Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans

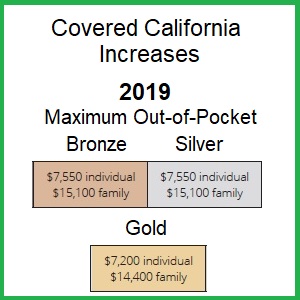

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans The big change for covered california health plans is the hefty increase in the maximum out of pocket amount on bronze, silver, and gold plans. covered california released their summary of benefits and cost sharing for their 2019 individual and family plans and the maximum out of pocket amount jumped 7% from 2018 for most health plans. Follow up care. the help you need to get back to good health. home health $3 to $45 per visit. durable medical equipment 10% to 20% of bill. skilled nursing care* 10% to 30% of bill. * full price until deductible is met, if applicable. never more than $8,700 per year for an individual.

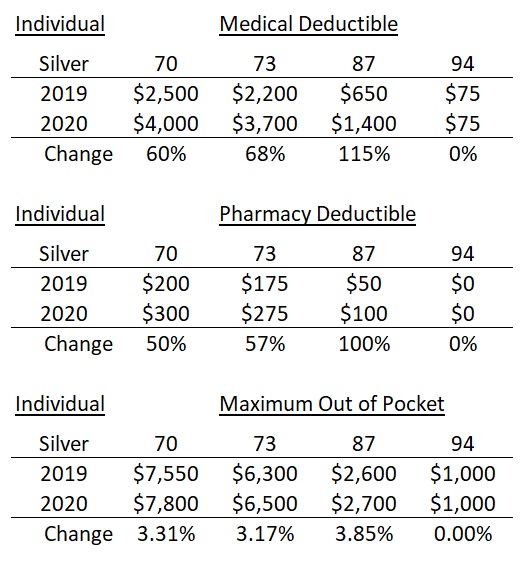

Maximum Out Of Pocket Amount Jumps 7 For 2019 Covered California Plans Your “out of pocket maximum” is a limit on how much you’ll have to pay for covered health services in a year. after that, your plan covers 100 percent of costs. deductible: the amount you owe for health care services your health insurance plan covers before your plan begins to pay. for example, if your deductible is $1,000, your plan won. Copays, deductibles and coinsurance. copays are a fixed out of pocket amount paid for covered services. insurance providers often charge copays for services such as doctor visits or prescription drugs. your deductible is the amount you pay out of pocket for health care services covered under your insurance plan before your plan begins to pay. The platinum plans had a major spike in the maximum out of pocket dollar amount. they jumped from $3,350 in 2019 to $4,500 for 2020, an increase of 34%. the gold plans also had an increase in the maximum out of pocket amount of 8.3%, from $7,200 up to $7,800. the gold plan’s maximum out of pocket amount is now the same as silver 70 and bronze 60. Bronze 60 california coverage, maximum out of pocket maximum of $8,200 for 2021. silver 70, on the other hand, has most health care service at a set copayment or 20% coinsurance. very few health care services are subject to the medical deductible of $4,000. it’s possible to hit the maximum out of pocket amount in the silver plan without ever.

Among Covered Workers With An Out Of Pocket Maximum For Single Coverage The platinum plans had a major spike in the maximum out of pocket dollar amount. they jumped from $3,350 in 2019 to $4,500 for 2020, an increase of 34%. the gold plans also had an increase in the maximum out of pocket amount of 8.3%, from $7,200 up to $7,800. the gold plan’s maximum out of pocket amount is now the same as silver 70 and bronze 60. Bronze 60 california coverage, maximum out of pocket maximum of $8,200 for 2021. silver 70, on the other hand, has most health care service at a set copayment or 20% coinsurance. very few health care services are subject to the medical deductible of $4,000. it’s possible to hit the maximum out of pocket amount in the silver plan without ever. The average out of pocket maximum in the employer sponsored health insurance market is $4,415 a year for high deductible health plans, according to kff. how to choose health insurance based on costs. With this plan you will be required to pay approximately 13% of your medical expenses. annual wellness exam $0. primary and urgent care $15.00 per visit. specialist visit $25.00. emergency room facility $150.00. laboratory tests $20.00. x rays & diagnostics $40.00. imaging $100.00. drugs tier 1 (generic drugs) $5.

Covered California Keeps Rates Low By Increasing Silver Plan Deductibles The average out of pocket maximum in the employer sponsored health insurance market is $4,415 a year for high deductible health plans, according to kff. how to choose health insurance based on costs. With this plan you will be required to pay approximately 13% of your medical expenses. annual wellness exam $0. primary and urgent care $15.00 per visit. specialist visit $25.00. emergency room facility $150.00. laboratory tests $20.00. x rays & diagnostics $40.00. imaging $100.00. drugs tier 1 (generic drugs) $5.

Among Covered Workers With An Out Of Pocket Maximum For Single Coverage

Among Covered Workers With An Out Of Pocket Maximum For Single Coverage

Comments are closed.