Medicare Supplement Plans Chart Best Picture Of Chart Anyimage Org

Medicare Supplement Plans Chart Best Picture Of Chart Anyimage Org Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best. As mentioned above, the medicare part a deductible is $1,632 per benefit period in 2024. the medicare part a deductible isn't an annual deductible. this means that you could potentially have to meet the part a deductible more than once in a given year. medicare part b deductible.

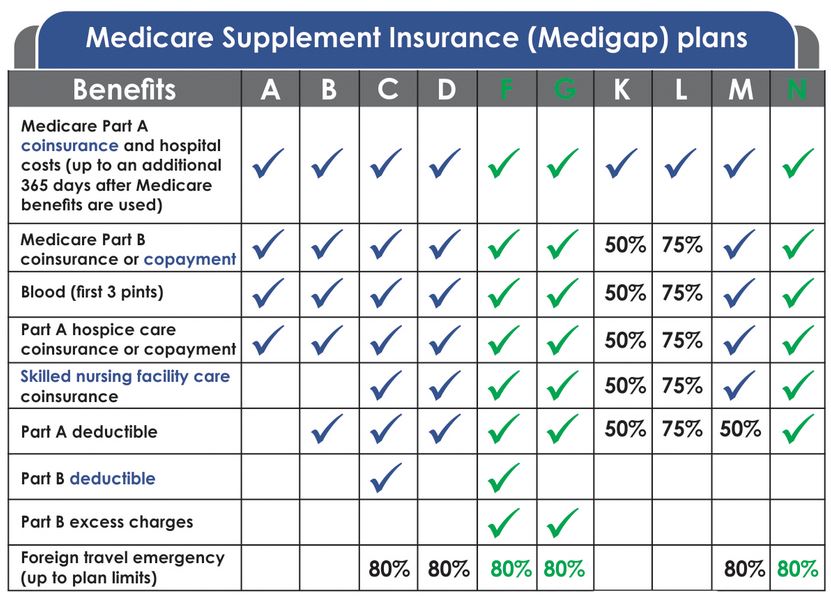

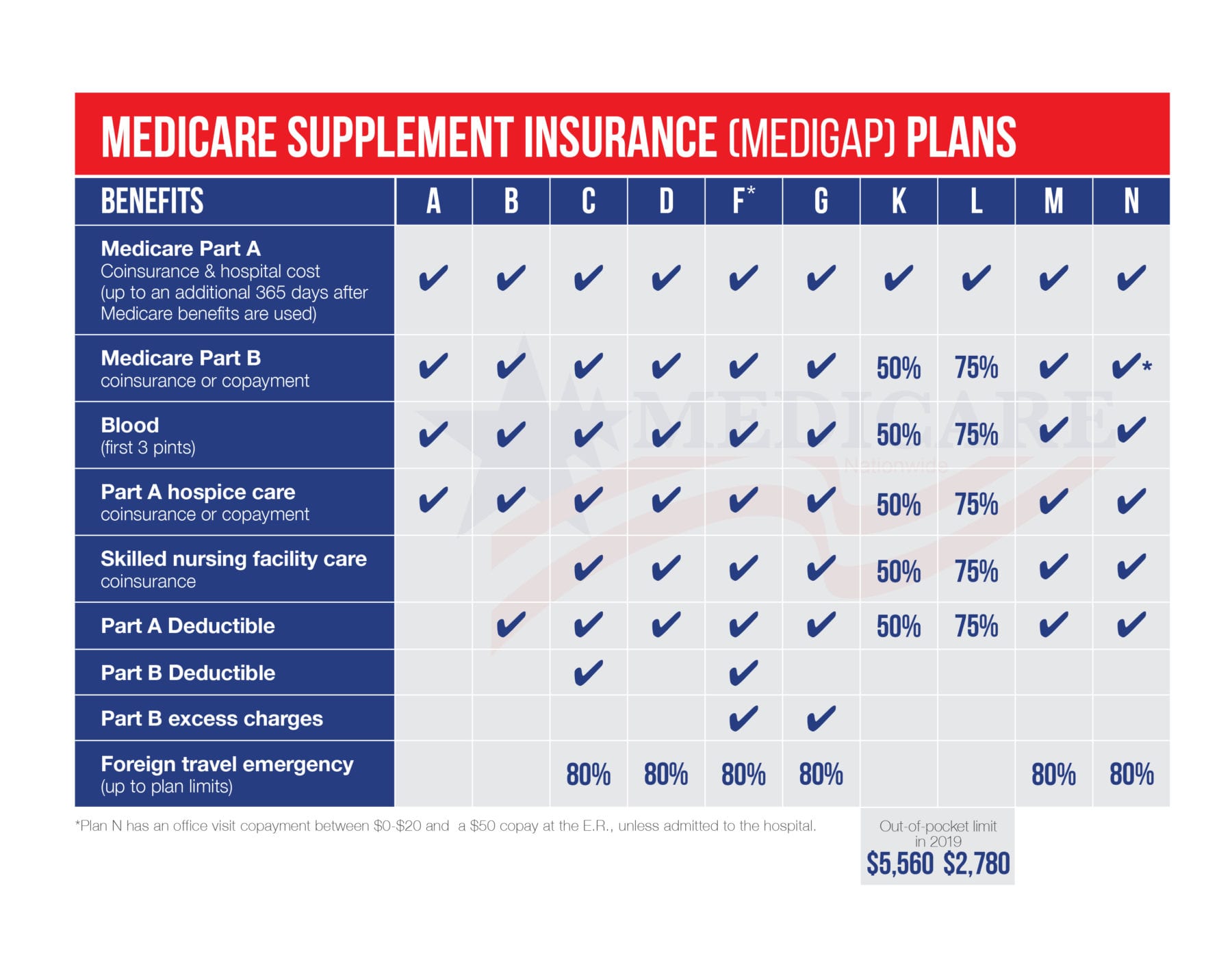

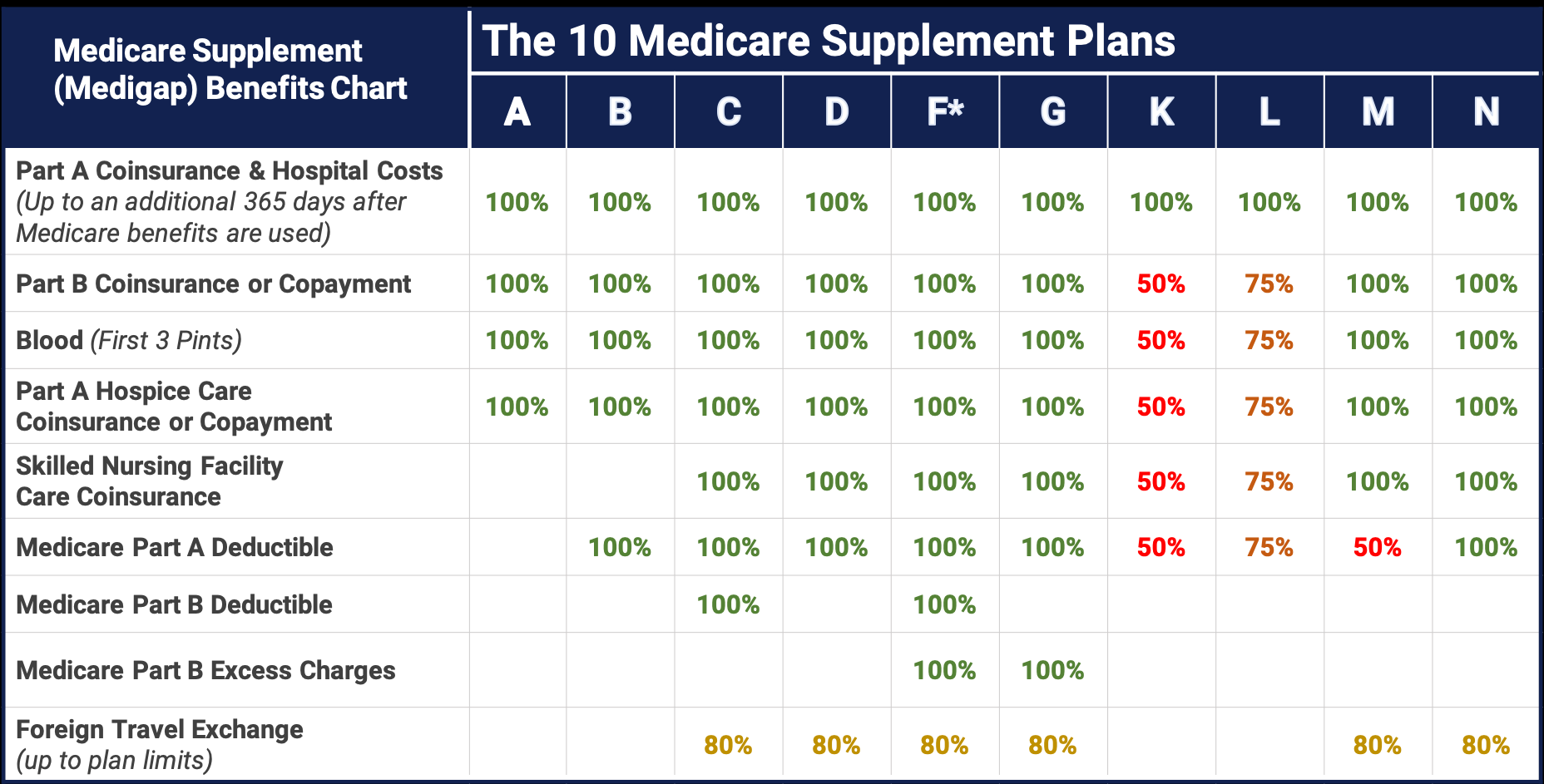

Best Medicare Supplement Plans Medicare Nationwide Medicare beneficiaries must meet a $1,632 deductible for each benefit period in 2024 before medicare part a covers any inpatient hospital costs. part a coinsurance and hospital costs. in 2024, medicare part a coinsurance is $408 per day for days 61 90 of an inpatient hospital stay, and $816 per day thereafter. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. The 2025 medicare supplement plans comparison chart below highlights the benefits and some limitations for all medigap plans. *high deductible plans (such as hd f or hd g) are offered in some states, meaning you pay for medicare covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 (for the year 2024). Medicare supplement average monthly premiums. a medicare supplement policy can cost between $50 to $300 monthly. the cost of a medigap policy varies by state and the insurance company. for example, a plan n in washington could cost less than a plan n in new york. premiums depend primarily on the plan you select.

Compare Medicare Supplement Plans In Your Area The 2025 medicare supplement plans comparison chart below highlights the benefits and some limitations for all medigap plans. *high deductible plans (such as hd f or hd g) are offered in some states, meaning you pay for medicare covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,800 (for the year 2024). Medicare supplement average monthly premiums. a medicare supplement policy can cost between $50 to $300 monthly. the cost of a medigap policy varies by state and the insurance company. for example, a plan n in washington could cost less than a plan n in new york. premiums depend primarily on the plan you select. Medigap plan d could be the best medicare supplement insurance plan for some enrollees, depending on their coverage needs. plan d covers everything that plan f does, with the exception of the medicare part b deductible and part b excess charges. as previously discussed, the part b deductible averages out to $20 per month in 2024. One of the keys to remember is that both medigap plan k and plan l are cost sharing plans. this means that your plan covers each benefit it provides with a limit set to help you avoid paying over a set limit: medicare supplement plan k covers 50% of each benefit. medicare supplement plan l covers 75% of each benefit.

Medicare Supplement Plans Medigap Medicare Hero Medigap plan d could be the best medicare supplement insurance plan for some enrollees, depending on their coverage needs. plan d covers everything that plan f does, with the exception of the medicare part b deductible and part b excess charges. as previously discussed, the part b deductible averages out to $20 per month in 2024. One of the keys to remember is that both medigap plan k and plan l are cost sharing plans. this means that your plan covers each benefit it provides with a limit set to help you avoid paying over a set limit: medicare supplement plan k covers 50% of each benefit. medicare supplement plan l covers 75% of each benefit.

Comments are closed.