Medicare Plan G Out Of Pocket Maximum How Much Is It

What Is The Maximum Out Of Pocket On The Medicare Plan G Cons. higher premiums: because it has high coverage, plan g also tends to have higher premiums. excess charges are rare: one of plan g’s unique features is coverage for part b excess charges. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered.

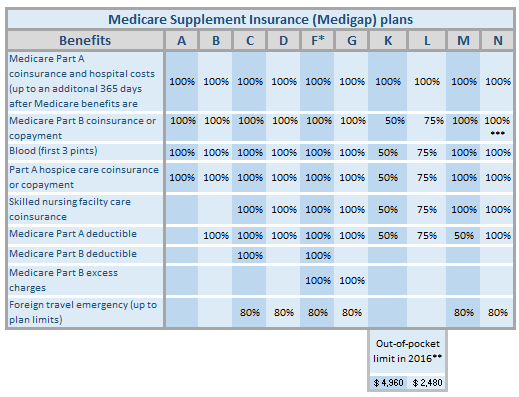

Maximum Out Of Pocket For Medicare Plans Medigap Advisors Learn more about medicare supplement plan g, including what it covers, how much it tends to cost and what to consider before purchasing a plan. in 2024 part b requires an annual deductible of. Medicare plan g is one of 10 medigap options. we explain the costs with plan g, how you can enroll, and more. plan g doesn’t have an out of pocket limit. what does medicare supplement plan g. For 2024, the out of pocket maximum for plan g should be close to $226 which is the 2023 medicare part b deductible amount. this means that after reaching this limit, plan g will cover 100% of your approved medicare healthcare costs for the rest of the calendar year. by understanding the out of pocket maximum for plan g and how it can impact. Medicare supplement plan g helps keep your out of pocket costs as low as possible. benefits of medicare supplement plan g include: 100% coverage for medicare part a deductible. 100% coverage for hospice copayments and coinsurance. additional foreign travel emergency benefits. 100% coverage for medicare part b excess charges.

What Are Out Of Pocket Expenses With Medicare For 2024, the out of pocket maximum for plan g should be close to $226 which is the 2023 medicare part b deductible amount. this means that after reaching this limit, plan g will cover 100% of your approved medicare healthcare costs for the rest of the calendar year. by understanding the out of pocket maximum for plan g and how it can impact. Medicare supplement plan g helps keep your out of pocket costs as low as possible. benefits of medicare supplement plan g include: 100% coverage for medicare part a deductible. 100% coverage for hospice copayments and coinsurance. additional foreign travel emergency benefits. 100% coverage for medicare part b excess charges. The average medigap plan g premium in 2023 was $135 per month. the only benefit not covered by plan g — the annual medicare part b deductible — costs just $240 per year in 2024 ($20 per month). beneficiaries who have a choice between plan g and plan f may benefit from choosing plan g if the cost of the plan is at least $20 lower per month. With a plan g, your out of pocket costs for covered services are reduced to just your annual part b deductible ($240 in 2024). there’s no out of pocket maximum for plan g because costs are reduced in a way that it’s not necessary.

Medicare Supplement Plan G For 2023 Medigap The average medigap plan g premium in 2023 was $135 per month. the only benefit not covered by plan g — the annual medicare part b deductible — costs just $240 per year in 2024 ($20 per month). beneficiaries who have a choice between plan g and plan f may benefit from choosing plan g if the cost of the plan is at least $20 lower per month. With a plan g, your out of pocket costs for covered services are reduced to just your annual part b deductible ($240 in 2024). there’s no out of pocket maximum for plan g because costs are reduced in a way that it’s not necessary.

Comments are closed.