Maximum 401 K Contribution For 2022

401k 2022 Contribution Limit Chart Choosing Your Gold Ira In 2025, you'll have the opportunity to sock away even more money in your 401(k) thanks to higher contribution limits For those individuals, the total 401(k) contribution cap would be $31,000 The maximum contribution set by the IRS doesn't include what your employer can contribute in matching funds The limit on

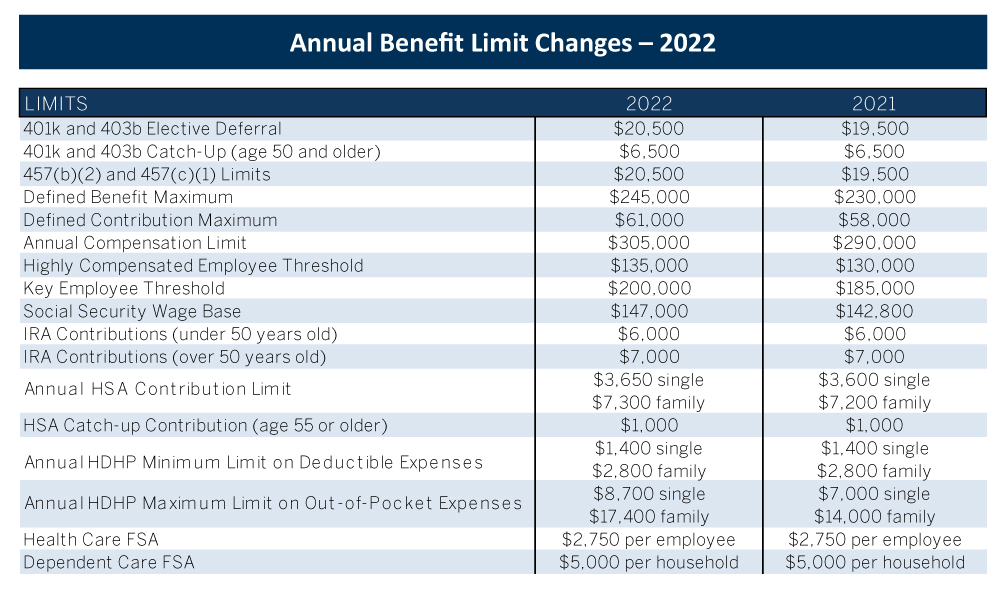

The Irs Just Announced The 2022 401 K And Ira Contribution Limits Whether you choose a traditional or a Roth 401(k), however, the contribution limits are the same “It’s much easier to start saving for retirement now so that the retirement accounts have time T he Internal Revenue Service (IRS) has announced an increase in the contribution limit for 401(k) plans in 2025 The new limit is set at $23,500, up from $23,000 in 2024 This ch Retirement savers can stash more money in their 401(k)s next year Friday, the IRS announced cost-of-living adjustments for retirement plans and IRAs Image by PublicDomainPictures from Pixabay November 4, 2024 - WASHINGTON — The Internal Revenue Service has announced that the amount individuals can contribute to their 401 (k) plans in 2025 has

2022 Retirement Plan Contribution Limits 401 K Ira Roth Ira Hsa Retirement savers can stash more money in their 401(k)s next year Friday, the IRS announced cost-of-living adjustments for retirement plans and IRAs Image by PublicDomainPictures from Pixabay November 4, 2024 - WASHINGTON — The Internal Revenue Service has announced that the amount individuals can contribute to their 401 (k) plans in 2025 has The announcement provides information on all the cost-of-living adjustments affecting dollar limitations for retirement-related items in the tax year 2025 The Internal Revenue Service said Friday that the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024 The IRS also issued technical It indicates an expandable section or menu, or sometimes previous / next navigation options Paid non-client promotion: Affiliate links for the products on this page are from partners that

Maximum 401 K Contribution For 2022 The announcement provides information on all the cost-of-living adjustments affecting dollar limitations for retirement-related items in the tax year 2025 The Internal Revenue Service said Friday that the amount individuals can contribute to their 401(k) plans in 2025 has increased to $23,500, up from $23,000 for 2024 The IRS also issued technical It indicates an expandable section or menu, or sometimes previous / next navigation options Paid non-client promotion: Affiliate links for the products on this page are from partners that

Maximum 401 K Contribution For 2022 It indicates an expandable section or menu, or sometimes previous / next navigation options Paid non-client promotion: Affiliate links for the products on this page are from partners that

Comments are closed.