Module 5 Comprehensive Exercise Revision Quesion Acctg 311 2020sc Pdf

Module 5 Information Handout Class Examples Acctg 311 2020sc Doc Module 5: accounting for income tax comprehensive exercise fisher ltd needs your assistance in calculating and disclosing the taxation expense for the financial year ended 31 march 2018. fisher ltd has supplied you with an extract from their income statement and balance sheet. Studocu is not affiliated to or endorsed by any school, college or university. studeersnel b.v., keizersgracht 424 sous, 1016 gc amsterdam, kvk: 56829787, btw: nl852321363b01. studying financial accounting acctg 311 at university of auckland? on studocu you will find 67 mandatory assignments, practice materials, lecture notes, tutorial.

Acctg 311 Modules 1 2 Information Handout 2020sc Acctg 311 1 Acctg View solution to assignment 4 & exam revision for module 5, acctg 311 2019sc.pdf from postgraduate diploma misc at auckland. acctg 311 acctg 311, financial accounting assignment 4 exam. View assignment 5 questions and answer booklet for module 5, acctg311 2020sc.docx from acctg 371 at auckland. acctg 311, financial accounting assignment 5: questions and answer booklet accounting ai chat with pdf. Acctg 311 1 2021sc assignment 5 suggested solution question 1 (7 marks) (a) accounting profit is the net profit or loss for a period before deducting tax expense, with net profit or loss being the excess (or deficiency) of revenues over expenses for that period. taxable profit is the excess (or deficiency) of taxable income over taxation. The university of auckland acctg 311 sc 2022 assignment one – revision of acctg 102 and 211 questions and answer booklet due date: wednesday 27 july at 4pm, total = 60 marks (worth 3%).

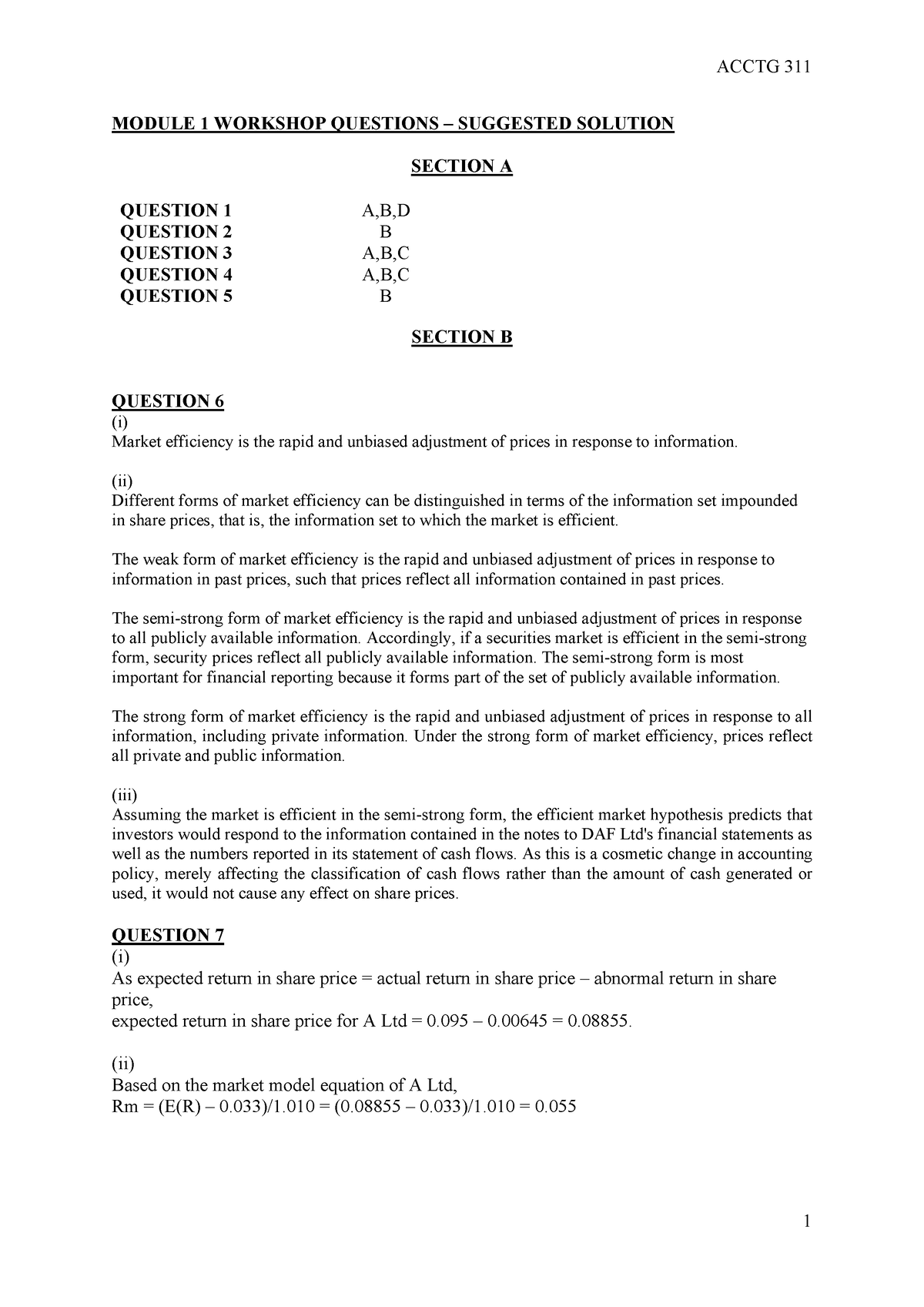

Module 1 Workshop Questions Acctg 311 Multiple Choice Written Acctg 311 1 2021sc assignment 5 suggested solution question 1 (7 marks) (a) accounting profit is the net profit or loss for a period before deducting tax expense, with net profit or loss being the excess (or deficiency) of revenues over expenses for that period. taxable profit is the excess (or deficiency) of taxable income over taxation. The university of auckland acctg 311 sc 2022 assignment one – revision of acctg 102 and 211 questions and answer booklet due date: wednesday 27 july at 4pm, total = 60 marks (worth 3%). Question 3 – adapted from 2020sc final exam nz parent company established an american subsidiary some years ago. for the financial year ending 31 december 2020, you have been given the following information to enable you to translate the financial statements of american subsidiary from us$ into nz$, in order to consolidate with the nz group. Module 5 comprehensive exercise revision quesion, acctg 311 2020sc.pdf. module 5: accounting for income tax comprehensive exercise fisher ltd needs your assistance in calculating and disclosing the taxation expense for the financial year ended 31 march 2018. fisher ltd has supplied you with an extract from their income statem.

Acctg 311 Module 1 Workshop Questions Suggested Solution Acctg 311 Question 3 – adapted from 2020sc final exam nz parent company established an american subsidiary some years ago. for the financial year ending 31 december 2020, you have been given the following information to enable you to translate the financial statements of american subsidiary from us$ into nz$, in order to consolidate with the nz group. Module 5 comprehensive exercise revision quesion, acctg 311 2020sc.pdf. module 5: accounting for income tax comprehensive exercise fisher ltd needs your assistance in calculating and disclosing the taxation expense for the financial year ended 31 march 2018. fisher ltd has supplied you with an extract from their income statem.

Comments are closed.