Medicare Supplement Plan A For 2023 Medigap

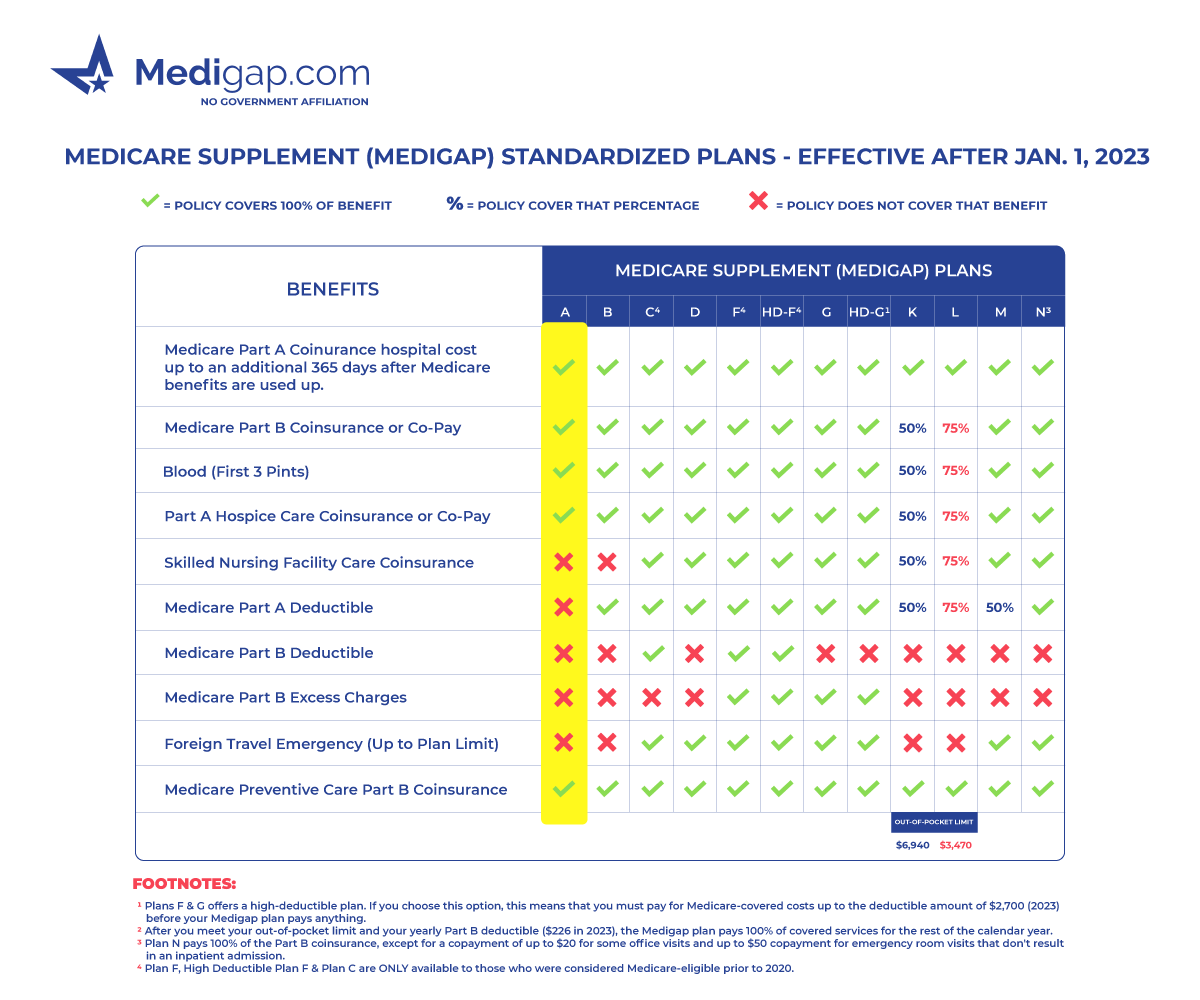

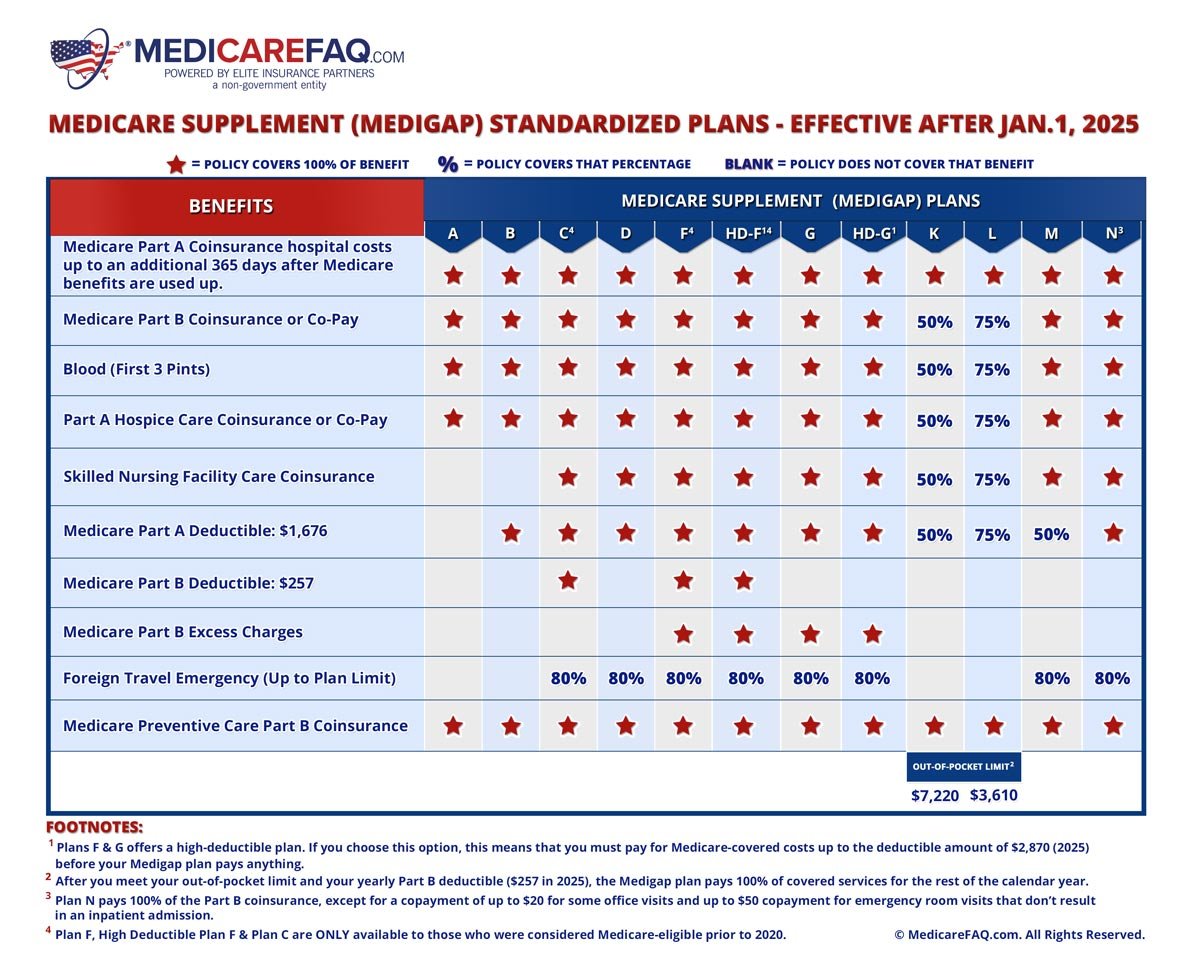

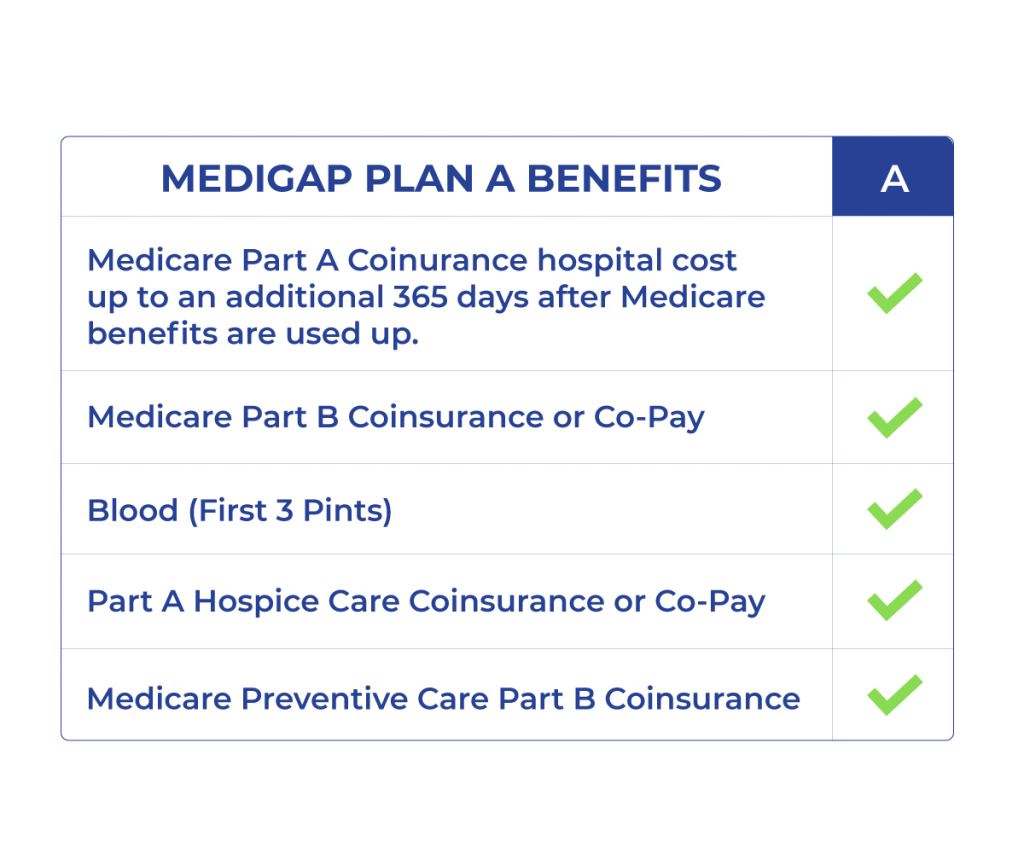

Medicare Supplement Plan A For 2023 Medigap N a. $7,060 in 2024. $3,530 in 2024. n a. n a. note: plan c & plan f aren’t available if you turned 65 on or after january 1, 2020, and to some people under age 65. you might be able to get these plans if you were eligible for medicare before january 1, 2020, but not yet enrolled. learn more about who can buy this plan. In original medicare, you generally pay some of the costs for approved services. medicare supplement insurance ( medigap ) is extra insurance you can buy from a private company to help pay your out of pocket costs that original medicare doesn’t cover.

Medicare Supplement Medigap Plans Comparison Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best. Medigap plan f is offered by private companies and provides the most comprehensive coverage of the medigap plans. it covers 100% of: part a coinsurance and hospital costs. part b copays and. Aarp medicare supplement (medigap) plan comparison. only applicants first eligible for medicare before 2020 may purchase plans c and f. a checkmark indicates the benefit is paid at 100%. reference the chart below to understand coverage and costs associated with each medicare supplement plan. 1 plan n pays 100% of the part b coinsurance, except. The 2024 part b deductible is $240 per year ($20 per month). this means that if you find a medigap plan g option that costs only $20 more per month (or less) than plan f, it might be a better value over the course of the year than plan f if you meet the part b deductible.

Medicare Supplement Plan A For 2023 Medigap Aarp medicare supplement (medigap) plan comparison. only applicants first eligible for medicare before 2020 may purchase plans c and f. a checkmark indicates the benefit is paid at 100%. reference the chart below to understand coverage and costs associated with each medicare supplement plan. 1 plan n pays 100% of the part b coinsurance, except. The 2024 part b deductible is $240 per year ($20 per month). this means that if you find a medigap plan g option that costs only $20 more per month (or less) than plan f, it might be a better value over the course of the year than plan f if you meet the part b deductible. If you buy plans f or g with a “high‐deductible option,” you must pay the first $2,800 (in 2024) of deductibles, copayments, and coinsurance for covered services not paid by medicare before the medigap policy pays anything. you also pay a separate deductible ($250 per year) for foreign travel emergency care. Medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in. original medicare. a fee for service health insurance program that has 2 parts: part a and part b. you typically pay a portion of the costs for covered services as you get them.

Comments are closed.