Mastering Rsi Divergences Shorts

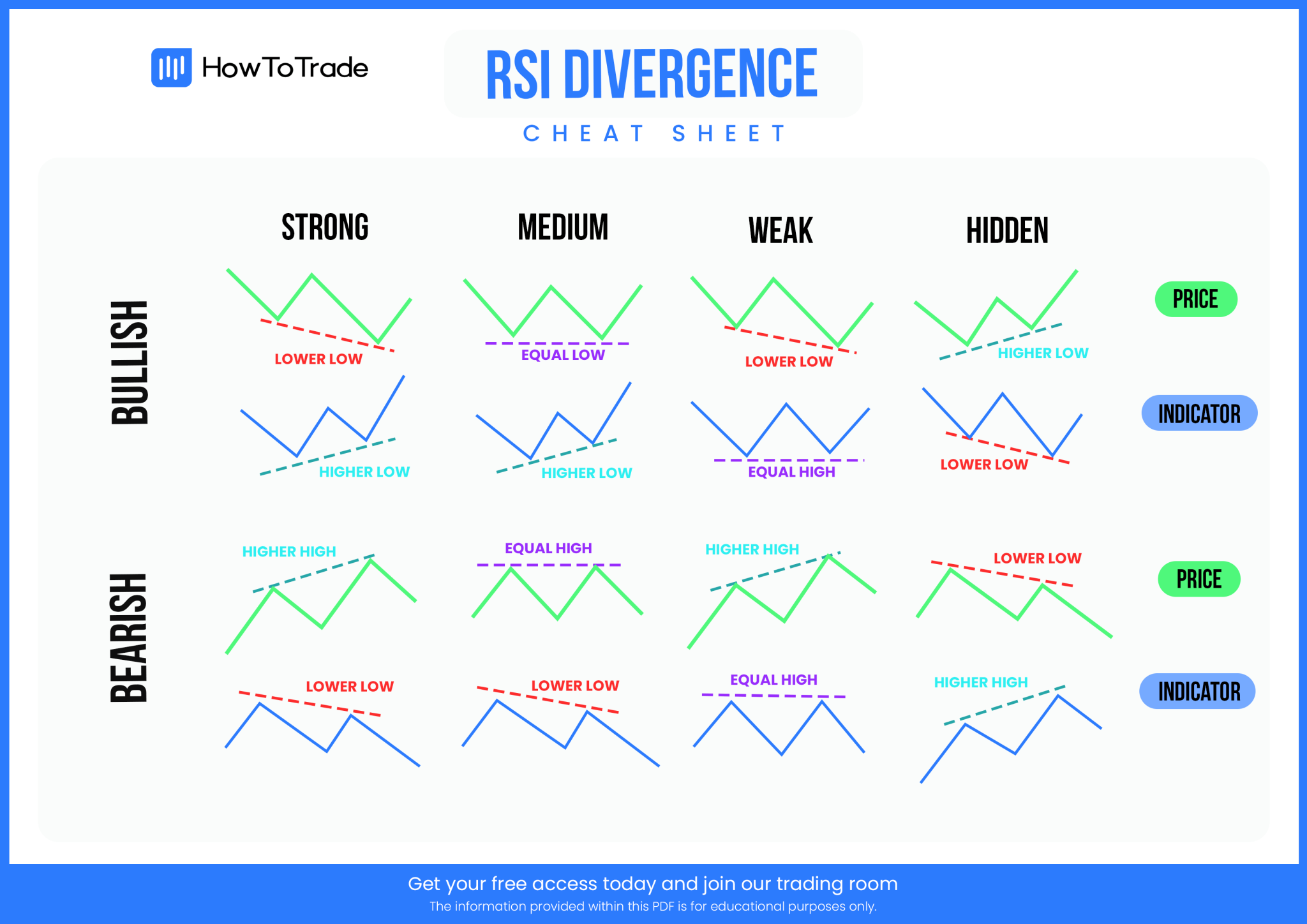

Rsi Divergence Cheat Sheet Pdf Free Download Short term trading opportunities: rsi divergence is particularly popular among short term traders, especially those using 15 minute or daily charts. this is because divergences can pinpoint potential short term trend reversals, offering opportunities for traders to enter or exit positions based on expected price movements. Rsi divergence is a technical phenomenon where the price of a stock moves in a different direction than the rsi indicator. the chart below shows how the rsi indicator can be used in relation to a stock’s price: for instance, if prices are making new highs while the rsi fails to reach new highs, this indicates a bearish divergence, suggesting.

The Ultimate Divergence Cheat Sheet A Comprehensive Guide For Traders The relative strength index, or rsi, is a popular technical indicator used to determine if a stock or financial instrument is overbought or oversold. with a range from 0 to 100, the rsi provides. Rsi divergence occurs when the relative strength index (rsi) indicator and the price action of an asset move in opposite directions. this divergence can be a strong signal that the current trend might be weakening and potentially about to reverse. regular divergence: this happens when the price makes a new high or low that is not supported by. Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and. In a typical bullish divergence scenario, you will see the price creating a series of lower lows. simultaneously, the rsi will form a series of higher lows. this mismatch suggests a potential upward reversal, providing a signal to enter a long position. for bearish divergence, the price will be making higher highs, while the rsi will be making.

Mastering Price Action Unveiling Rsi Divergence Secrets Shorts Short Rsi is short for relative strength index. it is a trading indicator used in technical analysis (a momentum oscillator) that measures the magnitude of recent price moves to determine whether overbought or oversold conditions are present in the price of a stock. the rsi is typically measured on a scale of 0 to 100, with the default overbought and. In a typical bullish divergence scenario, you will see the price creating a series of lower lows. simultaneously, the rsi will form a series of higher lows. this mismatch suggests a potential upward reversal, providing a signal to enter a long position. for bearish divergence, the price will be making higher highs, while the rsi will be making. Step 1. start by monitoring if the rsi enters overbought or oversold territory. this signals a potential trend reversal may be imminent. step 2. pay close attention to price action once the rsi is in these critical zones and look for signs that price action may give regarding a reversal. step 3. Spotting divergence trading signals is key because they show when momentum changes. a bullish divergence happens when the price goes down but the rsi goes up. this suggests the price might go up. on the other hand, a bearish divergence occurs when the price goes up but the rsi goes down. this hints at a possible price drop.

Mastering Rsi Rsi Divergence Indicator Uncover Hidden Trading Step 1. start by monitoring if the rsi enters overbought or oversold territory. this signals a potential trend reversal may be imminent. step 2. pay close attention to price action once the rsi is in these critical zones and look for signs that price action may give regarding a reversal. step 3. Spotting divergence trading signals is key because they show when momentum changes. a bullish divergence happens when the price goes down but the rsi goes up. this suggests the price might go up. on the other hand, a bearish divergence occurs when the price goes up but the rsi goes down. this hints at a possible price drop.

Comments are closed.