Mergers And Acquisitions Explained A Crash Course On Ma

Mergers Acquisitions Explained A Crash Course On M A Jul 29, 2023 — 11 min read. mergers and acquisitions explained: a crash course on m&a (free templates) in the ever evolving global business landscape, mergers and acquisitions (m&a) are powerful tools for growth and transformation. this comprehensive guide aims to shed light on the intricate world of m&a, offering fresh perspectives on. Enlisting in the m&a course? get ready to learn the terms and processes of combining or acquiring companies in a jiffy with this crash course! #crackingm&a #.

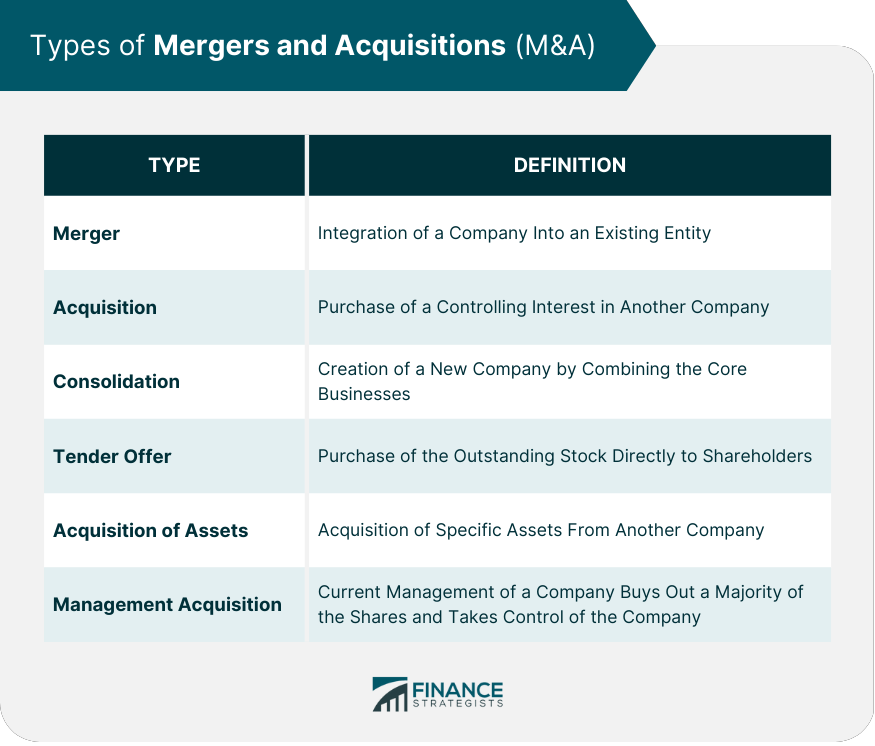

Mergers And Acquisitions Explained A Crash Course On M A Free Templates Mergers & acquisitions explained: a crash course on m&a. m&a stands for merger and acquisition and it’s nothing more than companies buying and selling each other. let’s say that company a wants to sell out. the owners of company a are tired of the business. they want to move on and sip cocktails on the beach forever, so they go and find a. #mergersandacquisitions #corporatelaw #businessmergers & acquisitions (commonly referred to as m&a) is often considered a fast paced, exciting niche of corpo. Introduction to mergers & acquisitions learning objectives. upon completing this course, you will be able to: explain the benefits and risks of m&a, as well as the m&a process. identify the types of m&a and different deal structures. analyze key factors and how deals are financed. calculate accretion dilution in eps. In this video series, i (1) provide high level views of the m&a arena, including key players in m&a transactions, deal structures, and buyer and seller motiv.

Mergers And Acquisitions M A Definition Types Process Introduction to mergers & acquisitions learning objectives. upon completing this course, you will be able to: explain the benefits and risks of m&a, as well as the m&a process. identify the types of m&a and different deal structures. analyze key factors and how deals are financed. calculate accretion dilution in eps. In this video series, i (1) provide high level views of the m&a arena, including key players in m&a transactions, deal structures, and buyer and seller motiv. There are 5 modules in this course. this course focuses on the theory and practice of mergers and acquisitions (m&a), with a focus on the finance. the finance of m&a uses tools from different areas of finance to help managers and investment bankers design successful m&a deals. in particular, we will learn to value and price m&a deals and how to. The introduction includes two main readings, which together cover the institutional and financial aspects of the typical m&a transaction. finance reading: the mergers and acquisitions process describes the m&a landscape and explains the process, including fundamentals of valuation, deal strategy, and financial and strategic objectives in m&a deals.

Comments are closed.