Medicare Supplement Plans Medigap Plan Pros Cons Medicare

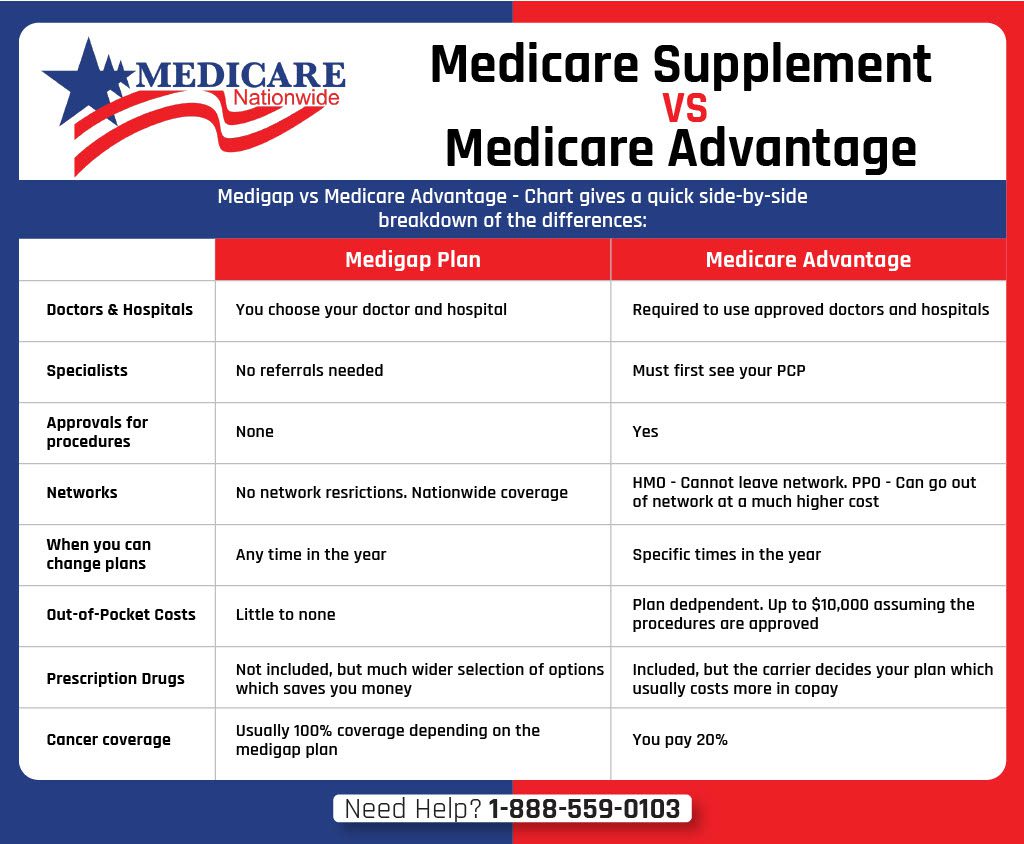

Medicare Advantage Vs Medigap Medicare Nationwide Plan options from aetna, anthem, bcbs, cigna, humana, and more. licensed, experienced and dedicated medicare professionals are here to help you navigate your options. call 855 644 2121 to speak. Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best.

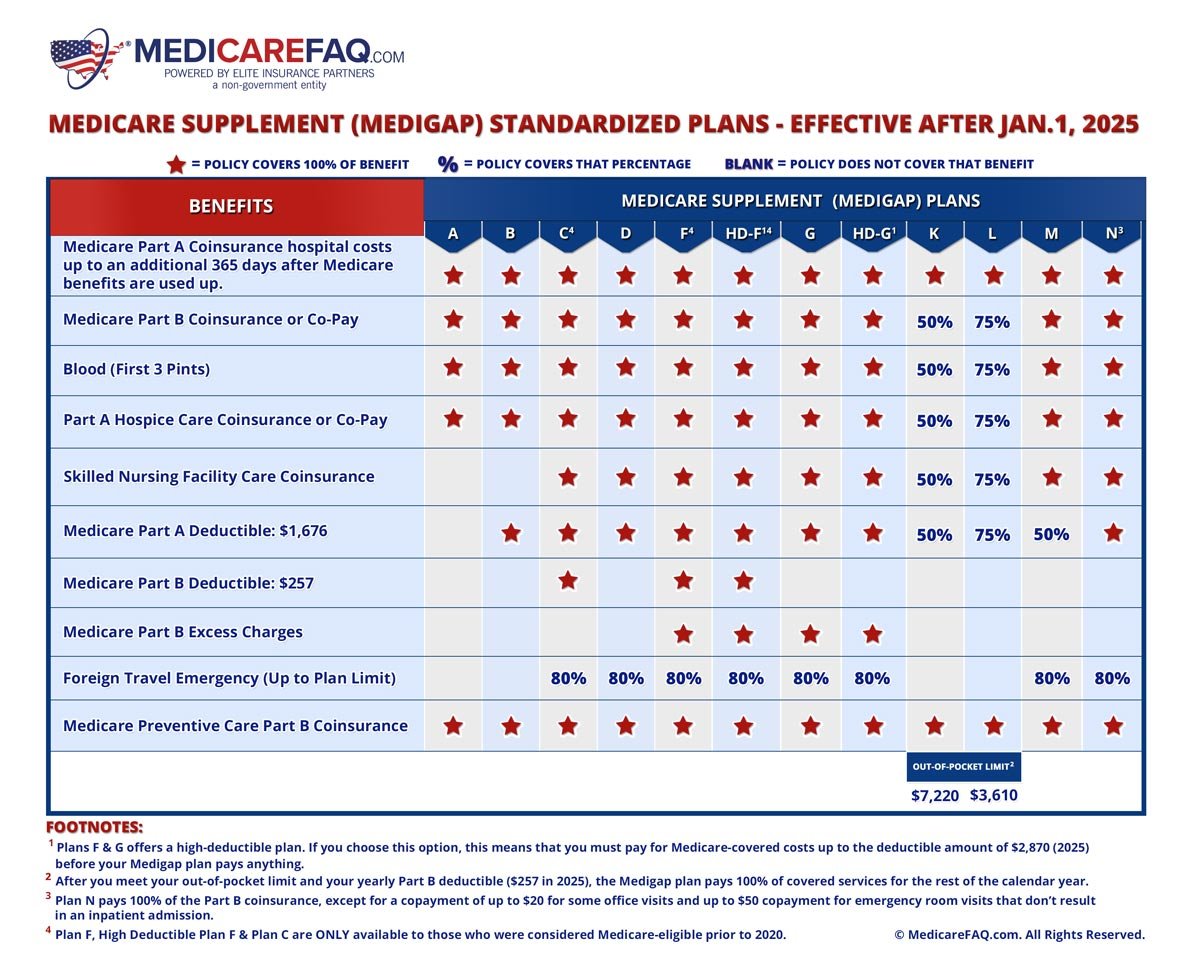

Medicare Supplement Medigap Plans Comparison Key takeaways: medicare advantage and medigap plans can help you cover health care costs, but the two options are different in what they offer. medicare advantage plans, provided through private. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered. Medicare supplement plan g pros and cons. medigap plan g has pros and cons: maximum coverage: plan g covers the most benefits out of the medigap plans available to new medicare beneficiaries. wide. Blue cross blue shield is one of the largest insurance companies offering medigap plans in every state. the company offers a range of plans, including a, c*, d, f*, g, n, and high deductible plans.

Medicare Supplement Or Medigap Plans Explained Medicare supplement plan g pros and cons. medigap plan g has pros and cons: maximum coverage: plan g covers the most benefits out of the medigap plans available to new medicare beneficiaries. wide. Blue cross blue shield is one of the largest insurance companies offering medigap plans in every state. the company offers a range of plans, including a, c*, d, f*, g, n, and high deductible plans. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. N a. $7,060 in 2024. $3,530 in 2024. n a. n a. note: plan c & plan f aren’t available if you turned 65 on or after january 1, 2020, and to some people under age 65. you might be able to get these plans if you were eligible for medicare before january 1, 2020, but not yet enrolled. learn more about who can buy this plan.

Comments are closed.