Mergers And Acquisitions Types What Are They Examples

Mergers And Acquisitions Types What Are They Examples Bank2home Congeneric acquisition. reverse takeover (spac) acqui hire. 1. horizontal acquisition. horizontal acquisitions (often called ‘horizontal mergers’) involve gaining market share through consolidation. both companies should be operating in the same space, providing more or less the same products and services. A merger is the combination of two firms, which subsequently form a new legal entity under the banner of one corporate name. mergers and acquisitions require the valuation of a company or its.

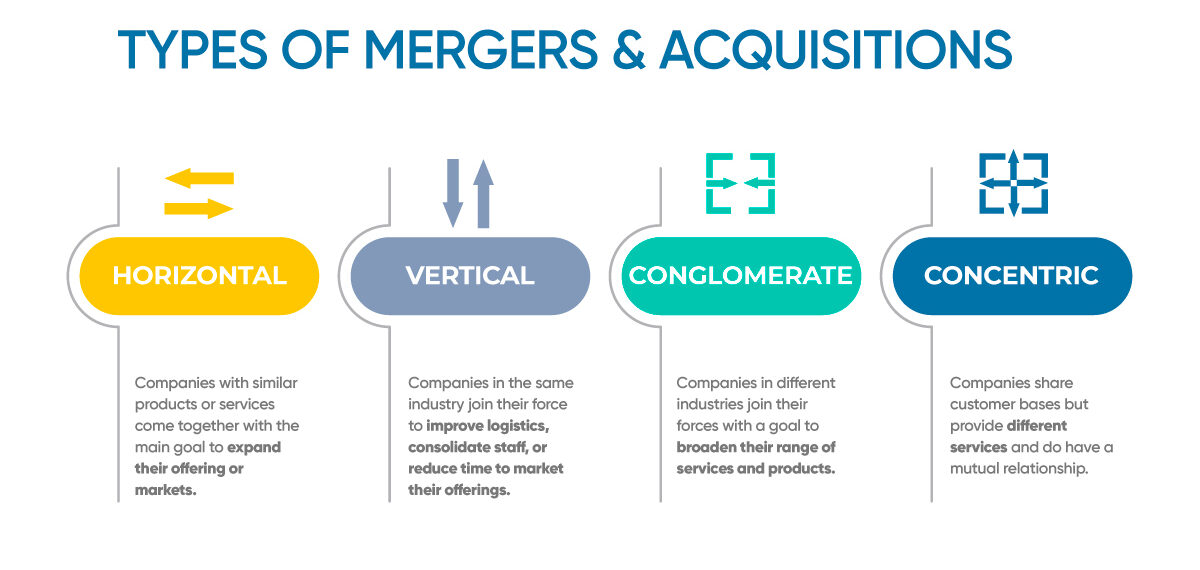

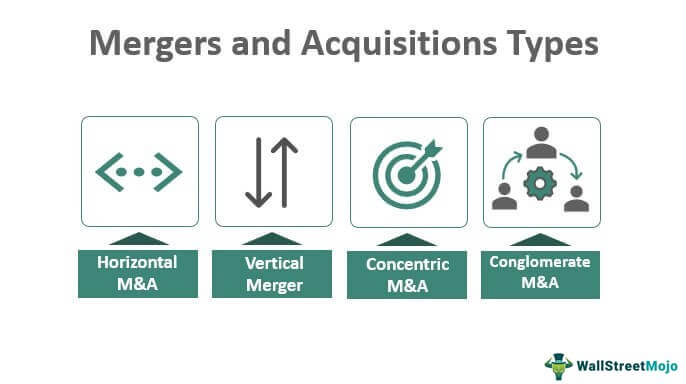

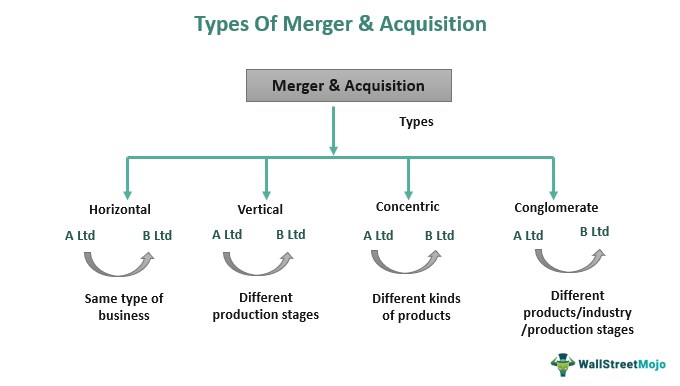

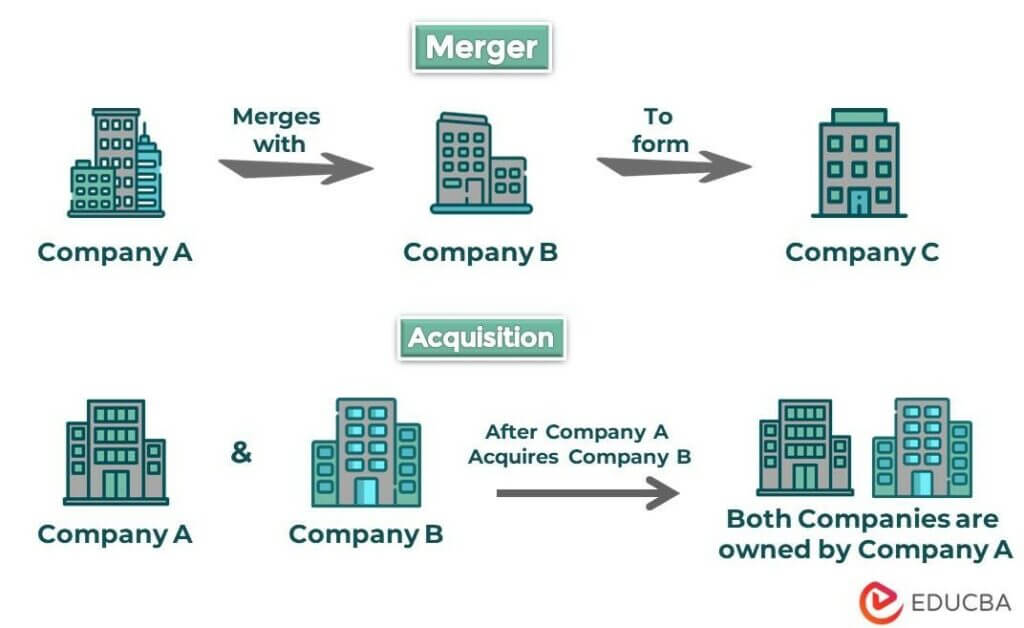

Mergers And Acquisitions Types What Are They Examples Key takeaways. how to identify the most common types of mergers and acquisitions: horizontal, vertical, conglomerate, concentric, and reverse. when two or more companies (usually similar in power or size) voluntarily combine their assets to create a new company or legal entity, this is called a merger. when one company acquires a target company. Different types of mergers & acquisitions 1. mergers. a merger is a corporate strategy of combining two separate business entities of roughly the same size into a single company to increase their financial and operational strengths. unlike an acquisition, corporate mergers are mutual, and both parties feel they will benefit from the transaction. While there are multiple variations of mergers and acquisitions, we can divide them into the following seven categories: horizontal. vertical. conglomerate. market extension. product extension. reverse merger. acquihire. each approach varies slightly in its method, purpose, and results. Mergers and acquisitions involve combining companies or assets through different financial transactions. mergers and acquisitions play a significant role in shaping the business landscape and can have far reaching implications for companies, investors, and consumers. companies engage in m&a for various reasons, such as growth diversification.

Mergers And Acquisitions Types What Are They Examples While there are multiple variations of mergers and acquisitions, we can divide them into the following seven categories: horizontal. vertical. conglomerate. market extension. product extension. reverse merger. acquihire. each approach varies slightly in its method, purpose, and results. Mergers and acquisitions involve combining companies or assets through different financial transactions. mergers and acquisitions play a significant role in shaping the business landscape and can have far reaching implications for companies, investors, and consumers. companies engage in m&a for various reasons, such as growth diversification. Key takeaways. mergers are a way for companies to expand their reach, expand into new segments, or gain market share. a merger is the voluntary fusion of two companies on broadly equal terms into. Mergers and acquisitions (m&a) are collaborations between two or more firms. in a merger, two or more companies functioning at the same level combine to create a new business entity. in an acquisition, a larger organization buys a smaller business entity for expansion. the collaboration between merger and acquisition companies is to eliminate.

Mergers And Acquisitions M A Definition Examples Types Salary Key takeaways. mergers are a way for companies to expand their reach, expand into new segments, or gain market share. a merger is the voluntary fusion of two companies on broadly equal terms into. Mergers and acquisitions (m&a) are collaborations between two or more firms. in a merger, two or more companies functioning at the same level combine to create a new business entity. in an acquisition, a larger organization buys a smaller business entity for expansion. the collaboration between merger and acquisition companies is to eliminate.

Comments are closed.