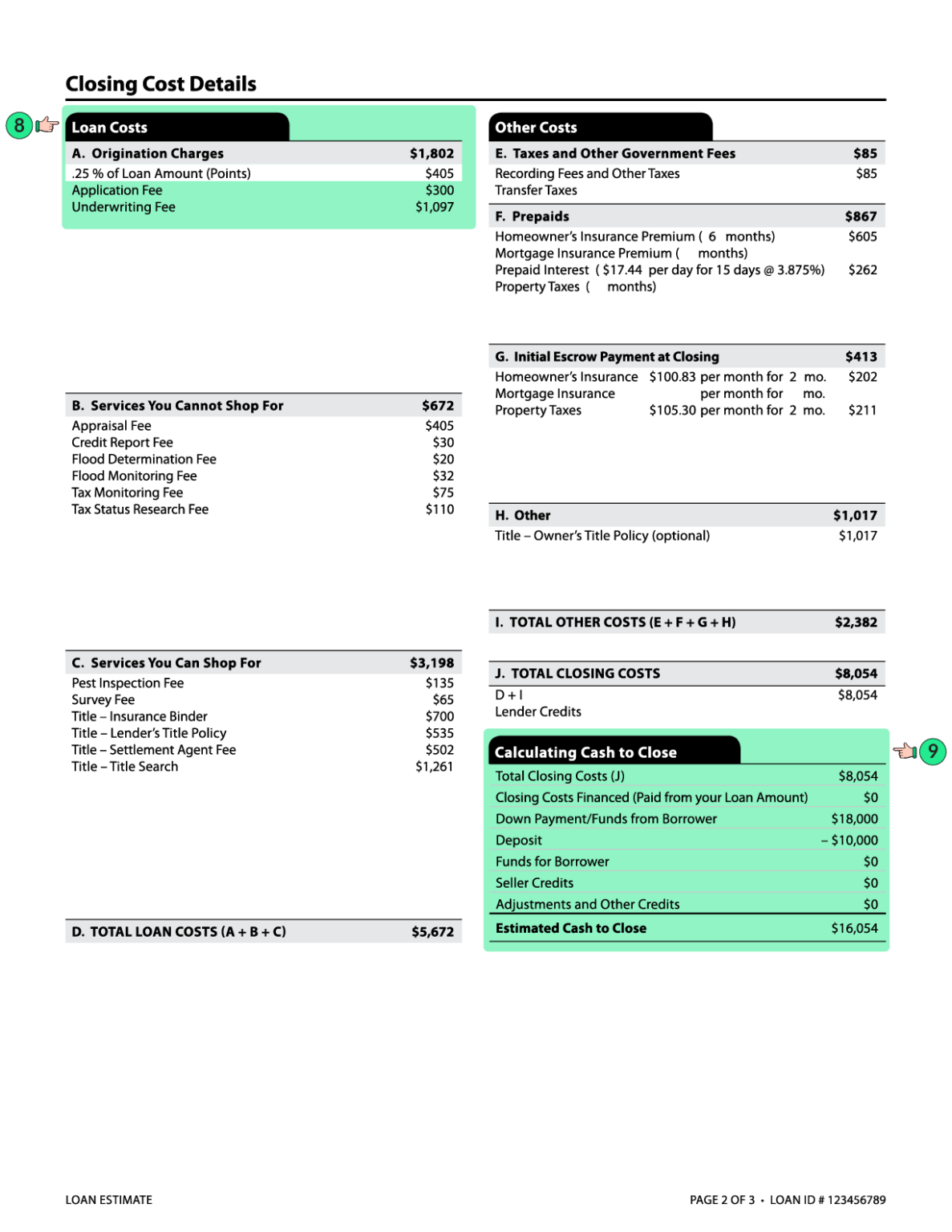

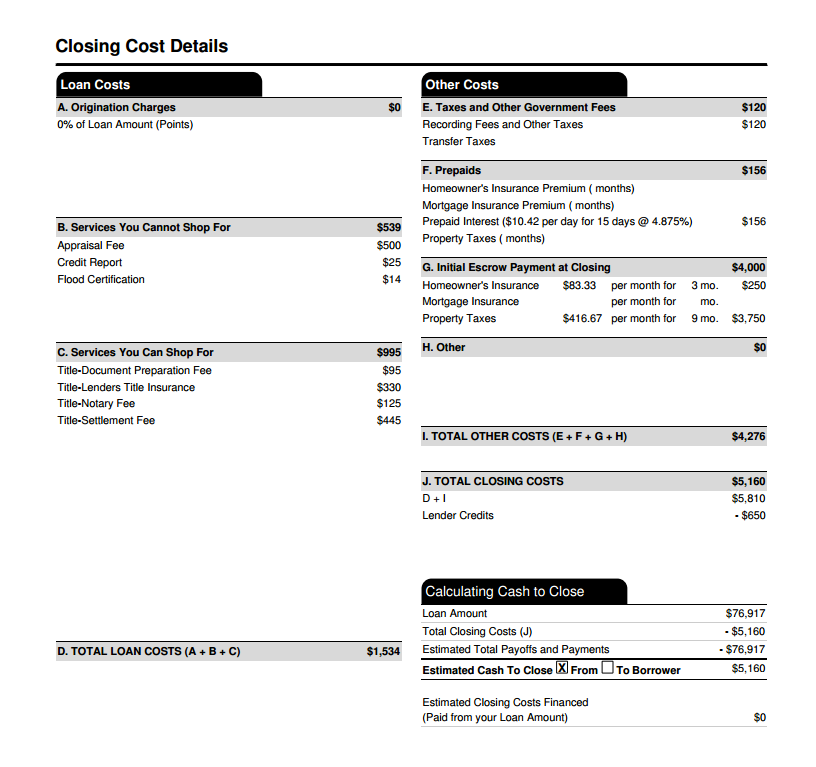

What Is A Loan Estimate How To Read And What To Look For Example: what items appear on a loan estimate. the loan estimate contains three pages of information about your loan. below is a loan estimate example highlighting the 11 most important details to review. page 1 of the loan estimate. 1. “save this loan estimate to compare to your closing disclosure.”. A loan estimate is a three page government mandated document that spells out the terms of a mortgage offer. to get a loan estimate you must provide a lender your name, income amount and social. A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. Loan amount. interest rate. monthly principal and interest. if there is a prepayment penalty. if there is a balloon payment. 2. projected payments. this section underscores how much you can expect.

What Is A Loan Estimate How To Read And What To Look For A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. Loan amount. interest rate. monthly principal and interest. if there is a prepayment penalty. if there is a balloon payment. 2. projected payments. this section underscores how much you can expect. Loan information. the loan estimate will detail the loan total amount, the interest rate you’ll pay each month for borrowing money and the loan term, which is the total length of the loan. for example, it may state that you’re applying for a $350,000 mortgage loan with a fixed interest rate of 6.5% for a 30 year term. An interest rate on your loan estimate is not a guarantee. some lenders may lock your rate as part of issuing a loan estimate but others may not. if you choose to move forward with the loan and lender, you must convey your intent to proceed. what should i look for? use our loan estimate explainer to understand and double check important details.

Loan Estimate Explained Mortgage Pro Loan information. the loan estimate will detail the loan total amount, the interest rate you’ll pay each month for borrowing money and the loan term, which is the total length of the loan. for example, it may state that you’re applying for a $350,000 mortgage loan with a fixed interest rate of 6.5% for a 30 year term. An interest rate on your loan estimate is not a guarantee. some lenders may lock your rate as part of issuing a loan estimate but others may not. if you choose to move forward with the loan and lender, you must convey your intent to proceed. what should i look for? use our loan estimate explainer to understand and double check important details.

How To Compare Mortgage Loan Estimates Bankrate 2023

A Quick Guide To Your Loan Estimate Better Mortgage

Comments are closed.