Medicare Part D Coverage Phases Deductible Premium Medicarefaq

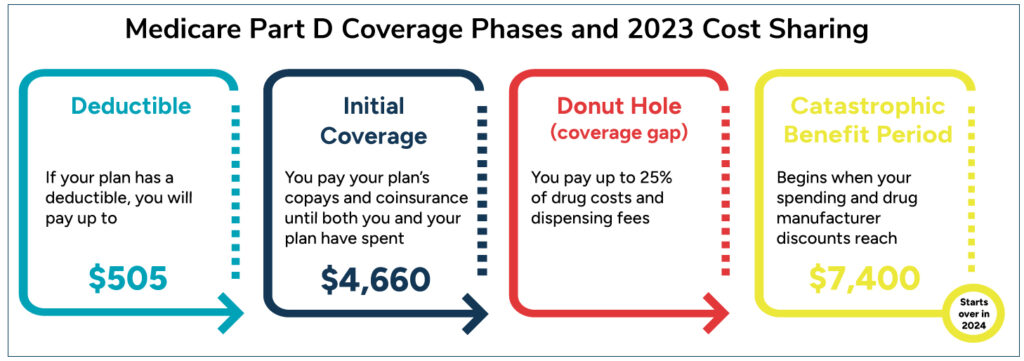

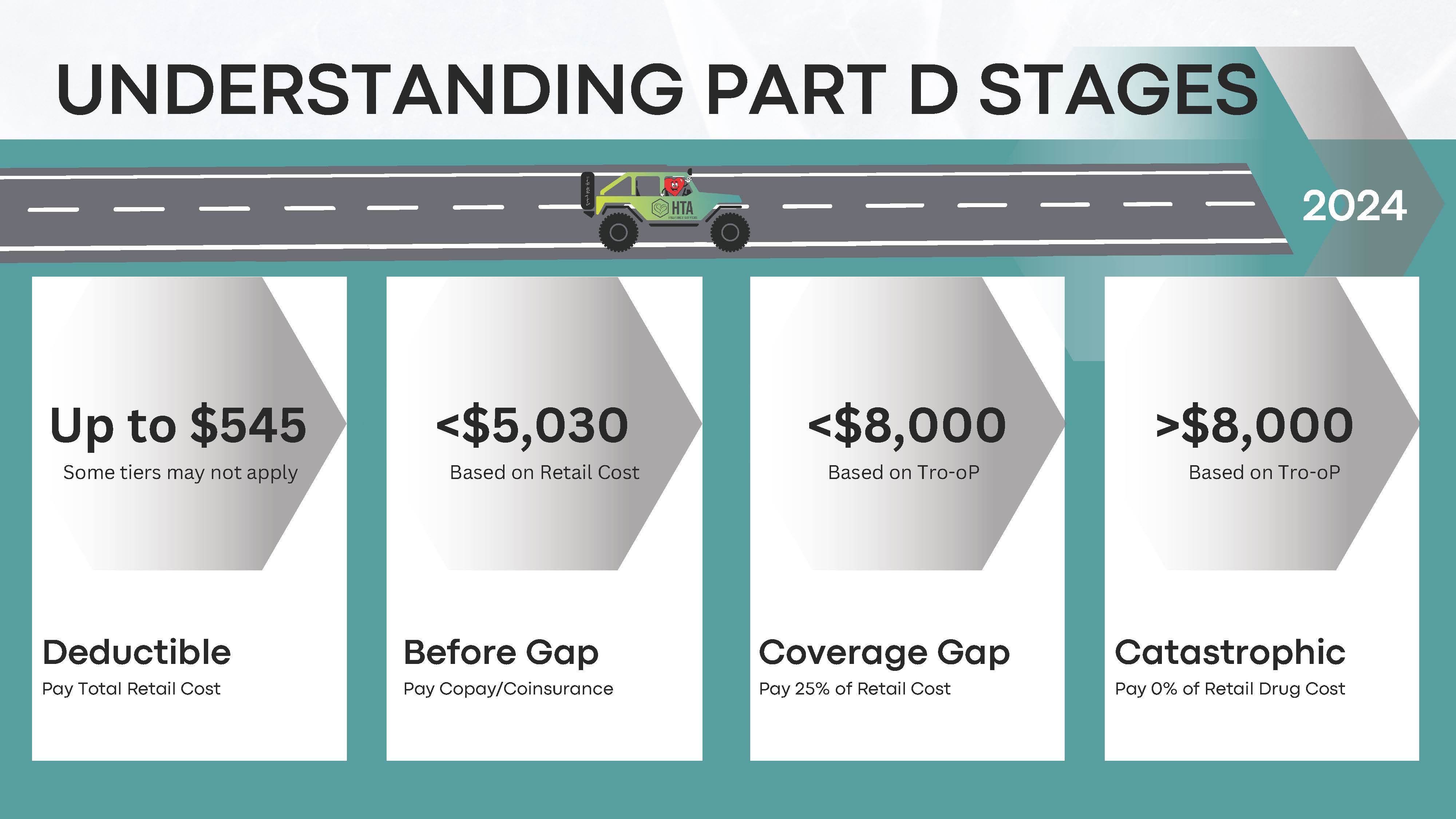

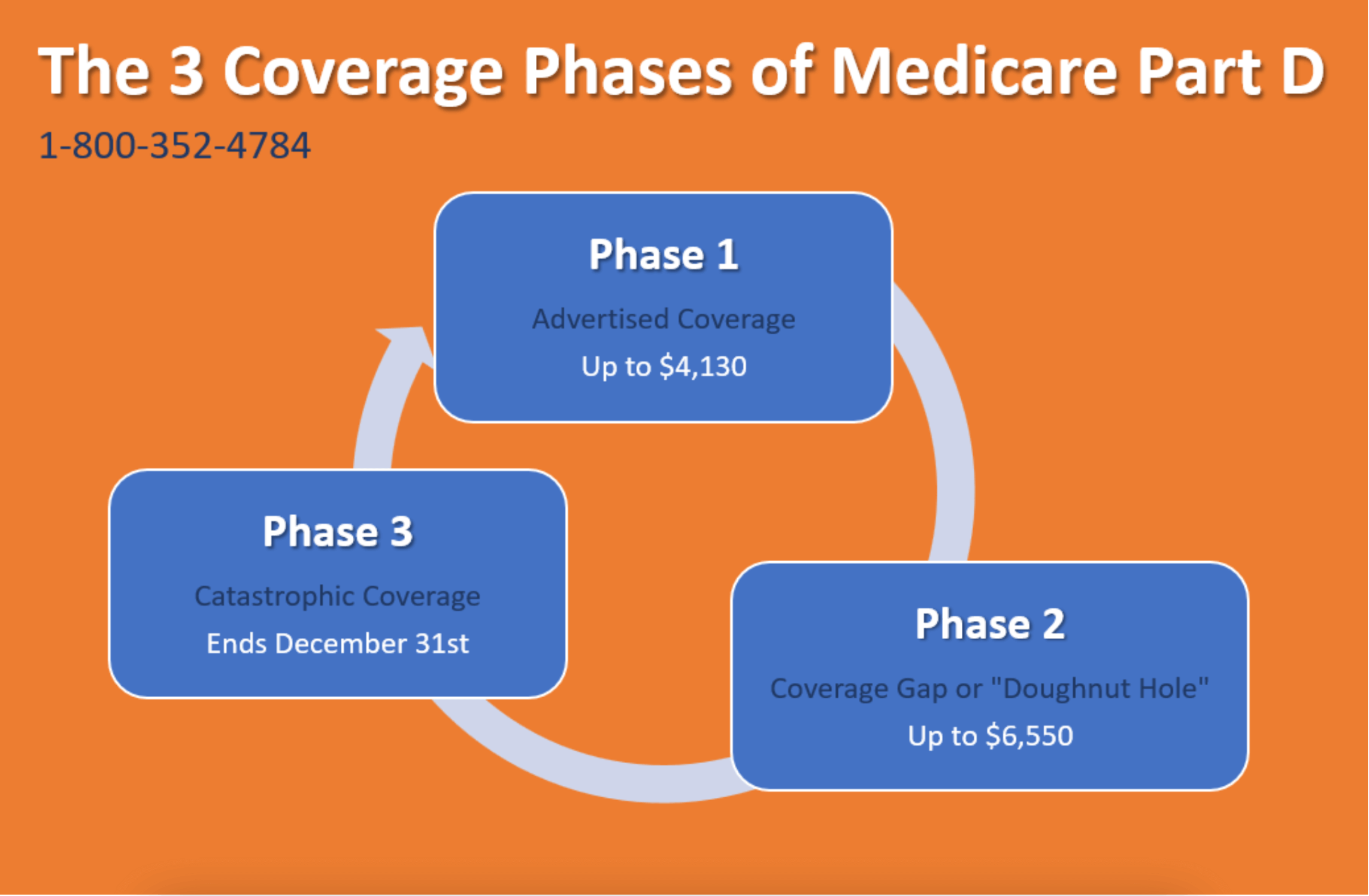

Prescription Drug Coverage Other expenses for which you are responsible include the initial deductible, initial coverage limit, out of pocket costs, and the coverage gap (donut hole). in 2022, the medicare part d deductible cannot exceed $545 for any plan or carrier. additionally, the average medicare part d monthly premium is $34.70. There are four different phases—or periods—of part d coverage: deductible period: until you meet your part d deductible, you will pay the full negotiated price for your covered prescription drugs. once you have met the deductible, the plan will begin to cover the cost of your drugs. while deductibles can vary from plan to plan, no plan’s.

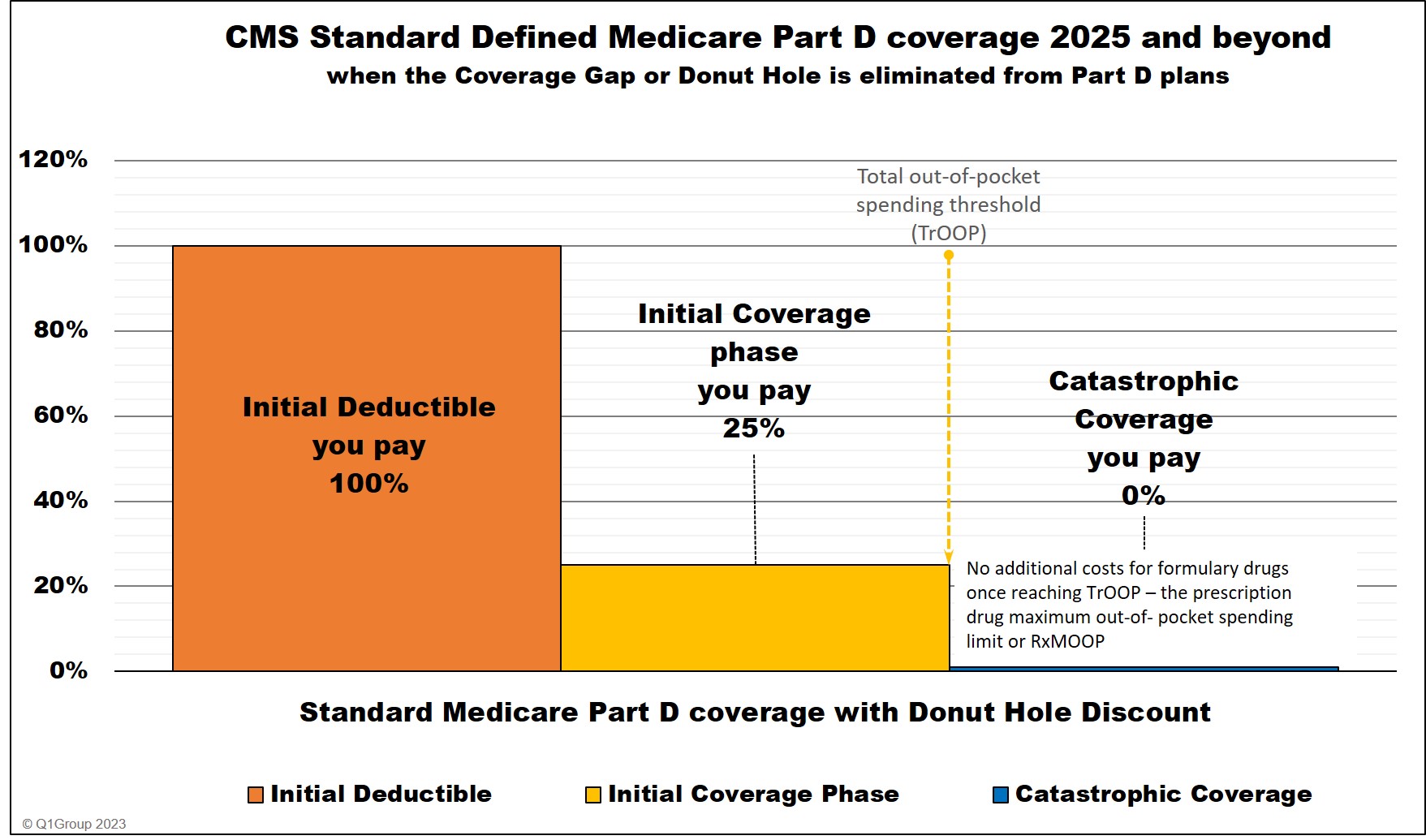

Understanding The Medicare Part D Donut Hole Or Coverage Gap In 2024, the average monthly medicare part d premium will be approximately $55.50. additionally, your premium cost may vary based on your income. if you receive an annual income higher than $103,000 individually or $206,000 as a couple, you will be responsible for paying a higher medicare part d premium due to irmaa. Get the right medicare drug plan for you. what medicare part d drug plans cover. overview of what medicare drug plans cover. learn about formularies, tiers of coverage, name brand and generic drug coverage. official medicare site. costs for medicare drug coverage. learn about the types of costs you’ll pay in a medicare drug plan. Additionally, some medicare part d plans have a deductible in addition to the monthly premium. the deductible is the amount you pay for covered drugs before the plan starts sharing costs. the maximum medicare part d deductible for 2025 has not yet been set. however, once the amount is available, we will provide that information here. Initial coverage phase. once you meet your deductible, you enter the initial coverage phase. in this phase, you pay 25% of the cost of your covered prescription drugs, while your plan covers 65% of the cost. for brand name drugs, manufacturers also contribute 10% of the cost. you remain in this phase until your out of pocket costs reach $2,000.

Medicare Part D Additionally, some medicare part d plans have a deductible in addition to the monthly premium. the deductible is the amount you pay for covered drugs before the plan starts sharing costs. the maximum medicare part d deductible for 2025 has not yet been set. however, once the amount is available, we will provide that information here. Initial coverage phase. once you meet your deductible, you enter the initial coverage phase. in this phase, you pay 25% of the cost of your covered prescription drugs, while your plan covers 65% of the cost. for brand name drugs, manufacturers also contribute 10% of the cost. you remain in this phase until your out of pocket costs reach $2,000. The part d defined standard benefit is changing for 2025 and will include a new $2,000 cap on out of pocket drug spending. the benefit will have three phases, including a deductible, an initial. The enrollee pays 100% of their gross covered prescription drug costs (gcpdc) until the deductible of $590 for cy 2025 is met. initial coverage. the enrollee pays 25% coinsurance for covered part d drugs. the sponsor typically pays 65% of the cost of applicable drugs and 75% of the cost of all other covered part d drugs.

Medicare Prescription Drug Coverage Part D Health For California The part d defined standard benefit is changing for 2025 and will include a new $2,000 cap on out of pocket drug spending. the benefit will have three phases, including a deductible, an initial. The enrollee pays 100% of their gross covered prescription drug costs (gcpdc) until the deductible of $590 for cy 2025 is met. initial coverage. the enrollee pays 25% coinsurance for covered part d drugs. the sponsor typically pays 65% of the cost of applicable drugs and 75% of the cost of all other covered part d drugs.

What Is The Medicare Part D Initial Coverage Limit Icl

Comments are closed.