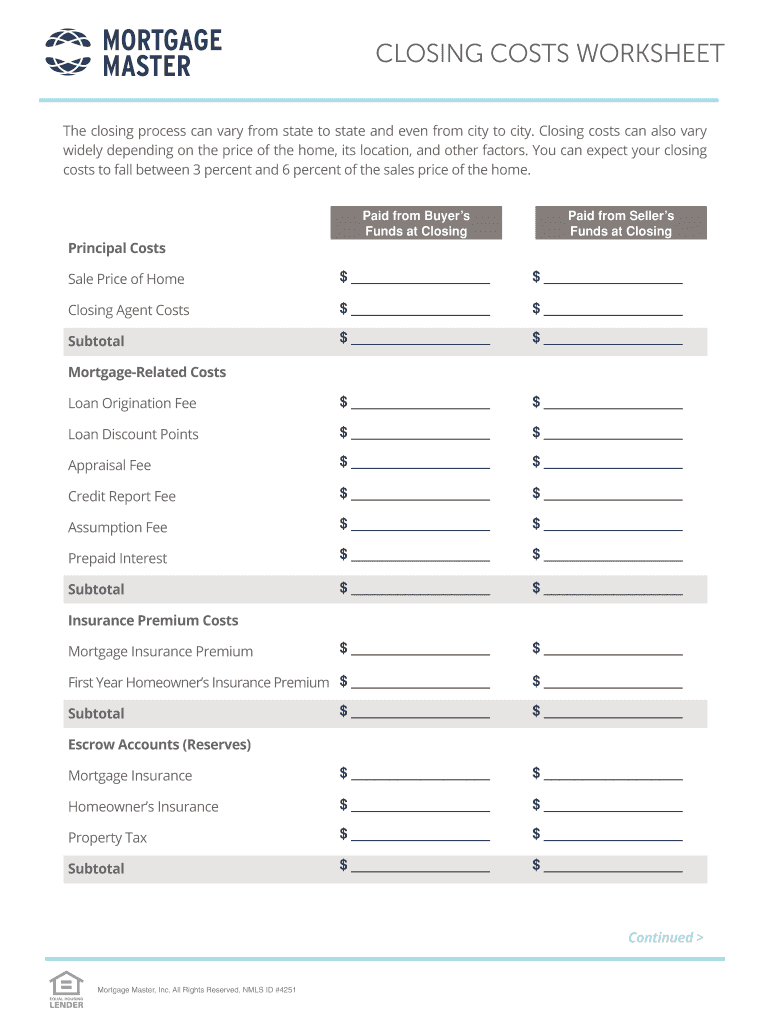

Mortgage Closing Cost Estimate Worksheet

Closing Costs Worksheet 2020 Fill And Sign Printable Template Online Closing costs usually range from 2% to 5% of the value of your mortgage and are paid in addition to your down payment. state. county. home purchase price $. please enter a valid amount between $10,000 and $5,000,000. down payment. $. %. total loan amount $ purchase price down payment = total loan amount. The best guess most estimates will give you is that closing costs are typically between 2% and 5% of the home value. true enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 – that’s a huge range!.

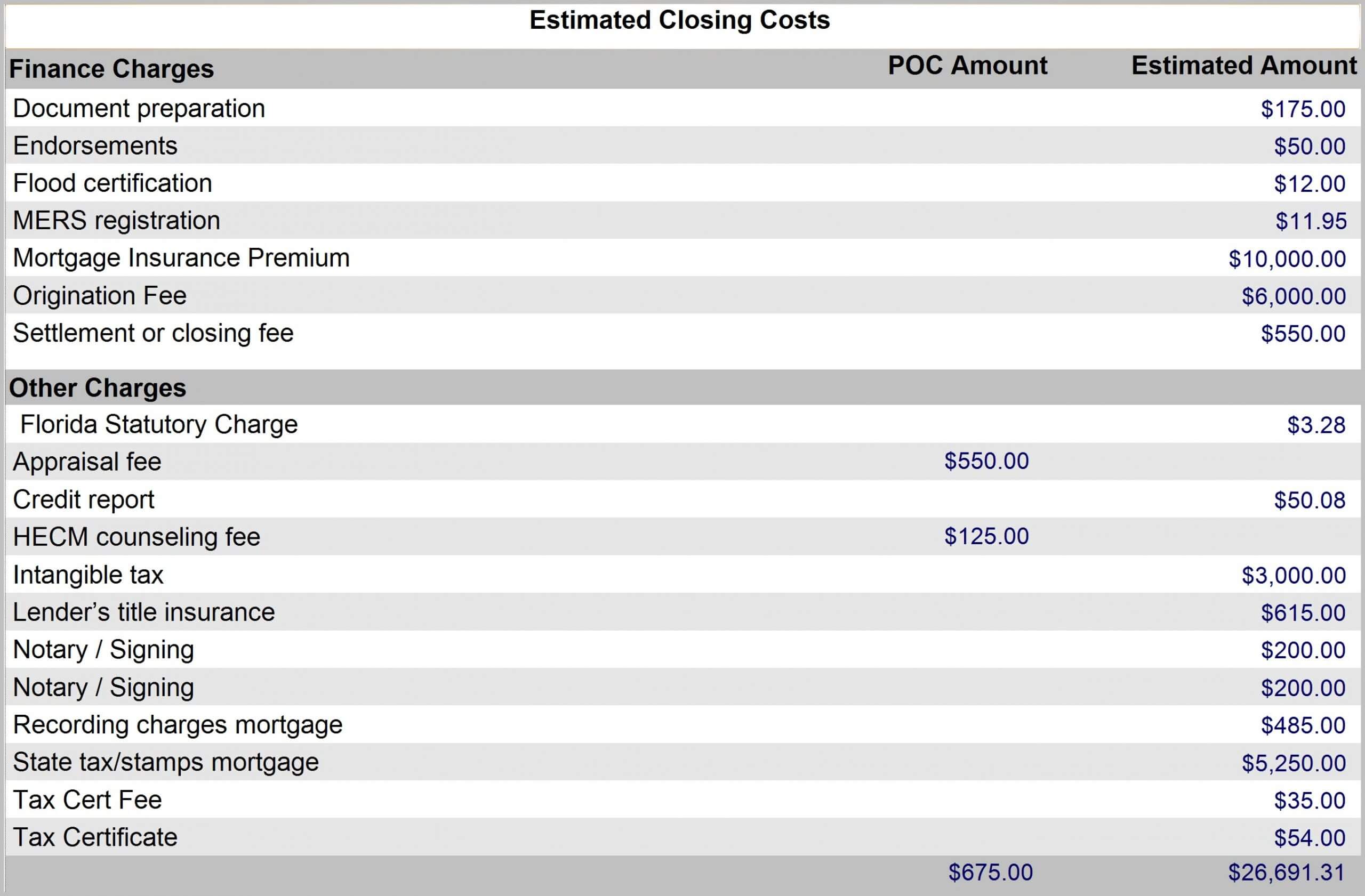

Mortgage Closing Cost Estimate Worksheet Advanced estimated closing cost calculator (conventional, fha, va & more!) here is a more in depth closing cost calculator which highlights individual fees you can expect to pay. this calculator allows you to select your loan type (conventional, fha or va) or if you will pay cash for the property. it will then estimate your total expected. The calculator will provide the following: estimated total costs. the top result shows total closing costs in dollars and as a percentage of the loan amount (usually 2% to 6%). you’ll also see. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. closing costs are typically about 3 5% of your loan amount and are usually paid at closing. while each loan situation is different, most closing costs typically fall into four categories: third party fees such as appraisal, title, taxes and credit. Closing costs are usually 2% to 5% of the loan amount. if no loan is involved, the percentage may be as low as 1%. paying mortgage discount points to lower your rate can be another significant.

Buyers Estimated Closing Costs Worksheet Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. closing costs are typically about 3 5% of your loan amount and are usually paid at closing. while each loan situation is different, most closing costs typically fall into four categories: third party fees such as appraisal, title, taxes and credit. Closing costs are usually 2% to 5% of the loan amount. if no loan is involved, the percentage may be as low as 1%. paying mortgage discount points to lower your rate can be another significant. The fees associated with hiring an appraiser are covered by the borrower and usually amount to $300 $600. these fees are settled at the end of the mortgage process and are included in our closing cost estimator. To use our mortgage closing calculator to estimate closing costs, have the below items available: down payment–the up front amount you are planning to put down on the purchase of the home. it can be entered as a dollar amount or a percentage. note that any percentages over 99% will automatically be calculated as a dollar amount.

Comments are closed.