Mortgage Co Signer Risks Responsibilities Allen Ehlert Mortgage

Mortgage Co Signer Risks Responsibilities Allen Ehlert Mortgage In ontario, canada, the obligations to pay when a mortgage payment is missed differ between a guarantor and a co signer. understanding the differences between these roles can help clarify the responsibilities involved in guaranteeing or co signing a mortgage. guarantor. a guarantor is someone who agrees to pay the mortgage if the borrower. The co signer’s credit score and income can help strengthen the primary borrower’s loan application, increasing the chances of mortgage approval. co signing can be beneficial if one person in the relationship has a lower credit score or limited income, but it’s important to fully understand the legal obligations and potential risks involved.

Mortgage Cosigner Risks Ppt Powerpoint Presentation Visual Aids 1. seek a co signer or co buyer. one option to address the appraisal shortfall is to seek a co signer or co buyer who can help cover the difference. a co signer is an individual who signs the mortgage contract alongside you, taking on shared responsibility for the loan. their financial strength and creditworthiness can enhance your overall. As far as responsibilities, you're 100% responsible for the complete repayment of the loan. before you cosign, ensure you're comfortable covering the mortgage payments if the primary borrower can't. what is the difference between a cosigner and co borrower on a mortgage loan? "cosigner" and "co borrower" are two terms that describe a person who. Co signing a mortgage is a significant financial decision that requires a comprehensive understanding of the responsibilities and risks involved. it is a legal agreement where a person pledges to pay back a loan on behalf of the primary borrower if they fail to make payments. There are clear benefits of co signing, but most of them are for the primary borrower. helps build their credit when all payments are made on time. helps them qualify for a loan when they couldn’t on their own. build equity in a home, which can be shared by the co signer if later sold. make sure the benefits outweigh the risks if you are.

The Responsibilities Of Becoming A Mortgage Co Signer Co signing a mortgage is a significant financial decision that requires a comprehensive understanding of the responsibilities and risks involved. it is a legal agreement where a person pledges to pay back a loan on behalf of the primary borrower if they fail to make payments. There are clear benefits of co signing, but most of them are for the primary borrower. helps build their credit when all payments are made on time. helps them qualify for a loan when they couldn’t on their own. build equity in a home, which can be shared by the co signer if later sold. make sure the benefits outweigh the risks if you are. Co signer responsibilities. as a mortgage co signer, you: have no ownership in the property. have income, assets, liabilities, and credit history reviewed during the application process. are listed on the mortgage documents, but not the title. are required to sign loan documents. are liable for repaying the obligation if the primary borrower. In a nutshell, when you co sign a mortgage, it means if they can’t pay their monthly dues, the lender will expect you to cough up the cash instead. it’s a noble idea, helping someone buy a.

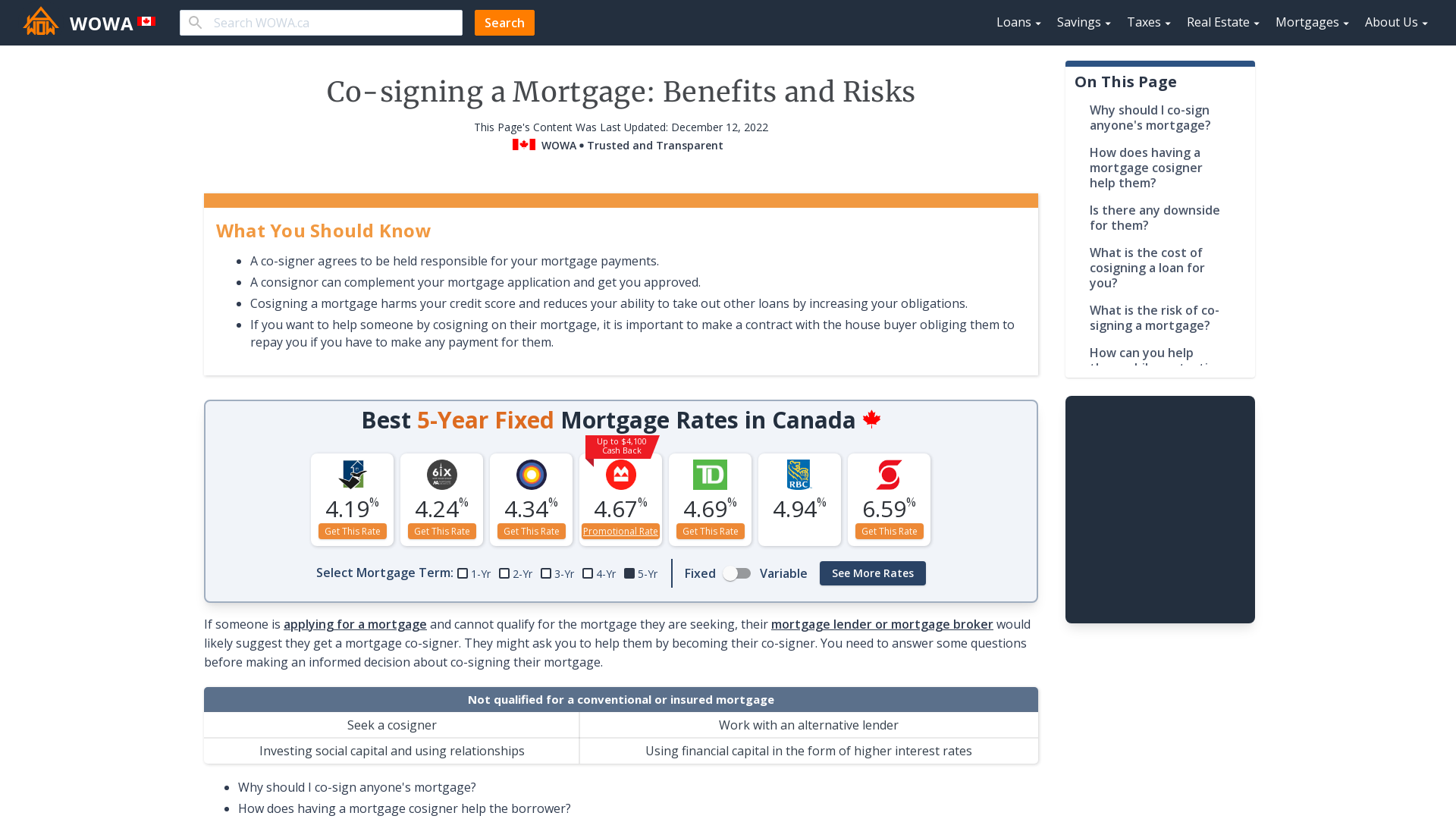

Co Signing A Mortgage Benefits And Risks Wowa Ca Co signer responsibilities. as a mortgage co signer, you: have no ownership in the property. have income, assets, liabilities, and credit history reviewed during the application process. are listed on the mortgage documents, but not the title. are required to sign loan documents. are liable for repaying the obligation if the primary borrower. In a nutshell, when you co sign a mortgage, it means if they can’t pay their monthly dues, the lender will expect you to cough up the cash instead. it’s a noble idea, helping someone buy a.

Risks Cosigning Mortgage In Powerpoint And Google Slides Cpb

Mortgage Co Borrower Vs Co Signer Auto Lending

Comments are closed.